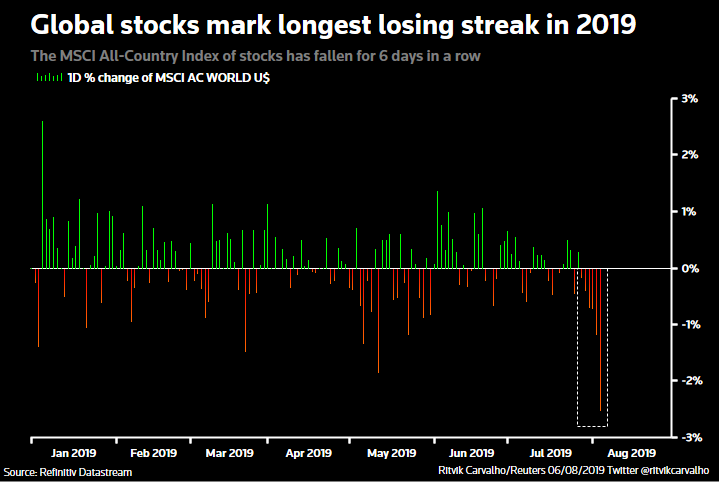

The broad indices tested their February lows today; and the Nasdaq 100 and S&P500 Index stayed above that level.

For a brief period of time, $IWO sliced through its February low but it staged a late rally and closed above that level...

Today's action doesn't mean the market...

Due to the hedges, my portfolio remained somewhat insulated but because of the vicious sell-off in...

Given the recent developments; I sold out of my position in $LK at the open today and also drastically reduced my position in $SPCE

$LK was meant to announce...

As far as I'm aware, there was no Press Release, no announcement of any sorts to confirm the delay and when I emailed IR, it confirmed that a definitive date hasn't been set yet...

Mgt. quality plays a big part in my investment process and given the company's failure to communicate with shareholders (especially during a crisis); I decided to book my gains and part ways..

Not only are they behind their operational schedule, I recently realised that they took down their Investor Presentation (with all the financial projections) from the company's website!

I've re-invested the above sales proceeds in a rapidly growing, dominant global payments platform Adyen (listed in Amsterdam, $ADYYF on OTC) and also increased my positions in $PDD $ROKU $TWLO ...

The next few weeks/months could be rocky but world-class businesses will continue to thrive in the long run.

The end.