It’s just as riveting as the 2018 letter.

I thoroughly enjoyed digging through it,

Here are key points and my notes in [ ]

Cc: @nlw @grummz @radigancarter

Thread…#investing #markets #entrepreneurship

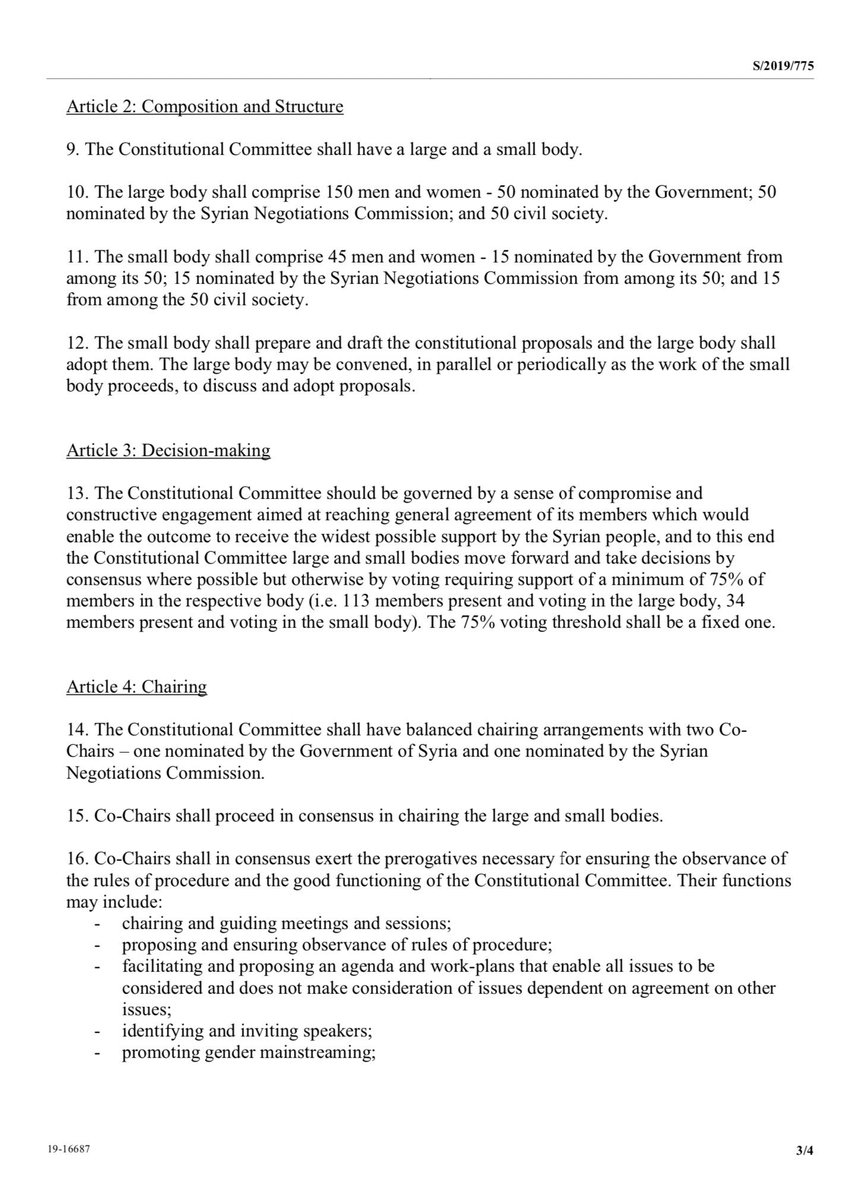

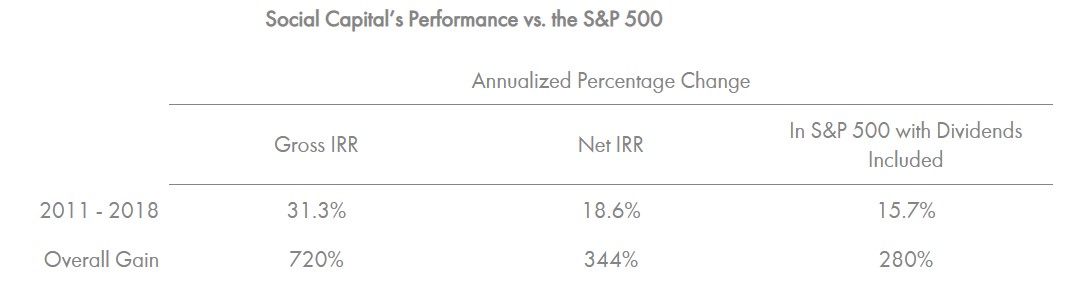

The 2018 and 2019 letters state different gross IRRs for the years 2011-2018…images below.

@chamath care to clarify?

In the 30yr run of the gilded age, America faced 2 market shocks, the panic of 1873 and the panic of 1893.

both comparable to the Dot-Com Bubble and the Great Financial Crisis.

political and business reform everywhere,

regulated monopolies, new government rules and administrative offices such as the FDA.

An unbelievable consumer surplus that came with a hidden cost, our data.

Massive gains in wealth only for a few companies [FB,Goog etc] while we wonder why we aren’t living better than our parents nor able to give better lives to our children.

These changes are represented by political proxies that may be forgotten; however, their ideals will evolve to be better, faster.

The new progressive era begins with a regulatory noose;

$msft, $apl, $amzn, $goog, $fb need to be reigned in under strict control,

Regulators will need to convene broad groups of experts with no conflicts of interest who can articulate bigtech business models, their pros/cons and how to limit their impact.

This will allow the demand side of the internet economy to compete with the supply side.

Regulators can achieve this within 10yrs. [IF they want to]

Resilient national economies are a fresh trend, events like the #coronavirus compound the argument for strong local economies.

[Weren’t we striving for a borderless world?🤨This is sound…but grim]

Govs. need to do more to allow small businesses to compete and create vibrant ecosystems:

1) Make RSU compensation expensive for companies above a certain size/profitability.

investopedia.com/terms/r/restri…

2) Favor remunerative tax treatments for employees who choose to receive stock/income from small companies.

3) Prevent M&A from bigtech as well as acqui-hiring.

Make the engineer expensive for bigtech but cheap for startups and a new wave of entrepreneurship will ensue.

[Can you name something truly innovative that BigTech has invented in the last decade?

….

….

Neither can I ¯\_(ツ)_/¯ ]

The need for true progress is increasing. Gov's cannot solve these issues alone.

STEM grads lured by big pay to work on photo-tagging and ad targeting instead of clean energy and space exploration.

Intellect has been lobotomized just like it was pre 2008 by Wall St.

This practice was taken over by BigTech post 2008.

Tech progress has been declining since we landed on the moon.

Bigtech is fueled by profitability and stock prices instead of altruistic innovation.

In the 60’s a bright engineer worked on fuel cells, thermodynamic systems etc.

This capital misallocation needs to end…we must demand it.

[ideally, the cost to buy a home and raise a family need to be lowered if we are to entice engineers to work on big picture missions, until this is done, no1 will give a shit about “the greater good”]

SC faces no pressure from limited partners.

Capital allocation is about a few good decisions supported by a lot of thinking and debate with a good team.

SC generated $1.7B in cash and equivalents in 2019.

Liquidity focus is important as exogenous events like the #coronavirus are no longer priced appropriately.

SC also invested in another company that they will keep confidential for now.

[Who? WHO?!? J/K…it doesn’t matter]

The SC stealth acquisition has eliminated all options for employees and simply pays more so that they may focus on living well and caring for their families.

Company equity is made available for purchase by employees each year. 👏👏👏

VC’s have never done anything important.

Bigger funds and fee-based compensation are their fuel, not bigger ideas.

Startups are shipping product features that have no moat.

Work With @Socialcapital and live a life of purpose;

If you’re working on something hard and useful get in touch with them. Change the world (literally)

Be coherent and honest with others.

Take the advice of others but carefully consider how it applies to you.

“Put on your oxygen mask before helping others” -Internalize this timeless airline announcement.

cont…

[It broke me to read the last 3 sections of this letter,

while I consider myself to be monetarily stable due to a long stint @ a cushy job and asset investing…neither has armed me with technical skillsets required to do something impactful for the world. it hurts]

[It’s consolation to know that you, dear reader, who may be very talented,

you may have the opportunity with a company like SC to make a difference and be compensated accordingly. I’m grateful for that.]

We need more companies like @socialcapital, I’m glad they’re setting an example for others to follow.

cont...

In the video above, @chamath jokes about not really having any backroom negotiations that have led to enormous success,

It seems that they’ve turned the page though. I remain optimistic.

Read the entire letter here: socialcapital.com/annual-letters…

/fin