Nifty PE Ratio at 28.86 (Highest level in 2020)

Nifty has moved from 'Screaming Sell' to 'Buy' to a 'Screaming Sell' once again in 12 months.

#Nifty #nifty50 #PEratio #Pricetoearnings

Nifty has moved from 'Screaming Sell' to 'Buy' to a 'Screaming Sell' once again in 12 months.

#Nifty #nifty50 #PEratio #Pricetoearnings

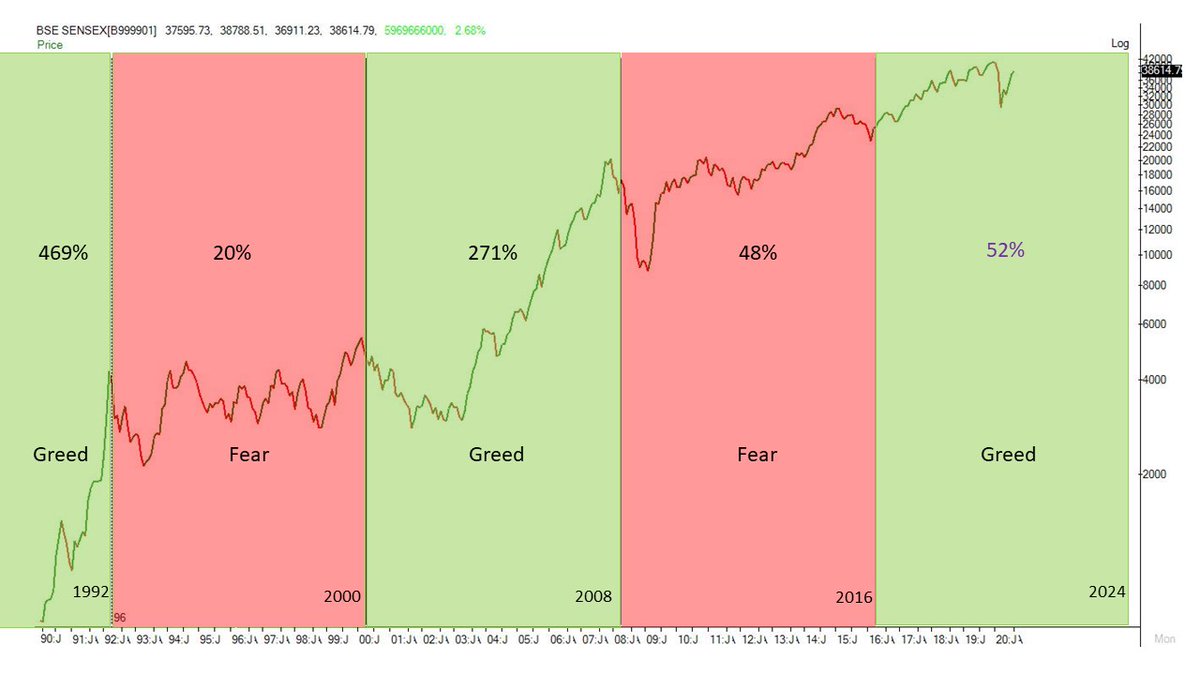

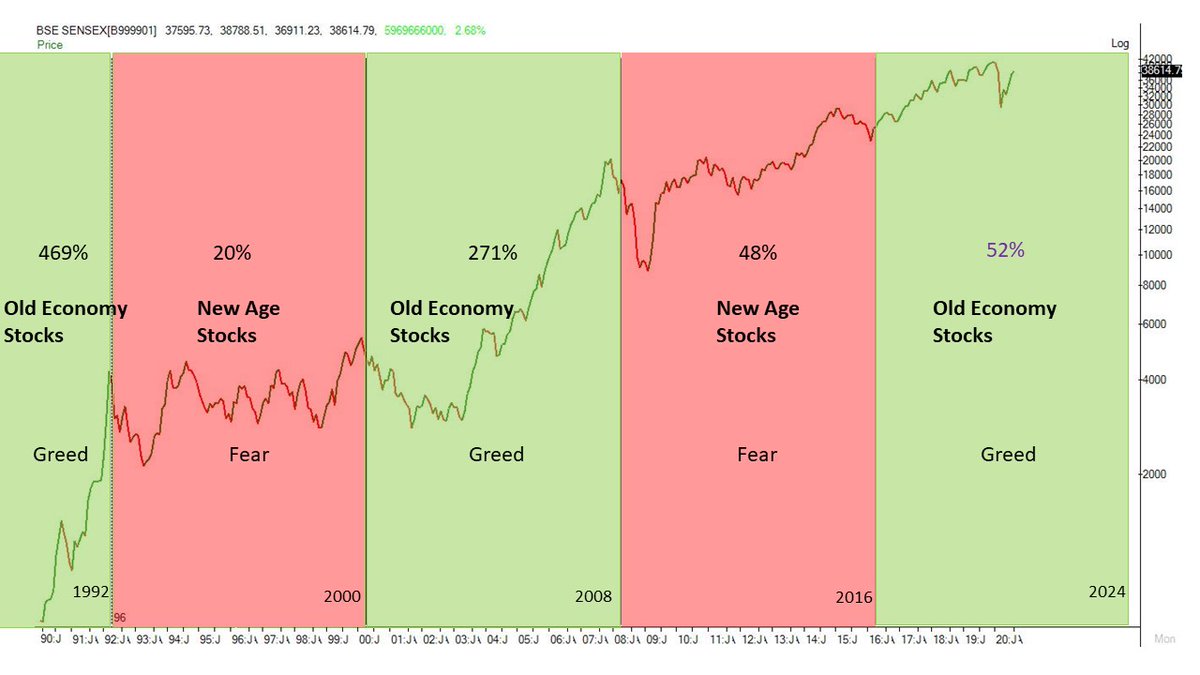

Heres a similar view based on a study of different parameters...

https://twitter.com/purohitjay/status/1285265446061527041

We are in the 6th consecutive weekly rally in nifty. The previous two longest rallies in last 5 yrs lasted for 8 and 7 weeks in Jan-2018 and Apr-2019 resp. All three rallies are 15 months apart from each other.

• • •

Missing some Tweet in this thread? You can try to

force a refresh