France down 14%

Singapore minus 41%

#USGDP minus 32.9%,as per advance estimates

#COVID has inflicted universal damage--fall in India will be relatively lower&cushioned by good agri growth

Even when March qtr GDP grew 3.1%,#AgriGrowth was 5.9%

#SBI reported 81% jump in net profit at Rs 4189Cr

Yes,there was one time gain of 1540Cr--But even without this,profit grew by 15%& #NII by 19%

#GrossNPAs fell from 6.15% to 5.44% QoQ💪

Improvement in #AssetQuality of SBI is good news&this,despite providing for #COVID19India related losses

SBI made Covid related provisions worth 1836Cr inJune qtr

Total provisions against Covid related losses are 3008Cr

In June qtr,SBI recorded fresh slippages of only 3637Cr,Vs 8105Cr of slippages in March2020 qtr

In March2019 qtr,slippages were a high 16212Cr

Steep fall in #Slippages is proof of bad loans falling💪

Surge in recoveries for many Banks, in last 6 months,leading to lower NPAs,is thx to #IBC,among other things

Despite 42000Cr of loans classified as #SpecialMentionAccounts&9.5% of loan book as #Moratorium,SBI posted great results

With #ECLGS now extended to individuals,@narendramodi govt has taken a bold move,to boost #Creditgrowth

ECLGS to #MSMEs has been a big success,with over 1.14 lakhCr loans sanctioned

#economy

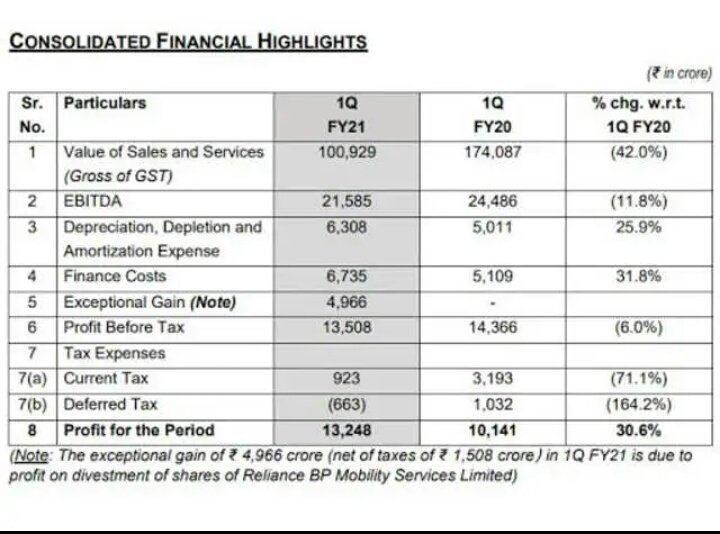

Consolidated PAT rise of 30.6%,was led by one time gain of 4966Cr

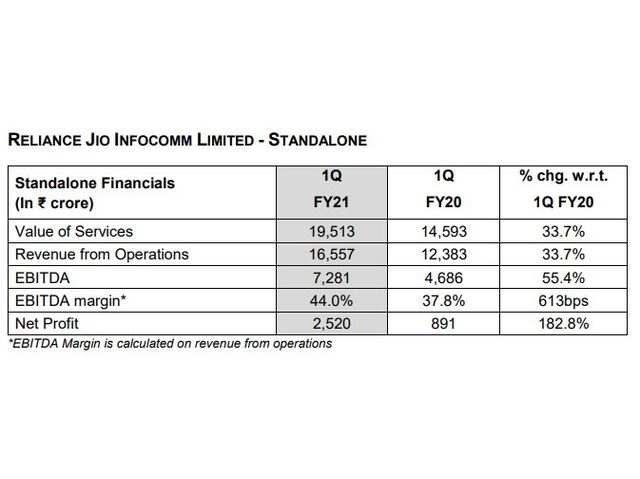

Like March qtr,big positives in June qtr too,were #Jio& #RelianceRetail numbers

Ebitda was up a solid 55.4%

Revenues up a good 33.7%

Jio's #Arpu though,was only 140.30, Vs nearest rival #BhartiAirtel's at 157

#EconomyOnTrack despite #Covid_19 related stress

India's #ManufacturingPMI is 47.2 in June2020,Vs 30.8 in May&24.7 in April 2020,indicating firm trends in private investment spending

Employment component rose from 42.7 in May,to 44.2 in June

With partial #Unlock&resumption of economic activity,#Unemployment rate fell to 7.26% in June,after peaking at 29.22% in May 2020

#EconomyOnTrack

Take M&M for example-while Auto sales fell 36% YoY in July 2020&CV sales by 18%,#TractorSales in July rose by solid 27% YoY

Btw,M&M derives over 40% sales from rural areas