I believe #ratio #charts are one of the most underrated and underutilized tools in #technicalanalysis. Do you agree?

Ever wondered which stock to chose between the two?

#HDFC or #HDFCBank?

#TCS or #Infosys?

#HeroMoto or #BajajAuto?

#ACC or #Ambuja?

#BPCL or #HPCL?

#BajajFinserv or #Bajajfinance?

But don't know whats the best approach to pick one?

#HDFC or #HDFCBank?

#TCS or #Infosys?

#HeroMoto or #BajajAuto?

#ACC or #Ambuja?

#BPCL or #HPCL?

#BajajFinserv or #Bajajfinance?

But don't know whats the best approach to pick one?

#Ratio #charts can help you identify the best stock for #trading and #investment. You can plot a #ratiochart by dividing the price on one stock with another. Its preferable to divide the high priced stock with low priced one to get ratios greater than 1.

You can plot a #ratiochart of stocks of your choice by downloading their closing prices in excel sheet and divide them and plot a line chart or simply go on @tradingview and key in the scrip codes like this: BANKNIFTY/NIFTY

Here's the #Ratiochart of #BankNifty to #Nifty. Remember we are dividing the high priced security with low priced one.

Notice the big fall in ratio chart since March 2020. The #ratio dropped from a high of 2.60 to a low of 1.90 by May.

Notice the big fall in ratio chart since March 2020. The #ratio dropped from a high of 2.60 to a low of 1.90 by May.

A falling #ratio means that #BankNifty was #underperforming #Nifty. Please note underperformance doesnt mean that BankNifty was falling and Nifty was rising. It means Bank Nifty underperformed Nifty. (in this case it fell more than Nifty)

Underperformance can happen in either of these cases:

1. #BankNifty falls more than #Nifty

2. #BankNifty falls and #Nifty rises

3. #BankNifty rises less than #Nifty

1. #BankNifty falls more than #Nifty

2. #BankNifty falls and #Nifty rises

3. #BankNifty rises less than #Nifty

#Outperformance can happen in either of these cases:

1. #BankNifty rises more than #Nifty

2. #BankNifty rises and #Nifty falls

3. #BankNifty falls less than #Nifty

1. #BankNifty rises more than #Nifty

2. #BankNifty rises and #Nifty falls

3. #BankNifty falls less than #Nifty

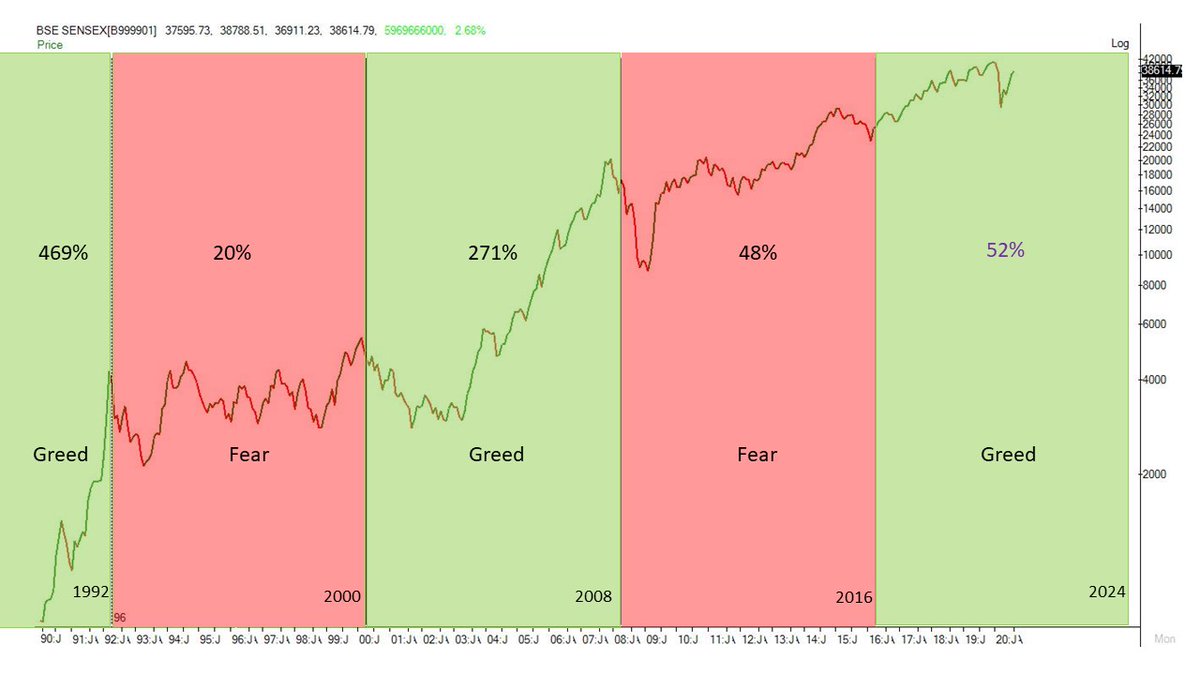

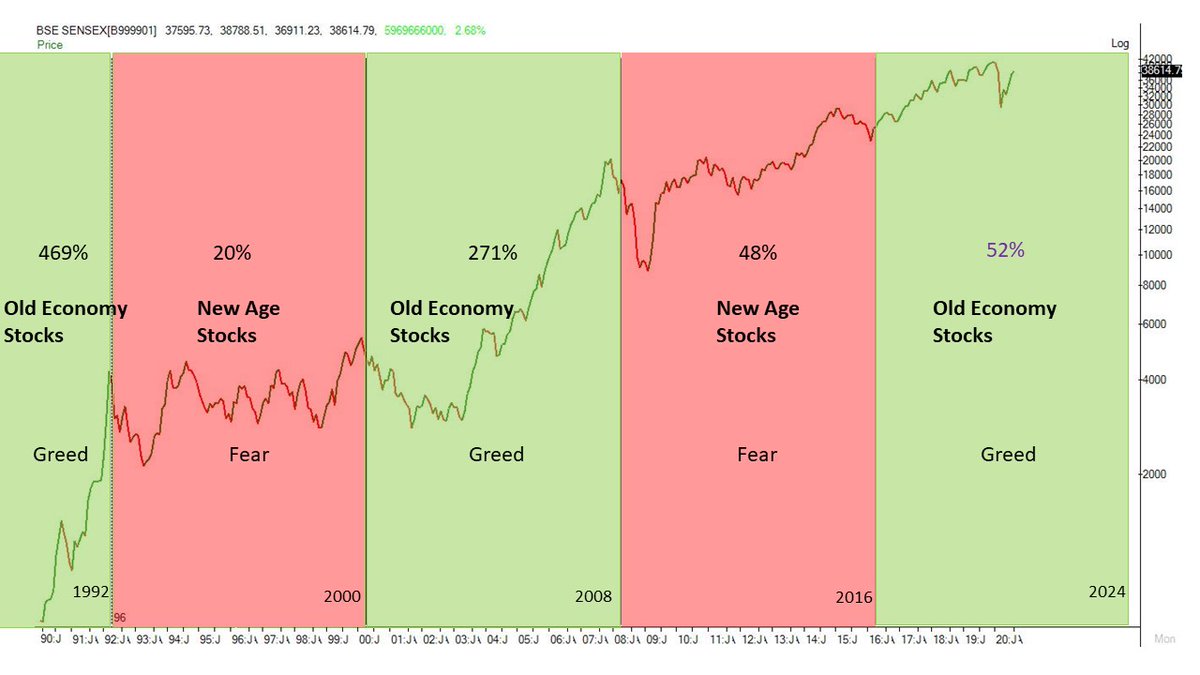

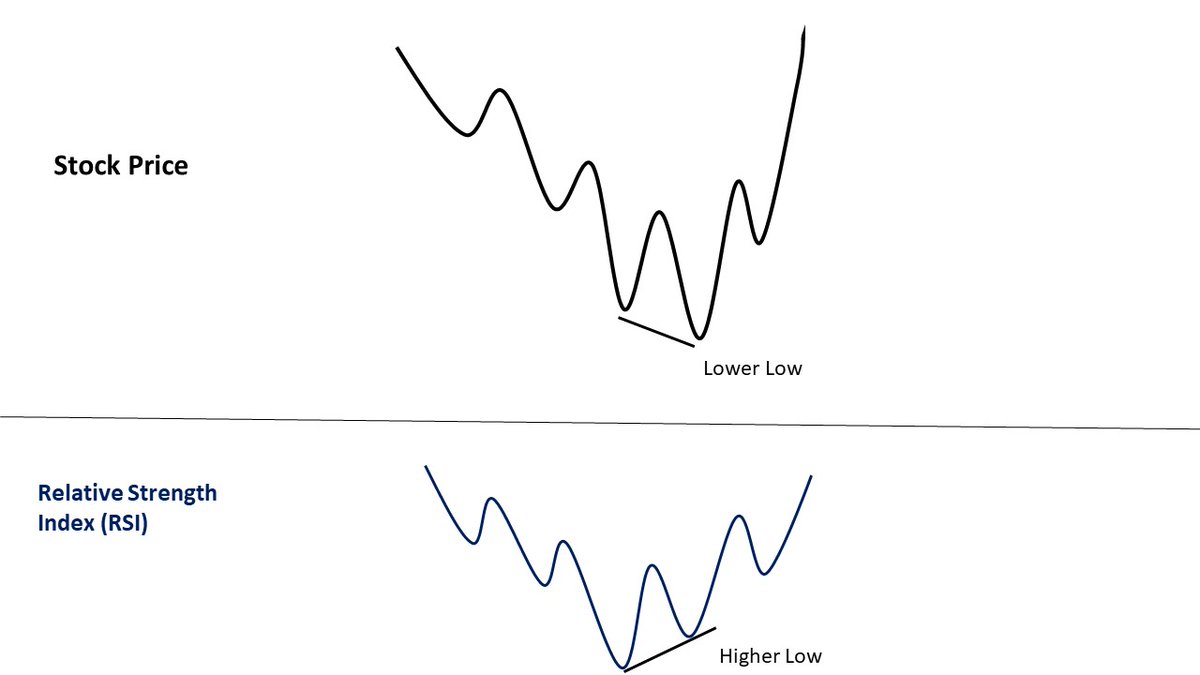

#Ratiocharts are just like your normal price charts so you can plot any technical indicator or study you want on them. But these ratio charts are cyclical in nature which makes them useful. Here's an example of #TCS & #Infosys.

#TCS & #Infosys stock price has multiplied by 4-5 times since 2013. But notice their #ratiochart trading nicely in the range of 2.00 to 3.00. At a ratio chart level of 2, TCS is underpriced compared to #Infy and at a level of 3 it is overpriced.

If you are a #fundmanager thinking which one to give more weightage in your #portfolio you could use #ratiocharts. Give more weightage to #TCS when the ratio is at 2 and give more weightage to #Infy when the ratio is at 3.

If you are a #trader with an appetite for risk you could go long on TCS and short Infosys when the ratio trades around 2. You could short #TCS and long #Infosys when the ratio is around 3. This strategy is known as #pairtrading.

The contract value of both the trades should be closer to each other. For example if you are shorting a stock with a contract value of Rs 6 lakh then you must buy the other stock worth Rs 6 lakh to maintain cash neutrality.

• • •

Missing some Tweet in this thread? You can try to

force a refresh