I've been crunching some numbers: if the reasonable worst case with partial mitigation is indeed 85,000 more #Covid deaths in the UK, it's very hard to justify going any further, especially if the alternative is #Lockdown2... (1/3)

Eg. suppose a full #lockdown would cut this number by 50%, to 42,500, and each premature death prevented is valued at £600k (10 years of life at the full QALY value of £60k from the Green Book, not the lower NHS figure of £30k), that's worth £25.5bn... (2/3)

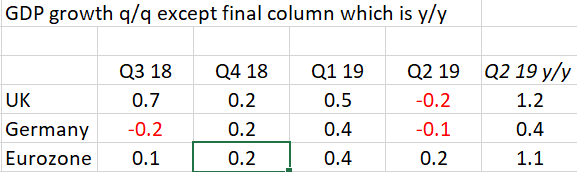

That's about 5% of one quarter's GDP. But another national #lockdown could easily cost 10% - and that's without taking account of other harms done by the lockdown to people's welfare.

Obviously I'm simplying a lot here, but can those supporting a lockdown do any better? (3/3)

Obviously I'm simplying a lot here, but can those supporting a lockdown do any better? (3/3)

• • •

Missing some Tweet in this thread? You can try to

force a refresh