#tether watch!

This time, captured it LIVE! (just happened to realize i was checking at the right time).

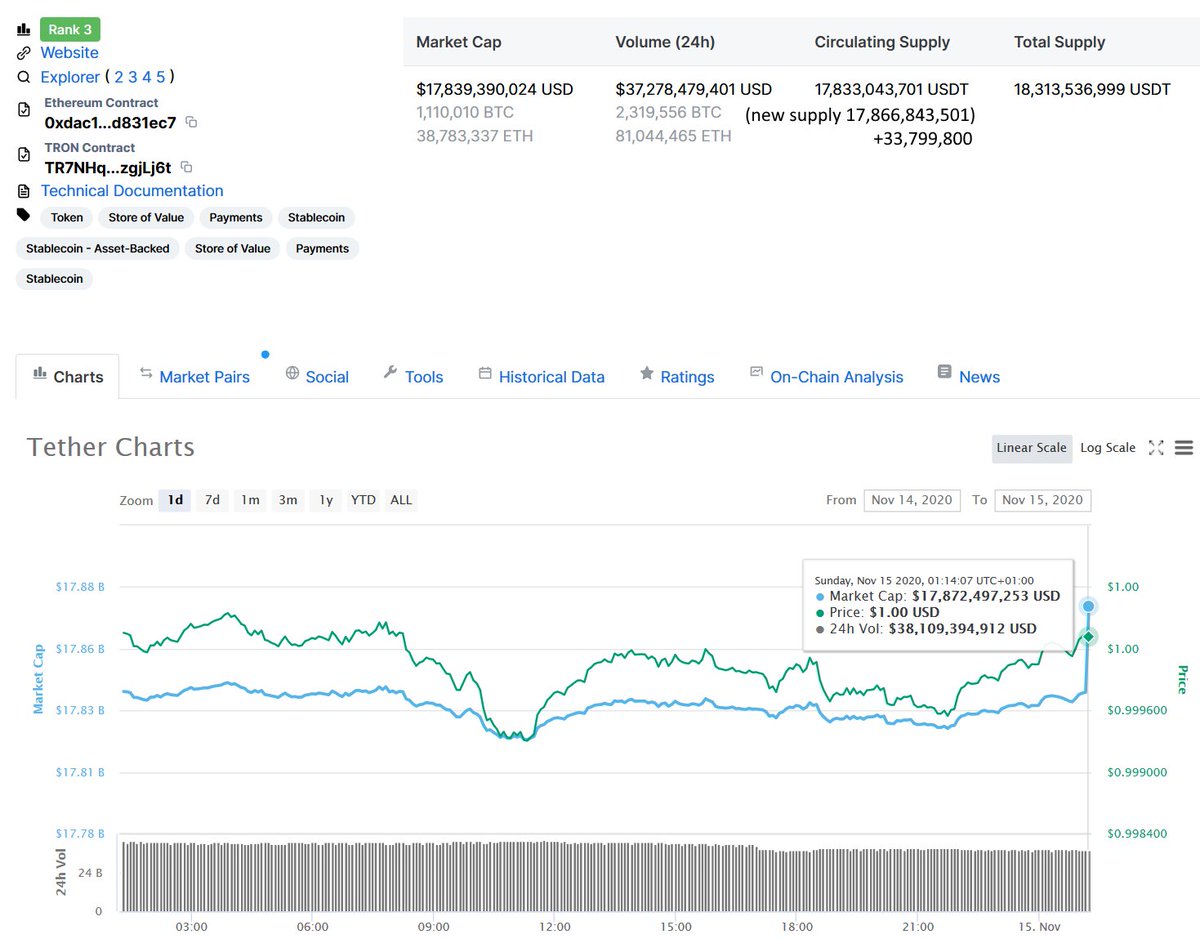

Top numbers took longer to update, so added em myself. +33 mil tonight, interesting.

Think that's cause it's a Saturday. Markets are quiet.

This time, captured it LIVE! (just happened to realize i was checking at the right time).

Top numbers took longer to update, so added em myself. +33 mil tonight, interesting.

Think that's cause it's a Saturday. Markets are quiet.

In order to buy bitcoin for tethers somebody's still gotta trade the #bitcoin for tethers.

Currently they're fine that as #Tether's become the medium of exchange between #crypto.

Point is, with less market participants, less people willing to sell their crypto for Tethers.

Currently they're fine that as #Tether's become the medium of exchange between #crypto.

Point is, with less market participants, less people willing to sell their crypto for Tethers.

BTW i'm also suspecting them of generating much of the bitcoin and tether volume in dollar terms themselves. If they'd move #crypto between accounts the they own on the exchange, it'd show up in the charts as volume. Since trade volume is low, they'd be pretty big block trades.

No way to prove that though unless i start tracking the ledger itself and THAT is a step too far xD

HOWEVER! To keep things fresh, i do have another way to keep things in perspective:

With this large a market cap, small changes in the coin's value quickly make BIG numbers.

HOWEVER! To keep things fresh, i do have another way to keep things in perspective:

With this large a market cap, small changes in the coin's value quickly make BIG numbers.

SO! Let's see what happens when we calculate the circulating supply of 17,83 billion Times a $0.02 price move as depicted below. And we get:

$35,666,087.402

And what did they print again? $33 mil worth of Tether?

Isn't that just *awfully* convenient?

$35,666,087.402

And what did they print again? $33 mil worth of Tether?

Isn't that just *awfully* convenient?

Correlation doesn't have to equal causation.

But it's starting to look like Tether's *positive* price action is mainly caused by #Tether themselves. AKA - they're using their #dollars during the day to support the price then swap tethers for #BTC/#USD during the night.

Behold:

But it's starting to look like Tether's *positive* price action is mainly caused by #Tether themselves. AKA - they're using their #dollars during the day to support the price then swap tethers for #BTC/#USD during the night.

Behold:

That's the price action on the 13th, GROSSLY simplified.

There are many more bounces then those arrows but i don't wanna go crazy typing zeroes so i isolated the major moves. I'm pretty sure if you isolate smaller ones too you'll find the missing ~30 mil.

There are many more bounces then those arrows but i don't wanna go crazy typing zeroes so i isolated the major moves. I'm pretty sure if you isolate smaller ones too you'll find the missing ~30 mil.

Meanwhile, add the downward price action and the number vastly exceeds the numbers printed, so that ain't it.

I'm not gonna do that for every day. I made my case i'm fine with conjecture and waiting for the movie at this point :D

But i gotta say. Quite the coinkidink.

I'm not gonna do that for every day. I made my case i'm fine with conjecture and waiting for the movie at this point :D

But i gotta say. Quite the coinkidink.

• • •

Missing some Tweet in this thread? You can try to

force a refresh