Wanted to make a post for the (cow)boys ^_^.

UNLESS YOU WANT TO GAMBLE STAY TF OUT!

That said, here's some credible info for once.

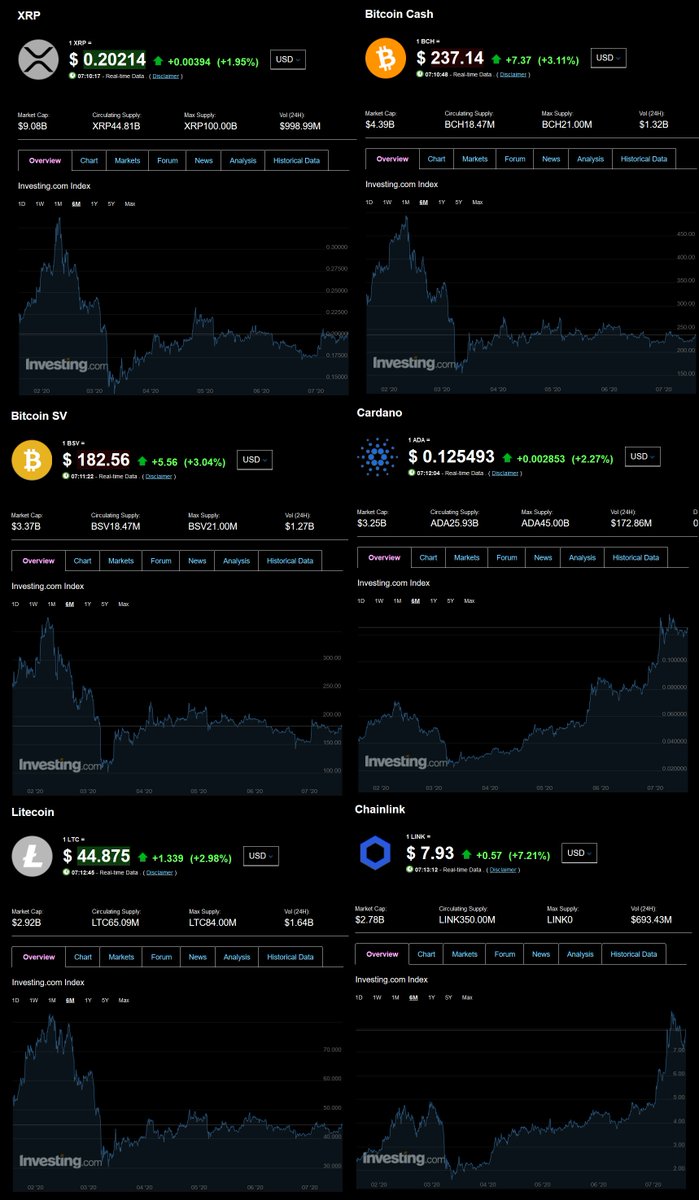

Here are top 10 Alt coins (Iota = "control")

The pattern reveals all....

$ETH $USDT $XRP $LINK $BCH $LTC $BNB $ADA $EOS #Fintwit $BTC #Bitcoin

UNLESS YOU WANT TO GAMBLE STAY TF OUT!

That said, here's some credible info for once.

Here are top 10 Alt coins (Iota = "control")

The pattern reveals all....

$ETH $USDT $XRP $LINK $BCH $LTC $BNB $ADA $EOS #Fintwit $BTC #Bitcoin

HOW TO READ THAT PICTURE:

#Tether's pumping up #bitcoin due to it being perfect for the scam, but they can't put all their eggs into one basket. They've bought some Alt Coins too, so those will follow the same pattern as Bitcoin.

Naturally, #Ethereum is 2nd in line.

#Tether's pumping up #bitcoin due to it being perfect for the scam, but they can't put all their eggs into one basket. They've bought some Alt Coins too, so those will follow the same pattern as Bitcoin.

Naturally, #Ethereum is 2nd in line.

So, the same pattern that reveals the #bitcoin scam; A Parabolic curve up combined with a continual Reduction in Trading Volume as measured in Trades; Also reveal which other coins are affected by the same scam.

Lined up side to side by Unaffected #Crypto; the pattern is obvious

Lined up side to side by Unaffected #Crypto; the pattern is obvious

Now not all of them *have* to go up, or sideways. There is an invisible hand at play. Don't take this as gospel!

Except #Ethereum that one's screwed due to its size. If it skews with #BTC too much it draws too much attention.

But #litecoin, #Ripple and #chainlink are primed IMO

Except #Ethereum that one's screwed due to its size. If it skews with #BTC too much it draws too much attention.

But #litecoin, #Ripple and #chainlink are primed IMO

There's precedence for #BTC/#ETH moving before the rest: In the August spike, those moved first (along with #Link and #Cardano), while the rest of the crypto space showed no action until a few days later.

Observe; this is not organic movement for the Top 4-9 #crypto at the time.

Observe; this is not organic movement for the Top 4-9 #crypto at the time.

Look i'm fine with people making money, and i'm fine with assets going up. But there should be some form of uniformity. Just like #Gold will drag #silver up or down, #Bitcoin should, at the very least, drag #bitcoincash up or down. It's a FORK for pete's sake!

A few days later, the rest of the space caught up. How convenient.

In any case that's just to say, it's likely the same thing happens again, this time because #tether hasn't got a choice.

Bet on the right horse at the start and jump off before it gets tired, you can make a buck

In any case that's just to say, it's likely the same thing happens again, this time because #tether hasn't got a choice.

Bet on the right horse at the start and jump off before it gets tired, you can make a buck

Oh, as a by the by;

#Tether is the perfect short.

Cause it's supposed to be a stable coin. 1 USDT = 1USD.

So if your account has a 10% margin buffer, you're good until Tether hits 1:$1,10USD - not likely. It hit $1,08 *in March*.

Literally you can borrow as much as you want.

#Tether is the perfect short.

Cause it's supposed to be a stable coin. 1 USDT = 1USD.

So if your account has a 10% margin buffer, you're good until Tether hits 1:$1,10USD - not likely. It hit $1,08 *in March*.

Literally you can borrow as much as you want.

MEANWHILE;

WHEN Tether collapses, price will start plummeting just like in 2019.

After all, Tether doesn't have the USD backing it, so 1 tether is worth LESS then 1 dollar.

Price must fall. Buy back cheap.

While shorts can't blow up on spikes up with enough buffer.

Genius.

WHEN Tether collapses, price will start plummeting just like in 2019.

After all, Tether doesn't have the USD backing it, so 1 tether is worth LESS then 1 dollar.

Price must fall. Buy back cheap.

While shorts can't blow up on spikes up with enough buffer.

Genius.

• • •

Missing some Tweet in this thread? You can try to

force a refresh