1/ Reality is that investors are not looking at Macro or Earnings right now. They were trapped last year and most of them don’t want to miss again any upside move.

bloomberg.com/news/articles/…

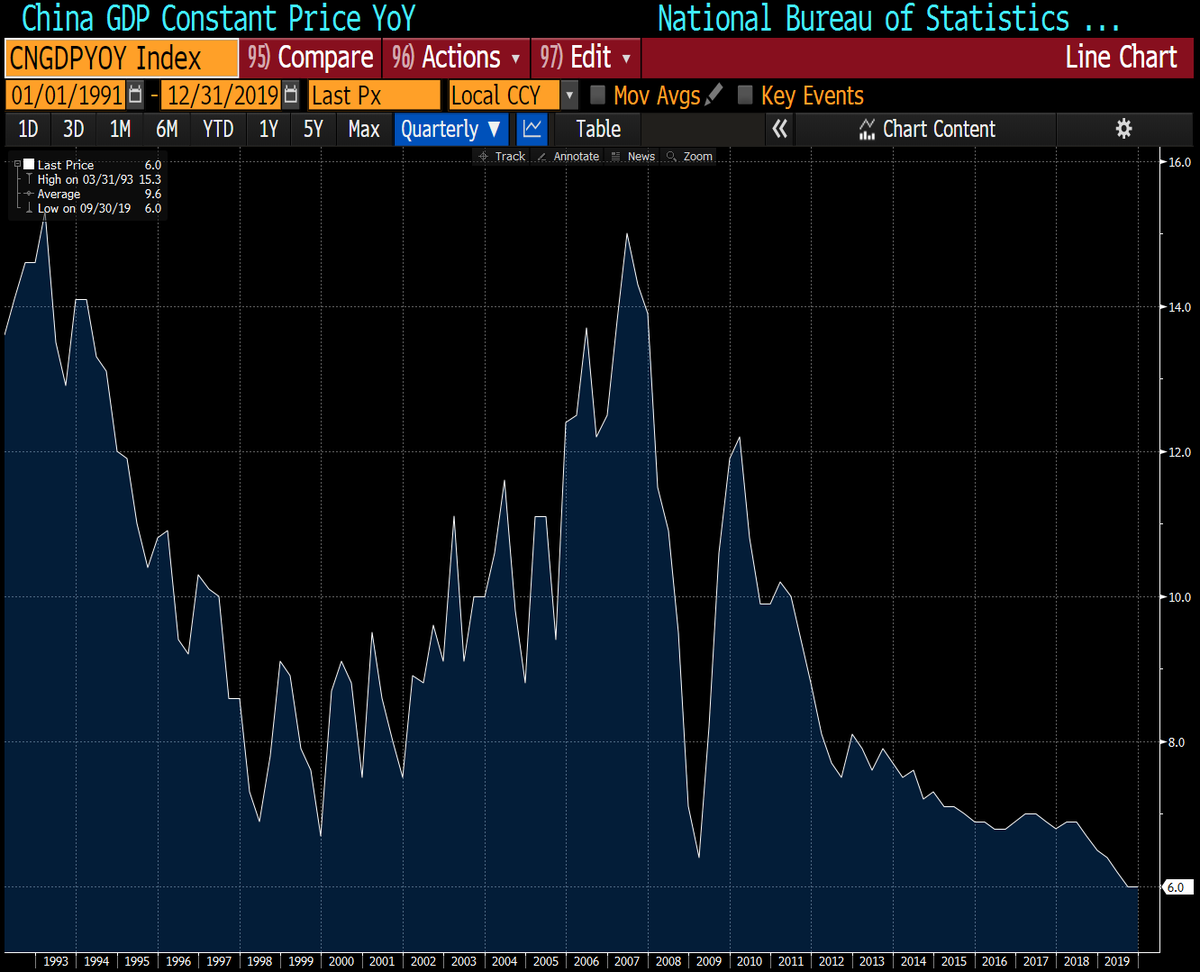

The paradox is that a counter-shock coming from China could lift growth & inflation expectations for 2021 but also push investors to return to earth by ending the liquidity party.

businessinsider.com/stock-market-i…