#GM!

What is #liquidity pool? how does it work? what is impermanent loss? how to minimize it?

This visual guide will help you understand #LP and how it enables decentralized #economy to thrive.

(1/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Uniswap #PancakeSwap

What is #liquidity pool? how does it work? what is impermanent loss? how to minimize it?

This visual guide will help you understand #LP and how it enables decentralized #economy to thrive.

(1/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Uniswap #PancakeSwap

LP is a vault into which participants deposit and lock their assets in smart contracts to form a market (trading pair) and make it liquid for those wishing to trade in that pair.

(2/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Infographic #yieldFarming

(2/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Infographic #yieldFarming

Most #LP requires assets to be paired, this asset will create trading pair by utilising constant product formula to ensure a fair price.

(3/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Infographic #yieldFarming

(3/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Infographic #yieldFarming

As mentioned before, LP must maintain its equilibrium to ensure minimum price inefficiency. This can be done through the #arbitrage process.

(4/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Infographic #yieldFarming

(4/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Infographic #yieldFarming

#Cryptocurrency #arbitrage is a #strategy in which #investors buy a cryptocurrency on one exchange and then quickly sell it on another exchange for a higher price. This will make the price in #LP become efficient.

(5/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX

(5/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX

Deep #liquidity in the pool will greatly affect the price, as it will determine how much slippage during the trade besides the size of the #trade.

(6/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Infographic #yieldFarming

(6/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Infographic #yieldFarming

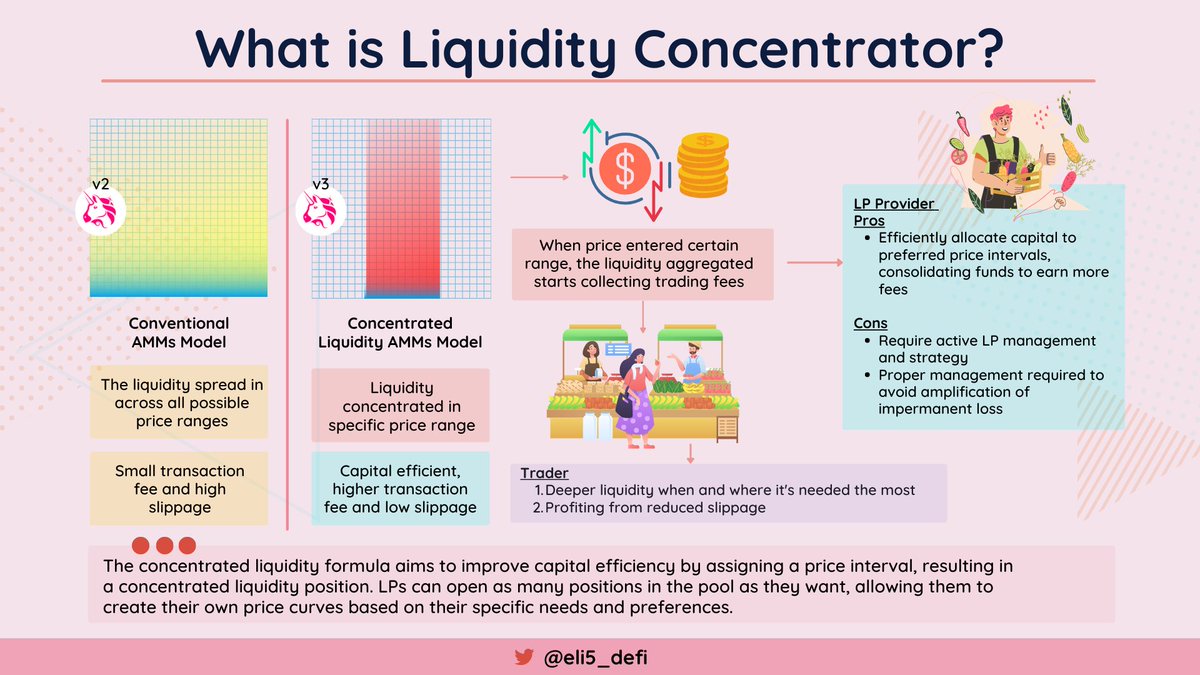

Other mechanism, liquidity concentrator also available in @Uniswap v3. The #formula aims to improve #capital efficiency by assigning a #price interval, resulting in a concentrated #liquidity position.

(7/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Uniswap #Infographic

(7/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Uniswap #Infographic

Participating as an LP provider enables someone to capture LP token #yield and #profit generated in that #protocol

(8/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Uniswap #YieldFarming #Infographic

(8/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Uniswap #YieldFarming #Infographic

LP Provider also facing several risks: securities, fraud and most importantly #impermanent #loss (IL) that will be an integral part of the liquidity pool.

(9/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Uniswap #yieldFarming #liquidity #Infographic

(9/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Uniswap #yieldFarming #liquidity #Infographic

#Impermanent #loss is when a liquidity provider has a temporary loss of funds because of volatility in a #trading pair.

(10/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Uniswap #yieldFarming #liquidity #Infographic

(10/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Uniswap #yieldFarming #liquidity #Infographic

To minimize IL, the provider could create a Volatile-Non Volatile or Non-Volatile LP to reduce the risk of IL. Also, the provider could tap the profit from the transaction fees and LP tokens.

(11/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Uniswap #yieldFarming

(11/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Uniswap #yieldFarming

Other methods are choosing liquidity pool w/ flexible ratio, single pool staking or LP asset that have an equal price (found in liquid staking)

(12/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Uniswap #yieldFarming #liquidity #Infographic

(12/12)

#DeFi #Crypto #Bitcoin #Ethereum #AVAX #BNB #DEX #Uniswap #yieldFarming #liquidity #Infographic

Below is several list of the DEXs where you could create LP:

@CurveFinance

@Uniswap

@SushiSwap

@RaydiumProtocol

@Bancor

@traderjoe_xyz

@BalancerLabs

@PancakeSwap

Complete List:

defillama.com/protocols/Dexes

@CurveFinance

@Uniswap

@SushiSwap

@RaydiumProtocol

@Bancor

@traderjoe_xyz

@BalancerLabs

@PancakeSwap

Complete List:

defillama.com/protocols/Dexes

Also shoutout to account below that have amazing educational content #DeFi

@blocmatesdotcom

@DeFi_educator

@rektdiomedes

@knowerofmarkets

@thedefiedge

@Route2FI

@VirtualKenji

@alpha_pls

@OmarOnChain

@DeFi_Made_Here

@0xHamz

@AstrocaveAvax

@The_ReadingApe

@JiraiyaReal

@blocmatesdotcom

@DeFi_educator

@rektdiomedes

@knowerofmarkets

@thedefiedge

@Route2FI

@VirtualKenji

@alpha_pls

@OmarOnChain

@DeFi_Made_Here

@0xHamz

@AstrocaveAvax

@The_ReadingApe

@JiraiyaReal

• • •

Missing some Tweet in this thread? You can try to

force a refresh