Thanks to @GeoffCutmore & @cnbcKaren for this morning's chat on #SquawkBox.

I did TRY to find something positive to say - honest, folks!

Following are the notes I sent the team before the show:-

🧵1/x

I did TRY to find something positive to say - honest, folks!

Following are the notes I sent the team before the show:-

🧵1/x

Something I've mentioned on here: the enormous scale of Europe's energy problem runs into the €trillions. The #AmpelDesGrauens "Doppel-Wums" -'bazooka' - relief package is €200bln & doubts are *already* being voiced whether will suffice.

3/x

3/x

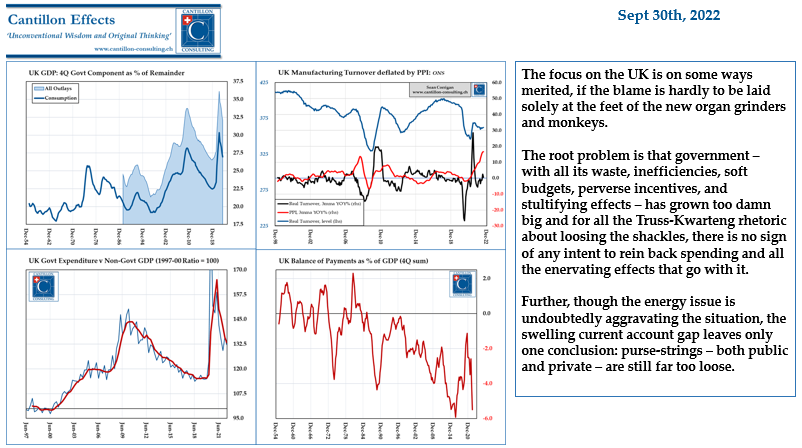

Of course, this also badly afflicts the market's punchbag-du-jour -the #UK. Once the Saudia Arabia of #coal; almost a petrostate in the North Sea's heyday: now sadly reliant on (#GBP expensive) imports to keep the lights on & the wheels turning.

4/x

4/x

Let EU politicians, US #Treasury officials, #IMF panjandrums & others criticise all they like, they need to take the beam out of their own eyes before pointing at the British mote.

5/x

5/x

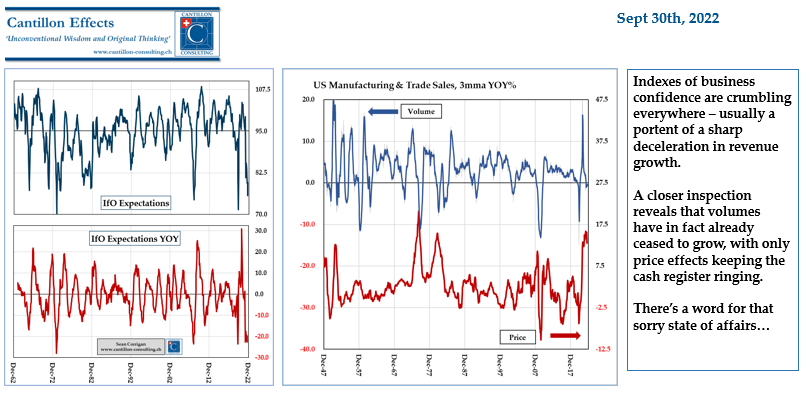

Rising prices and stagnant volumes plague businesses across the range - and that's even before we get to enforced shut-downs and rolling 'brownouts' this winter and spring.

'#stagflation', I believe it's called.

6/x

'#stagflation', I believe it's called.

6/x

All of which has been too much for CB-inflated asset prices. #Bonds, everywhere, have taken a pounding, not just in the Square Mile.

7/x

7/x

Take #Bunds, for example.

Given the long Calvary of #NIRP, do you honestly suppose that Continental #pension/insurer firms have abstained from playing some of the derivative games which occasioned the UK so much angst this week?

8/x

Given the long Calvary of #NIRP, do you honestly suppose that Continental #pension/insurer firms have abstained from playing some of the derivative games which occasioned the UK so much angst this week?

8/x

Ironically, higher yields, per se, are a BOON to pension accounts, as shown here for the Direct Benefit sector in the UK. Who DID this week's margin calls threaten? The end users or their typically less well-capitalized counterparts?

9/x

9/x

Ok, so long years of lazy #CentralBank consensus, interacting with wilful political folly in matters such as #NetZero, have greatly impaired the UK's ability to resist, but whose roof ISN'T leaking; whose storm shutters ARE hurricane proof?

10/x

10/x

A more dispassionate glance shows that #sterling has not been unique in slumping against the 'cleanest shirt in the laundry', the #USD. Nor have its #equities suffered more than its peers'.

We ARE in a dark place, but throwing brickbats at Britain is mere displacement.

11/x

We ARE in a dark place, but throwing brickbats at Britain is mere displacement.

11/x

Looks like Twitter severed the link between this and the rest of the thread. 😒

It's there, in the timeline if you look. Promise.

It's there, in the timeline if you look. Promise.

@threadreaderapp please unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh