The November #CPI report is notable in part due to the fact that it displays the second consecutive month of more moderate price pressures, providing some signal that the underlying trend of #inflation is decelerating.

Turning to the data, #coreCPI (excluding volatile food and #energy components) came in at 0.2% month-over-month and rose 6.0% year-over-year.

Meanwhile, #headlineCPI data printed 0.1% month-over-month and came in at 7.1% year-over-year, with declines in #UsedCars, medical care and airline fares contributing to this result. Still, both #shelter costs and the food index rose significantly.

Additionally, the @federalreserve’s favored measure of #inflation, #corePCE, increased 0.22% in October, bringing the year-over-year figure for the measure to 5.0%, as of that month.

Finally, another measure that’s worth looking at, the @DallasFed’s trimmed mean measure of PCE inflation, printed at 4.7% year-over-year in October.

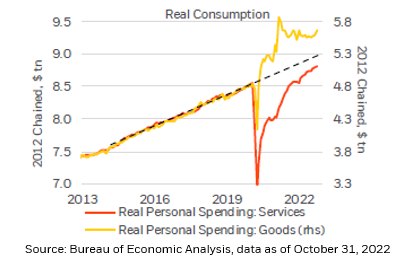

Taking a step back, after the pandemic period, demand surged, with #goods sectors witnessing a spending surge first, when engaging the services #economy was difficult in many places and then services spending catching up, as widespread reopening of the economy took place.

This profound disruption to the pre-pandemic personal #spending patterns also saw #prices follow that demand trajectory, with roughly a one-year lag.

For instance, in core goods #UsedCars were a large contributor to #inflation in 2022, but as the year closes, we’ve begun to see the category turn into a drag on price pressures (with a decline of -2.9% month-over-month in November).

Similarly, while we think #OilPrices could remain near $80 bbl. in 2023, even at that level, we’d see 2022’s #inflation in the #commodity turn to 2023’s deflation, on a year-over-year basis.

All told, as interest-rate sensitive #HomePrices likely soften at the margin in the year ahead, as used car prices continue to turn down, and if we assume…

…the #energy disinflation that should take place if we merely remain near current price levels (prices have been falling for five months), then #inflation should moderate meaningfully in the year ahead.

Indeed, given that dynamic, even if one assumes fairly robust #inflation in every other category (e.g., 4% to 5%), we could still see the year-over-year rate of inflation get close to 3% next year.

If data such as today’s suggests a real trend- that the momentum of inflation is lower- we could then see the #Fed pause over the next few months at a still restrictive policy-rate…

…but not one that would put potentially excessive pressure on the #economy, and particularly on the interest-sensitive parts of the economy that have already begun to show signs of real (and anticipated) weakness.

• • •

Missing some Tweet in this thread? You can try to

force a refresh