TODAY IN THE MARKETS

$SPX

A low #CPI triggered a 114-point jump that took it above the dominant trendline. At the open, sell orders above that level initiated a pullback that took it 126 points down to the 20DMA

Not what we would call a 1-day reversal, more upside to come

#SPX

$SPX

A low #CPI triggered a 114-point jump that took it above the dominant trendline. At the open, sell orders above that level initiated a pullback that took it 126 points down to the 20DMA

Not what we would call a 1-day reversal, more upside to come

#SPX

$DIA

Same picture for #DIA, sell orders above Dec 1 high pushed the #DJI lower

It went down after an impressive initial rally

Bounced from 20DMA

#DJIA will continue to lead the rally

Not a pretty candle, but not exactly a 1-day reversal

#DowJones #trading #options #trading

Same picture for #DIA, sell orders above Dec 1 high pushed the #DJI lower

It went down after an impressive initial rally

Bounced from 20DMA

#DJIA will continue to lead the rally

Not a pretty candle, but not exactly a 1-day reversal

#DowJones #trading #options #trading

$IWM

Same story

Perhaps an uglier candle, closer to a 1-day reversal than $DIA and $SPX.

$RTY looking much better

Bounced from important support in the trading channel

Big volume today.

#IWM needs to catch up with $DJI for accompanying leadership

$RUT #RUT #RTY_F #trading

Same story

Perhaps an uglier candle, closer to a 1-day reversal than $DIA and $SPX.

$RTY looking much better

Bounced from important support in the trading channel

Big volume today.

#IWM needs to catch up with $DJI for accompanying leadership

$RUT #RUT #RTY_F #trading

$QQQ

Another bounce from the 20DMA after rallying and plunging

#QQQ looks very good in its trading channel, the 20DMA coincided with the channel support to stop the fall

Expecting it to heal the damage and continue in its uptrending channel

#NDX #NQ_F $NDX #NASDAQ #trading

Another bounce from the 20DMA after rallying and plunging

#QQQ looks very good in its trading channel, the 20DMA coincided with the channel support to stop the fall

Expecting it to heal the damage and continue in its uptrending channel

#NDX #NQ_F $NDX #NASDAQ #trading

$SMH

Make a fresh break above the recent highs, and closed barely under that level

This sector will help with the continuation of the advance

#SMH $SOX #SOX #semiconductor

#QQQ #SPX #trading #options #futures

#DayTrading

Make a fresh break above the recent highs, and closed barely under that level

This sector will help with the continuation of the advance

#SMH $SOX #SOX #semiconductor

#QQQ #SPX #trading #options #futures

#DayTrading

The $SPX stocks above 200DMA index

It closed at 61.63%

Looking good, it hit Dec-1 highs and pulled back, but not as much as #SPX

It continues to show inner strength in SPX

#trading #ES_F $SPY $ES #trading #options #futures #DayTrading #bearmarket #inflation #TradingSignals

It closed at 61.63%

Looking good, it hit Dec-1 highs and pulled back, but not as much as #SPX

It continues to show inner strength in SPX

#trading #ES_F $SPY $ES #trading #options #futures #DayTrading #bearmarket #inflation #TradingSignals

The $SPX stocks above 50DMA index

It closed at 80.71% and below the 20DMA

Not a nice candle today, but in some way it's better that it didn't go to oversold territory

#SPX #ES_F #SPY $SPY $ES #trading #options #future #DayTrading #TradingSignals #MarketBreadth $QQQ $DIA $IWM

It closed at 80.71% and below the 20DMA

Not a nice candle today, but in some way it's better that it didn't go to oversold territory

#SPX #ES_F #SPY $SPY $ES #trading #options #future #DayTrading #TradingSignals #MarketBreadth $QQQ $DIA $IWM

$TSLA

It was a drag on the market

Its chart shows very nasty technical damage

It marked a 2-year low today

It needs to close above 178 this week to have any hope, but it doesn't look like a real possibility

Are you looking for a stock to short?

#TSLA #FAANG #QQQ #SPX #ES_F

It was a drag on the market

Its chart shows very nasty technical damage

It marked a 2-year low today

It needs to close above 178 this week to have any hope, but it doesn't look like a real possibility

Are you looking for a stock to short?

#TSLA #FAANG #QQQ #SPX #ES_F

Chart of the day

$FLNC

Fluence Energy made a great breakout closing today above resistance.

It looks like a good candidate to go long, its chart shows no immediate resistance so it can go up without too much of a struggle

#FLNC #energy #ElectricVehicles #GreenEnergy

#SPX

$FLNC

Fluence Energy made a great breakout closing today above resistance.

It looks like a good candidate to go long, its chart shows no immediate resistance so it can go up without too much of a struggle

#FLNC #energy #ElectricVehicles #GreenEnergy

#SPX

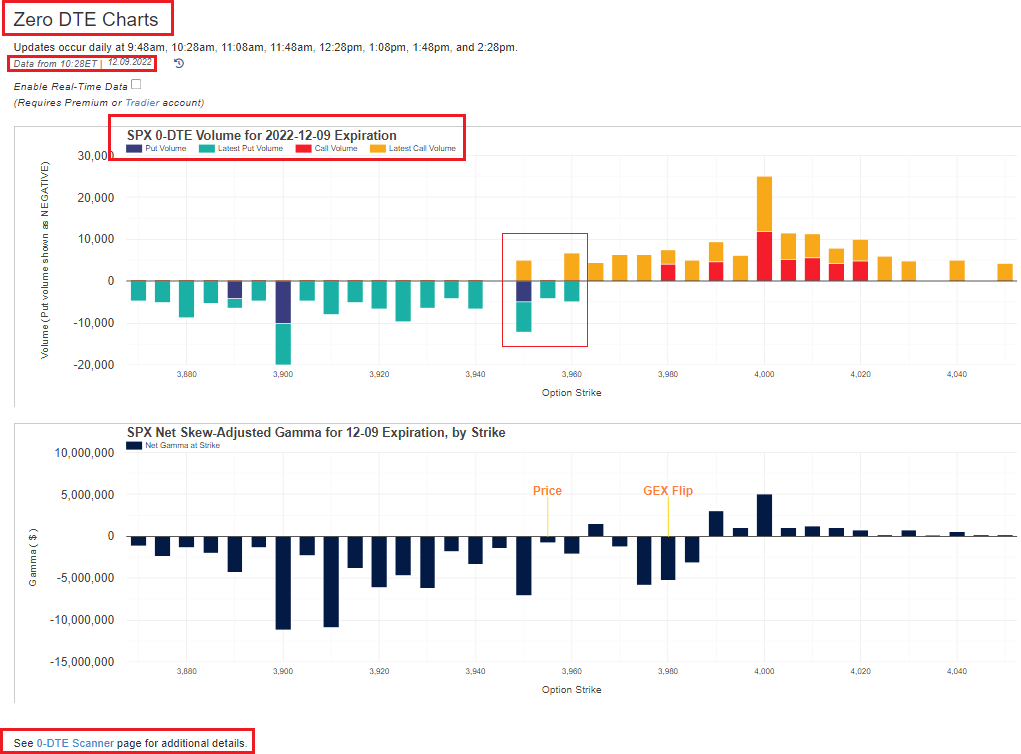

$SPX Net $Gamma for Dec-16 $OPEX

#Gamma is the main issue to watch

Final adjustments and hedging (tomorrow and Thursday) will push the market to the place where MMs have the least risk

Bets are still scattered, but will be concentrated on two or three strikes

@TradeVolatility

#Gamma is the main issue to watch

Final adjustments and hedging (tomorrow and Thursday) will push the market to the place where MMs have the least risk

Bets are still scattered, but will be concentrated on two or three strikes

@TradeVolatility

$VIX $VVIX

It printed a very large bearish engulfing candle

There is nothing bullish in the #VIX chart, only that it managed to close above the 20DMA after piercing its line

It may have some bounces, but it looks like we'll have a sub 20 VIX this year

#VVIX $UVIX #SVIX $SVIX

It printed a very large bearish engulfing candle

There is nothing bullish in the #VIX chart, only that it managed to close above the 20DMA after piercing its line

It may have some bounces, but it looks like we'll have a sub 20 VIX this year

#VVIX $UVIX #SVIX $SVIX

$VVIX

Its chart looks much better than #VIX

It managed to print a green candle, despite of negative day (-3,26%)

It may be the precursor of more #volatility to come, but we need more evidence of this

$VIX #VVIX $SPX $ES $SPY #SPX #ES_F $SVIX $VIXY #trading #options #future

Its chart looks much better than #VIX

It managed to print a green candle, despite of negative day (-3,26%)

It may be the precursor of more #volatility to come, but we need more evidence of this

$VIX #VVIX $SPX $ES $SPY #SPX #ES_F $SVIX $VIXY #trading #options #future

• • •

Missing some Tweet in this thread? You can try to

force a refresh