In our latest #growth report for #Pakistan, we examined, among other themes, the role of #FDI in the country. How much #Pakistan attracts, how much it could attract, the impact on #productivity and on #jobs.

A short 🧵👇

openknowledge.worldbank.org/handle/10986/3…

A short 🧵👇

openknowledge.worldbank.org/handle/10986/3…

1) #FDI is a useful source of financing for #developing countries. It is stable, and typically associated w/ #export growth, #job creation and #productivity upgrading. Does that all of that apply to #FDI in #Pakistan? Let's see...

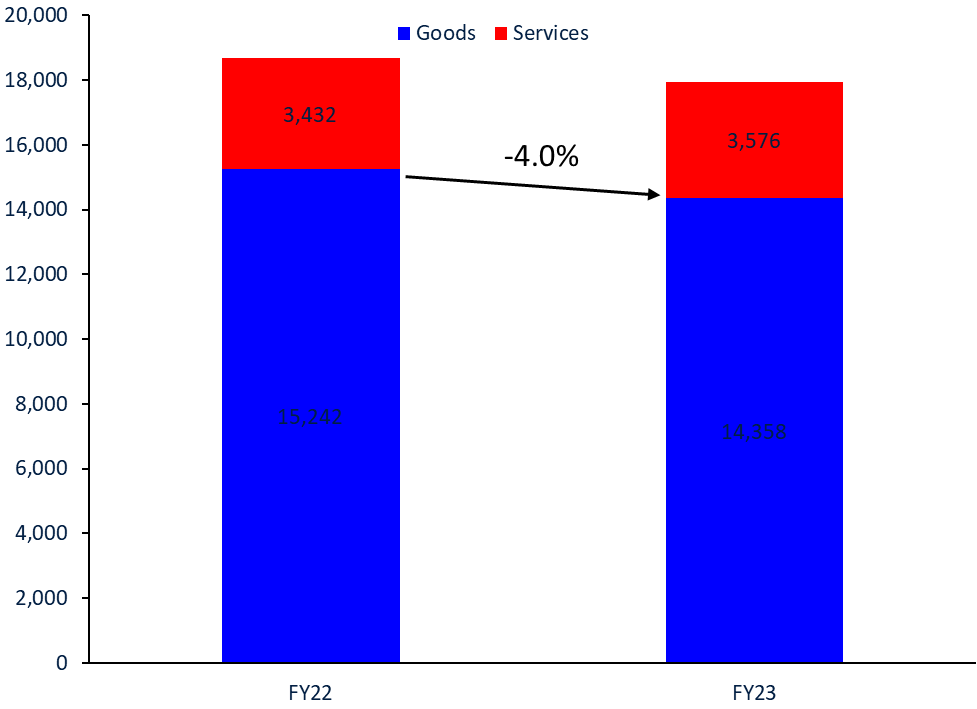

3) #FDI has also been low as a share of #foreign financing sources - this matters because #FDI is a relatively stable financing source, bringing #macroeconomic stability.

#Pakistan #investment #liabilities

#Pakistan #investment #liabilities

4) In #Pakistan, 1 in 4 greenfield #FDI (that is, new projects) announced over the past 5 years have focused on the #IT sector.

#greenfield #FDI announcements by #sector, #Pakistan

#greenfield #FDI announcements by #sector, #Pakistan

5) Is #FDI associated w/ #productivity growth in #Pakistan? Several ways of looking at this:

a- #foreign firms in #Pakistan are 46% more productive than domestic. They bring better #management & #technology, they also 'cherry pick' productive firms to acquire. (see col 2).

a- #foreign firms in #Pakistan are 46% more productive than domestic. They bring better #management & #technology, they also 'cherry pick' productive firms to acquire. (see col 2).

5) b- does more #FDI increase #productivity of other local firms (ie: #spillovers) ? Yes, but not by much.

Small vertical #spillovers from #services, benefitting the least productive local firms most.

#vertical #productivity #spillovers from #FDI

Small vertical #spillovers from #services, benefitting the least productive local firms most.

#vertical #productivity #spillovers from #FDI

6) a- Our finding of #vertical #FDI spillovers are in line with findings of @waqarwadho and Chaudhry suggesting #innovation is triggered by vertical linkages with #suppliers (eg FDI).

6) b- our finding of limited spillovers (think that a 10 percent increase in #FDI leads to a tiny 0.5% increase in #productivity) may be related to the composition of #FDI in #Pakistan - mostly in highly protected, domestic oriented sectors.

7) Looking forward - what's the #potential for #FDI in #Pakistan? We estimate the #untapped #potential for #FDI inflows at $2.8 billion annually (more than double current inflows).

8) How to realize the #FDI potential? What's needed 4 #FDI is similar to what's needed 4 #domestic #investment.

Think #investment #policy as a cycle: attract, retain, & ensure it links w/ rest of the economy 4 high #spillovers.

For more ideas, read: openknowledge.worldbank.org/handle/10986/3…

Think #investment #policy as a cycle: attract, retain, & ensure it links w/ rest of the economy 4 high #spillovers.

For more ideas, read: openknowledge.worldbank.org/handle/10986/3…

• • •

Missing some Tweet in this thread? You can try to

force a refresh