[1/🧵] "#ISO20022 is bigger than you think"

You've probably heard that term a few times and wondered what it meant. 🤔

In case you are curious now:

A brief explanation of everything important.

There will be nothing complicated ahead, so don't worry. 🧵👇

You've probably heard that term a few times and wondered what it meant. 🤔

In case you are curious now:

A brief explanation of everything important.

There will be nothing complicated ahead, so don't worry. 🧵👇

[2/24] — Outline —

🔹 Origin & Timeline

🔹 What's the big deal?

🔹 Details regarding the transformation

🔹 Migration Approaches

🔹 Relations to #Crypto (#DTI)

🔹 @Ripple & #JSON formats

🔹 Origin & Timeline

🔹 What's the big deal?

🔹 Details regarding the transformation

🔹 Migration Approaches

🔹 Relations to #Crypto (#DTI)

🔹 @Ripple & #JSON formats

[3/24] — Origin & Timeline —

The #ISO 20022 standardization efforts began very early on. Indeed, you may be wondering how you missed it until this date. 😅

The #ISO 20022 standardization efforts began very early on. Indeed, you may be wondering how you missed it until this date. 😅

[4/24] — 1⃣ What's the big deal? —

#ISO20022, the successor to #ISO15022, which is the successor to #ISO7775, has a single goal:

☑️ Facilitate communication interoperability across financial institutions, market infrastructures, and end-user groups.

. . .

#ISO20022, the successor to #ISO15022, which is the successor to #ISO7775, has a single goal:

☑️ Facilitate communication interoperability across financial institutions, market infrastructures, and end-user groups.

. . .

[5/24] — 2⃣ What's the big deal? —

. . .

☑️ The potential solution w/ #ISO20022 is to create a uniform standardization method that all financial standards organizations would follow.

🤔 As an illustration, consider the unification of all languages into a single standard: English

. . .

☑️ The potential solution w/ #ISO20022 is to create a uniform standardization method that all financial standards organizations would follow.

🤔 As an illustration, consider the unification of all languages into a single standard: English

[7/24] — 1⃣ Details regarding the transformation —

What will change ❓

🔹 @ecb #TARGET2 & #TARGET2-Securities Consolidation

🔸 Replaced by #T2, a new real-time gross settlement (#RTGS) technology that improves liquidity management.

What will change ❓

🔹 @ecb #TARGET2 & #TARGET2-Securities Consolidation

🔸 Replaced by #T2, a new real-time gross settlement (#RTGS) technology that improves liquidity management.

[8/24] — 2⃣ Details regarding the transformation —

What will change ❓

🔹 #TARGET Services - Shared features

🔸 Central #liquidity management

(single liquidity pool)

🔸 One message standard ISO 20022

🔸 Joint pricing guide

🔸 Multi-vendor connectivity

ecb.europa.eu/paym/target/co…

What will change ❓

🔹 #TARGET Services - Shared features

🔸 Central #liquidity management

(single liquidity pool)

🔸 One message standard ISO 20022

🔸 Joint pricing guide

🔸 Multi-vendor connectivity

ecb.europa.eu/paym/target/co…

[9/24] — 3⃣ Details regarding the transformation —

What will change ❓

🔹 New accounts with #TARGET

🔸 Main #Cash Account (#MCA)

🔸 Dedicated Cash Accounts (#DCA)

"The #ECB addresses the growing need for an effective facility for the supply of liquidity to present [...]

. . .

What will change ❓

🔹 New accounts with #TARGET

🔸 Main #Cash Account (#MCA)

🔸 Dedicated Cash Accounts (#DCA)

"The #ECB addresses the growing need for an effective facility for the supply of liquidity to present [...]

. . .

[10/24] — 4⃣ Details regarding the transformation —

. . .

[...] and future #Eurosystem #payment and #settlement services by separating the account structure in an #MCA and #DCA arrangement.

It facilitates the usage of a single data layer and service harmonization."

. . .

[...] and future #Eurosystem #payment and #settlement services by separating the account structure in an #MCA and #DCA arrangement.

It facilitates the usage of a single data layer and service harmonization."

[11/24] — 5⃣ Details regarding the transformation —

What will change ❓

🔹 Payment message formats defined by #ISO20022

🔸 The formats differ and must be translated or received in #MX directly.

What will change ❓

🔹 Payment message formats defined by #ISO20022

🔸 The formats differ and must be translated or received in #MX directly.

[12/24] — 6⃣ Details regarding the transformation —

What will change ❓

🔹 The transition to #ISO20022-defined messages

🔸 #EURO1

🔸 #SWIFT #CBPR+

🔸 Canada's #HVPS #Lynx

🔸 Australia's #HVCS #AusPayNet

🔸 New Zealand's HVCS #NZClear

What will change ❓

🔹 The transition to #ISO20022-defined messages

🔸 #EURO1

🔸 #SWIFT #CBPR+

🔸 Canada's #HVPS #Lynx

🔸 Australia's #HVCS #AusPayNet

🔸 New Zealand's HVCS #NZClear

[13/24] — 1⃣ Migration Approaches —

🔹 Ad-hoc Translation

📝 Converts incoming #MX messages to corresponding old #MT forms, as well as outgoing MT messages to equivalent MX formats, and enables needed #reporting and confirmation messages.

🔹 Ad-hoc Translation

📝 Converts incoming #MX messages to corresponding old #MT forms, as well as outgoing MT messages to equivalent MX formats, and enables needed #reporting and confirmation messages.

[14/24] — 2⃣ Migration Approaches —

🔹 Native Implementation

📝 Accepts the entire breadth of #ISO 20022.

🔹 Native Implementation

📝 Accepts the entire breadth of #ISO 20022.

[15/24] — 3⃣ Migration Approaches —

🔹 Hybrid Approach

📝 Achieves smoother #CBPR+ adoption by allowing financial institutions to migrate a subset of CBPR+ messages using an ad-hoc #translator and other messages using native CBPR+/#ISO 20022 implementation.

🔹 Hybrid Approach

📝 Achieves smoother #CBPR+ adoption by allowing financial institutions to migrate a subset of CBPR+ messages using an ad-hoc #translator and other messages using native CBPR+/#ISO 20022 implementation.

[16/24] — 4⃣ Migration Approaches —

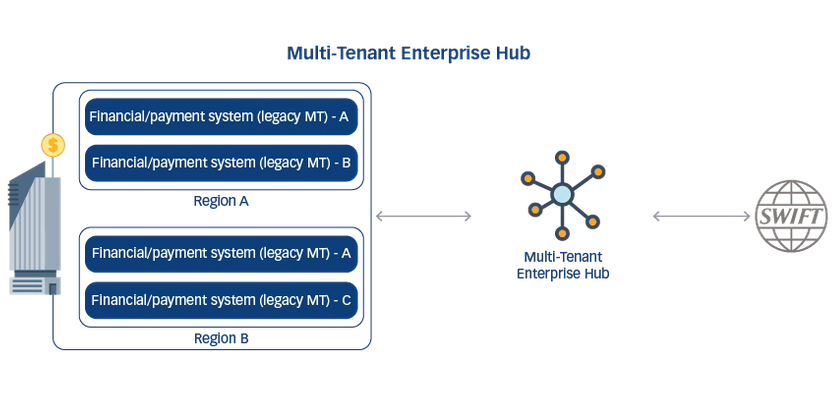

🔹 Centralized Payments Hub Orchestrator

📝 Operates as a #bridge between the financial institution's back-end systems and the #SWIFT network, and supports all other techniques as well as new additional functionalities

🔹 Centralized Payments Hub Orchestrator

📝 Operates as a #bridge between the financial institution's back-end systems and the #SWIFT network, and supports all other techniques as well as new additional functionalities

[17/24] — 5⃣ Migration Approaches —

🔹 Multi-Tenant Enterprise Hub

📝 Serves as a common #platform for #financial institutions, subsidiaries, branches, and offices across many areas, capable of handling local #market #infrastructure norms and #regulations.

🔹 Multi-Tenant Enterprise Hub

📝 Serves as a common #platform for #financial institutions, subsidiaries, branches, and offices across many areas, capable of handling local #market #infrastructure norms and #regulations.

[18/24] — 1⃣ Relations to #Crypto (#DTI) —

Because the entire purpose of this standard is to provide an uniform communications framework, there are no #ISO20022-compliant #cryptocurrencies.

The purpose of #crypto is to settle and transfer value and assets. 🙂

Because the entire purpose of this standard is to provide an uniform communications framework, there are no #ISO20022-compliant #cryptocurrencies.

The purpose of #crypto is to settle and transfer value and assets. 🙂

[19/24] — 2⃣ Relations to #Crypto (#DTI) —

The closest thing we have to anything that might be utilized in conjunction with #ISO20022's rich data fields is the ISO/AWI 24165-1 Digital token identifier standard.

🔹 Registration

🔹 Assignment

🔹 Structure

iso.org/standard/85546…

The closest thing we have to anything that might be utilized in conjunction with #ISO20022's rich data fields is the ISO/AWI 24165-1 Digital token identifier standard.

🔹 Registration

🔹 Assignment

🔹 Structure

iso.org/standard/85546…

[20/24] — 3⃣ Relations to #Crypto (#DTI) —

The Digital Token Identifier Foundation (#DTIF) was formed as one of #etradingsoftware's solutions in this regard.

ℹ️ The assignment is as follows:

The Digital Token Identifier Foundation (#DTIF) was formed as one of #etradingsoftware's solutions in this regard.

ℹ️ The assignment is as follows:

[21/24] — 1⃣ #Ripple & #JSON formats —

One option to #ISO 20022 messages with #XML syntax is the ability for an #API to also respond in a format with #JSON syntax.

This enables financial institutions to be flexible and #interoperable.

🔗 iso20022.org/sites/default/…

One option to #ISO 20022 messages with #XML syntax is the ability for an #API to also respond in a format with #JSON syntax.

This enables financial institutions to be flexible and #interoperable.

🔗 iso20022.org/sites/default/…

[22/24] — 2⃣ #Ripple & #JSON formats —

When it comes to #RippleNet, they do just that.

The Standard #RippleNet #Payment Object (#SRPO) provides a set of fields in the #JSON Schema while still adhering to #ISO20022.

docs.ripple.com/ripplenet/impl…

When it comes to #RippleNet, they do just that.

The Standard #RippleNet #Payment Object (#SRPO) provides a set of fields in the #JSON Schema while still adhering to #ISO20022.

docs.ripple.com/ripplenet/impl…

[23/24] — Summary —

The #ISO-20022 transformation is a huge undertaking.

#IT #admins will most likely spend the whole weekend inside a #datacenter upgrading infrastructure.

Because there will be no rollback, it is going to be challenging for the #IT department.

The #ISO-20022 transformation is a huge undertaking.

#IT #admins will most likely spend the whole weekend inside a #datacenter upgrading infrastructure.

Because there will be no rollback, it is going to be challenging for the #IT department.

[24/24] Thank you to everyone who read my ISO20022 🧵 and dug further into the complex aspects of the massive transformation! ❤️

If you enjoyed the thread, please follow me:

@krippenreiter

Please feel free to contribute by sharing here 👇

If you enjoyed the thread, please follow me:

@krippenreiter

Please feel free to contribute by sharing here 👇

https://twitter.com/krippenreiter/status/1637253580934598658?s=20

@threadreaderapp unroll

@WKahneman @digitalassetbuy @Fame21Moore @sentosumosaba @BCBacker @XRPcryptowolf @X__Anderson @stedas @XRPNews_ 👋

— My most recent article [🧵] tackles all there is to know about the major transition approaching this weekend and everything about #ISO 20022 in great depth —

— My most recent article [🧵] tackles all there is to know about the major transition approaching this weekend and everything about #ISO 20022 in great depth —

• • •

Missing some Tweet in this thread? You can try to

force a refresh