Today’s #CPI report continues to depict #inflation that is just too high for most people’s good, especially the @federalreserve’s.

In fact, the report showed that #inflation remains remarkably sticky, which doesn’t correspond to virtually any practical thinker’s timeline of when it might be expected to start to come down further.

These elevated levels of inflation continue to be remarkably high relative to the many months with which the #economy has now operated with persistently higher #InterestRates.

Turning to the data, #coreCPI (excluding volatile food and #energy components) came in at 0.41% month-over-month and rose 5.52% year-over-year.

Meanwhile, #headlineCPI data printed 0.37% month-over-month and came in just above 4.9% year-over-year, with declines in airline fares and new vehicles prices being offset by gains in #shelter, used cars and recreation.

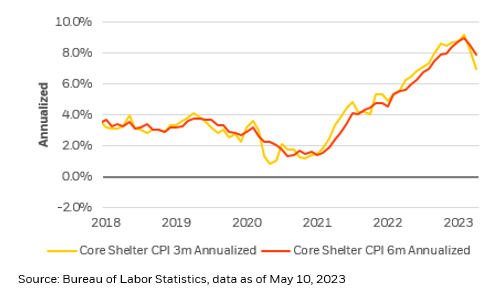

Although, we would note that the #shelter gain again remained slower in April (0.42%), providing additional evidence that the underlying trend has moved down from its 0.7% run rate over much of the last year.

Additionally, the #Fed’s favored measure of inflation, #corePCE, increased 0.3% in March, bringing the year-over-year figure for the measure to 4.6%, as of that month.

Finally, another measure that’s worth looking at, the @DallasFed’s trimmed mean measure of PCE #inflation, printed at 4.7% year-over-year in March.

Still, there are many indications that #inflation is on the way down from here, but not necessarily as depicted by today’s data.

Rather, we see positive signs from some of the lagged indicators that appear by other measures to be softening, such as some shelter prices and some softness in #retailing, hard goods and other products.

In fact, when we investigate a number of the retailer earnings reports we see some very indicative signs of consumer #inflation resistance.

More usage of couponing, trading down, usage of generics, buying in bulk, etc. have become a greater part of #consumer activity. That is usually a good sign of a growing #resistance to high prices, which in time can become a catalyst for corporations to hold the line on #prices.

Further, when considering #inflation as a global phenomenon, our research shows that over a 3-month window most #G10 economies (and many non-G10 as well) are experiencing #inflation declines at an accelerating pace.

Domestically, another important point to consider is that the #housing/rent data tends to move with a very significant lag, and we have only recently begun to see meaningful improvement here.

The recent #housing data suggests that activity levels are down, some new multi-family production is coming online and general pushback on high #rent prices are leading to rollover pricing toward less elevated levels.

Overall, though, we think the #Fed can afford to be patient today, despite these still elevated prices.

Could the #FOMC hike one more time at its next meeting on news of such sticky inflation? Maybe, but today’s interest rate levels are very restrictive and will bite into pricing power, #RealEstate financing and clearly are impacting #credit contraction in the banking sector.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter