Businesses raise their prices *without* the minimum wage going up allathetime! #cdnecon

2011 by 7¢ ("rising prices of coffee beans")

2014 by 10¢ ("rising operations costs", with coffee bean prices and, oh yah, costs of [$11B] Burger King deal identified)

August 2017 by 10¢ ("rising operations costs")

NONE.

Put price rises in context. Any rising input cost is a rising cost. Period.

Including executive pay and mergers and acquisitions.

So.....some follow up with the Timmy's case, which in some ways is exemplar for what is going on.

This may take a few tweets, so mute me if you're not interested.

In practice: a cup of Tim Horton's coffee increased by 7¢ in Aug 2011, but there was no change (ZERO increase) in the prov minimum wage between Mar 31/2010 - Jun 1/2014

So that's not why the price went up in 2011.

But labour costs were not mentioned as the reason for the increase.

Instead, the company specified two other costs of operations: ..../2a

October 1, 2016 it went up to $11.40

October 1, 2017 it went up to $11.60

(just pause on that a second, the 20/25 cent increases)

Tim Horton's raised the price of coffee again in 2017, but....

Every story at the time reported unspecified "operating costs". ..../4a

Their requests were ignored by the mothership (corporate HQ). They raise the price when they need the cash for buying other things.

This is important to understand.

It's an asset-stripping, risk-shifting, rent-extracting global business model. Bloomberg described it in a stunning cover story years in 2014:

bloomberg.com/news/articles/…

And this in 2017, having moved on from being the king of fast food chains. bloomberg.com/gadfly/article…

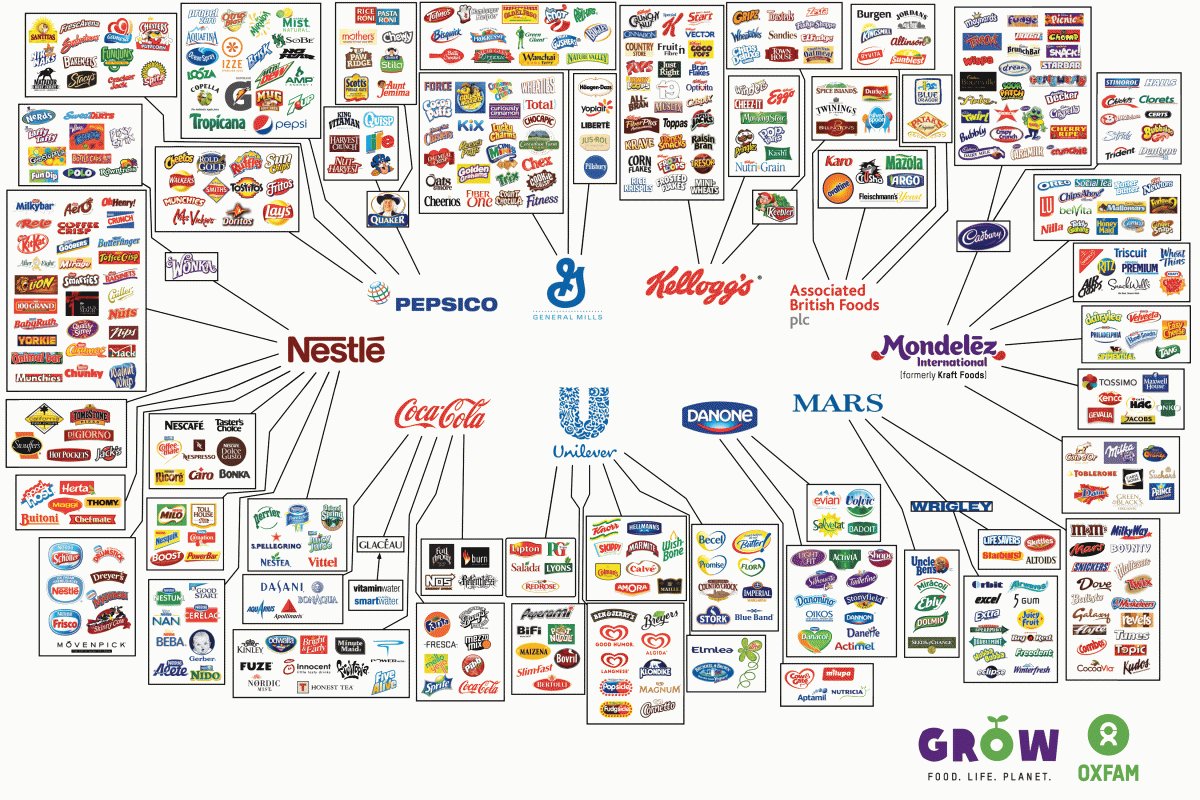

Corporate concentration is the name of the game in the era of slowth.

Check out the Behind the Brands campaign oxfam.org/sites/www.oxfa…

Well, when wages rise, input costs rise. But so too do cost rise when the price rises for electricity, petrol, avocados, steel, EXECUTIVE PAY. Or cash is needed to buy market share/eat competitors.

~FIN

#cdnecon #canlab #canpoli #FutureOfWork