#DemocracyDay

#DemocracyDay

#DemocracyDay

#DemocracyDay

#DemocracyDay

#DemocracyDay

#DemocracyDay

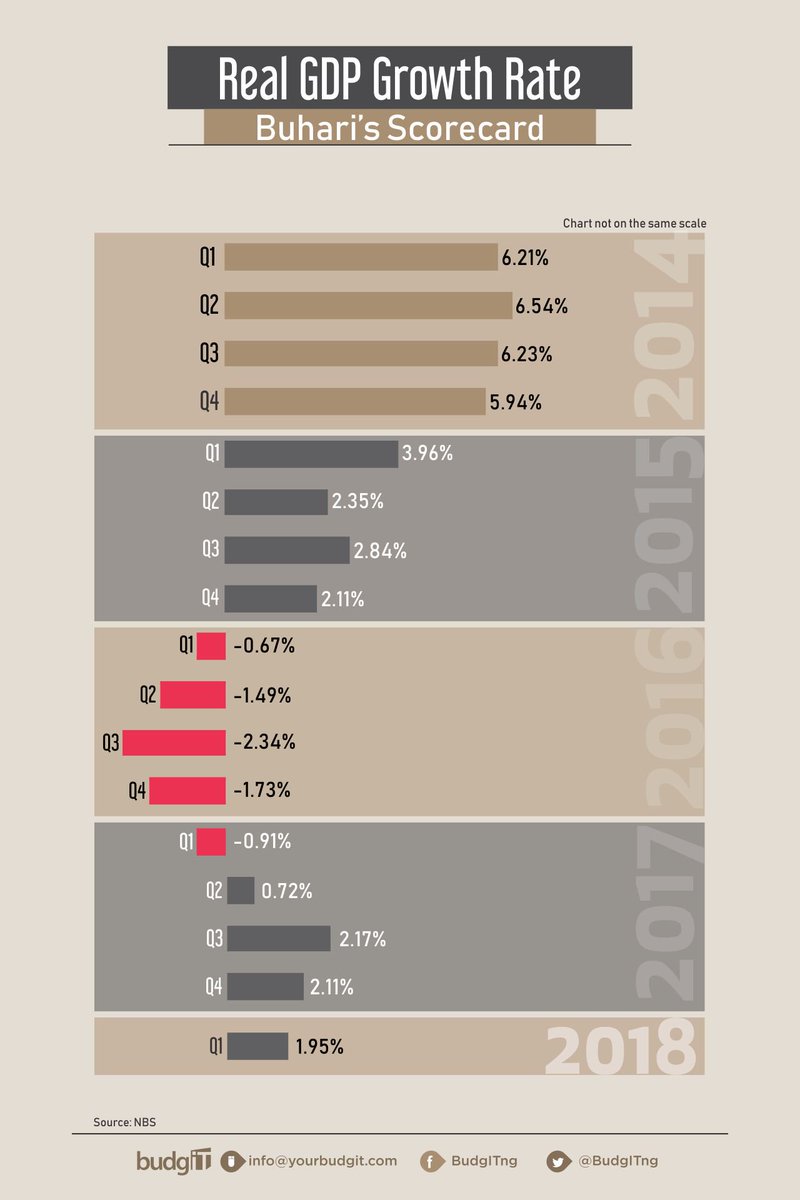

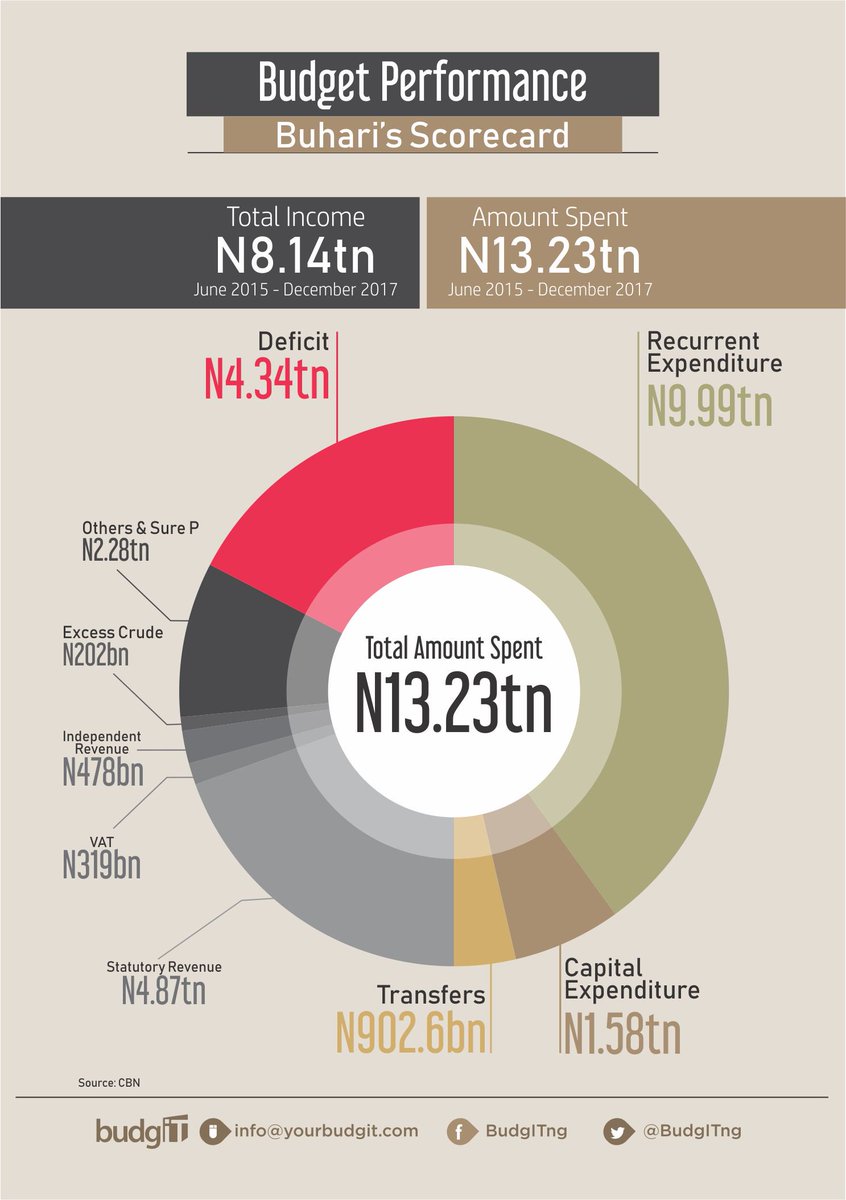

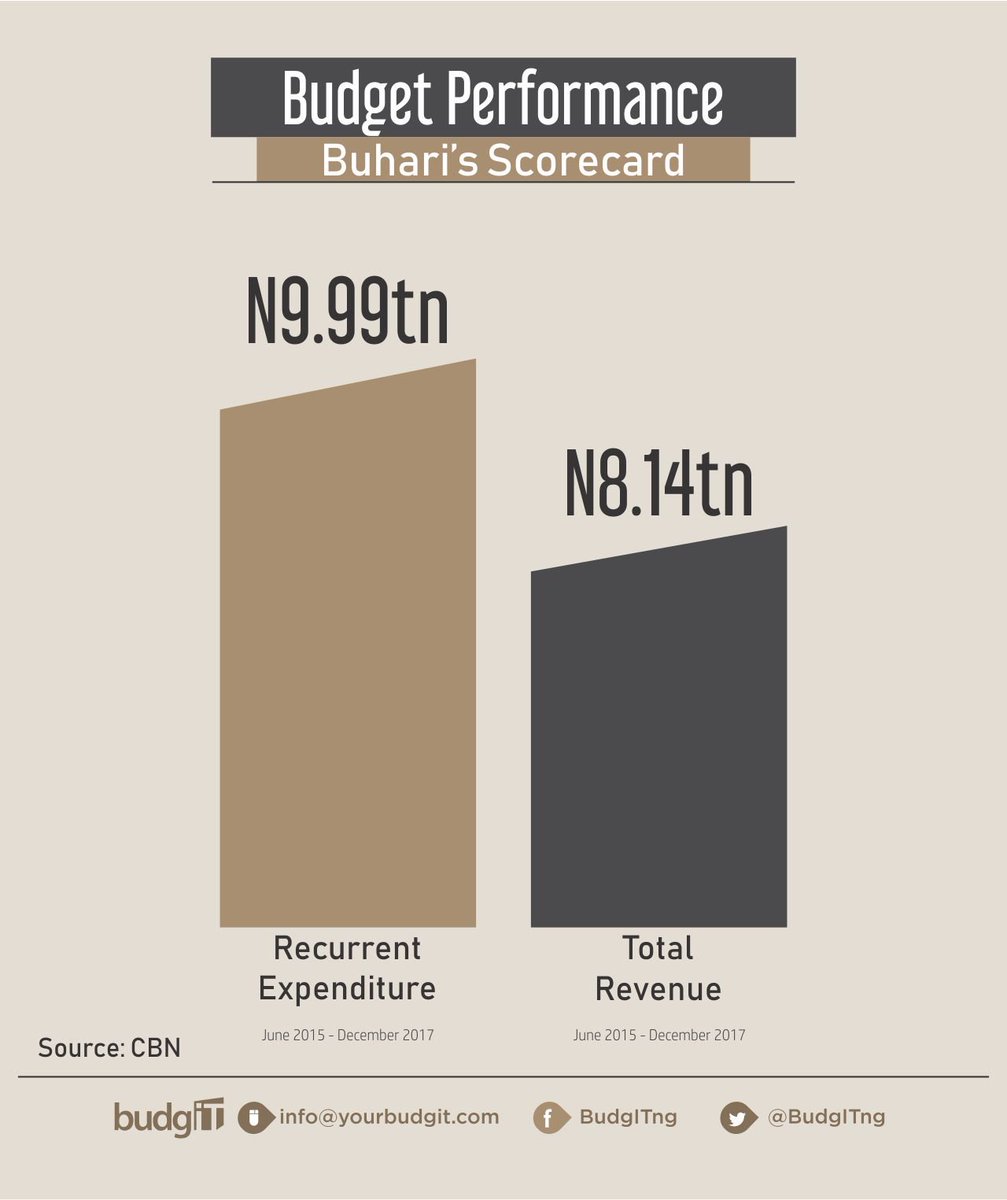

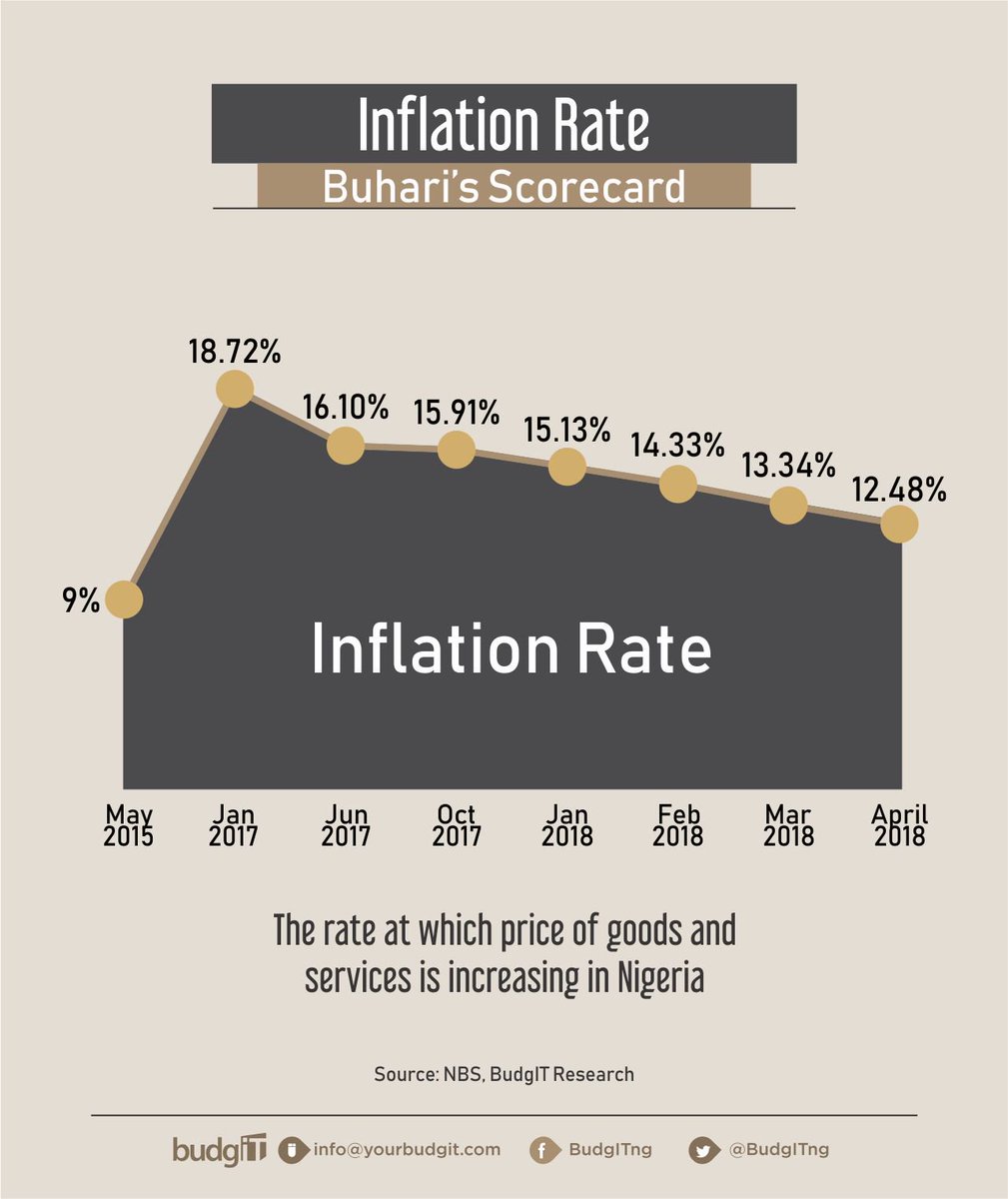

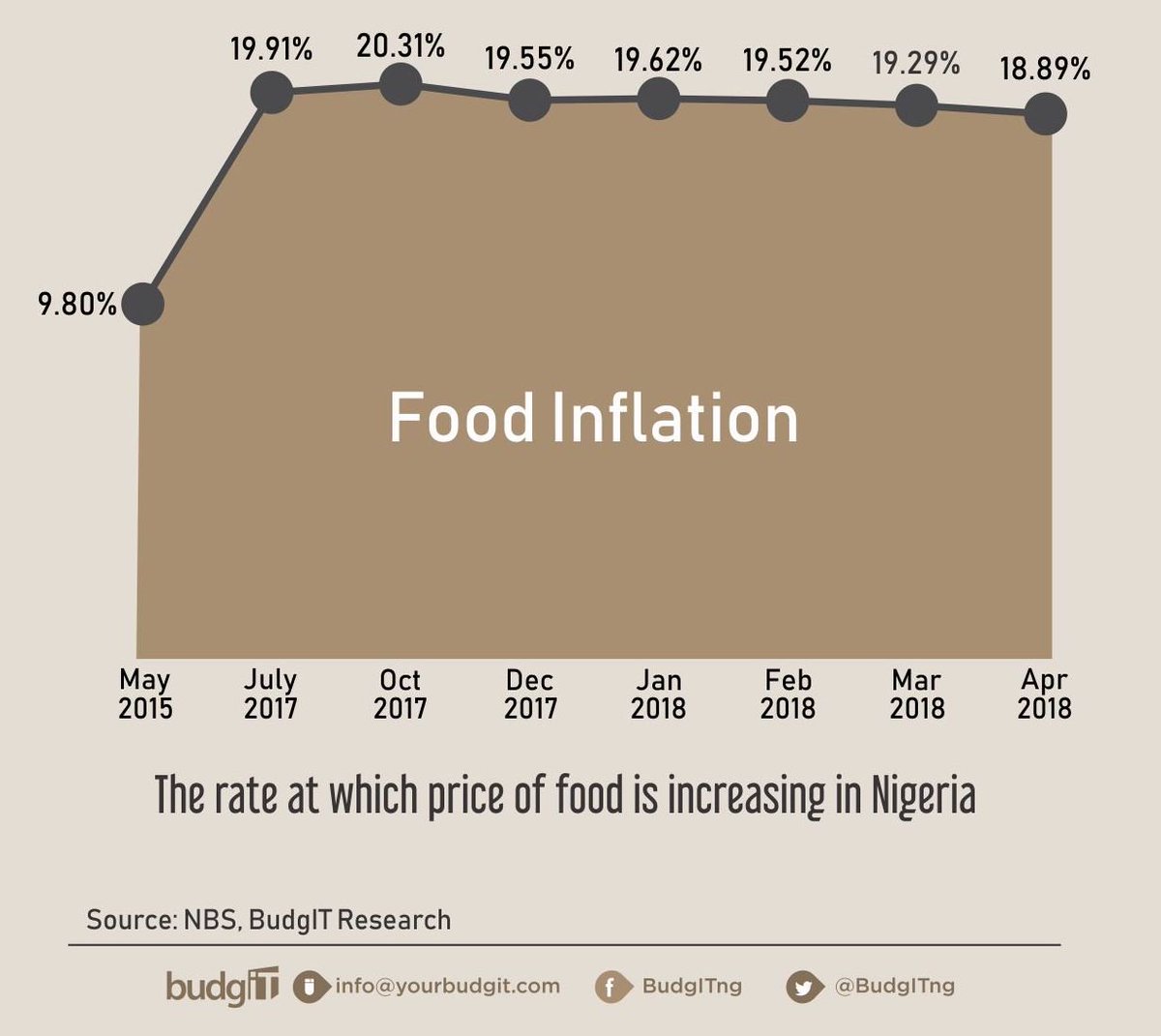

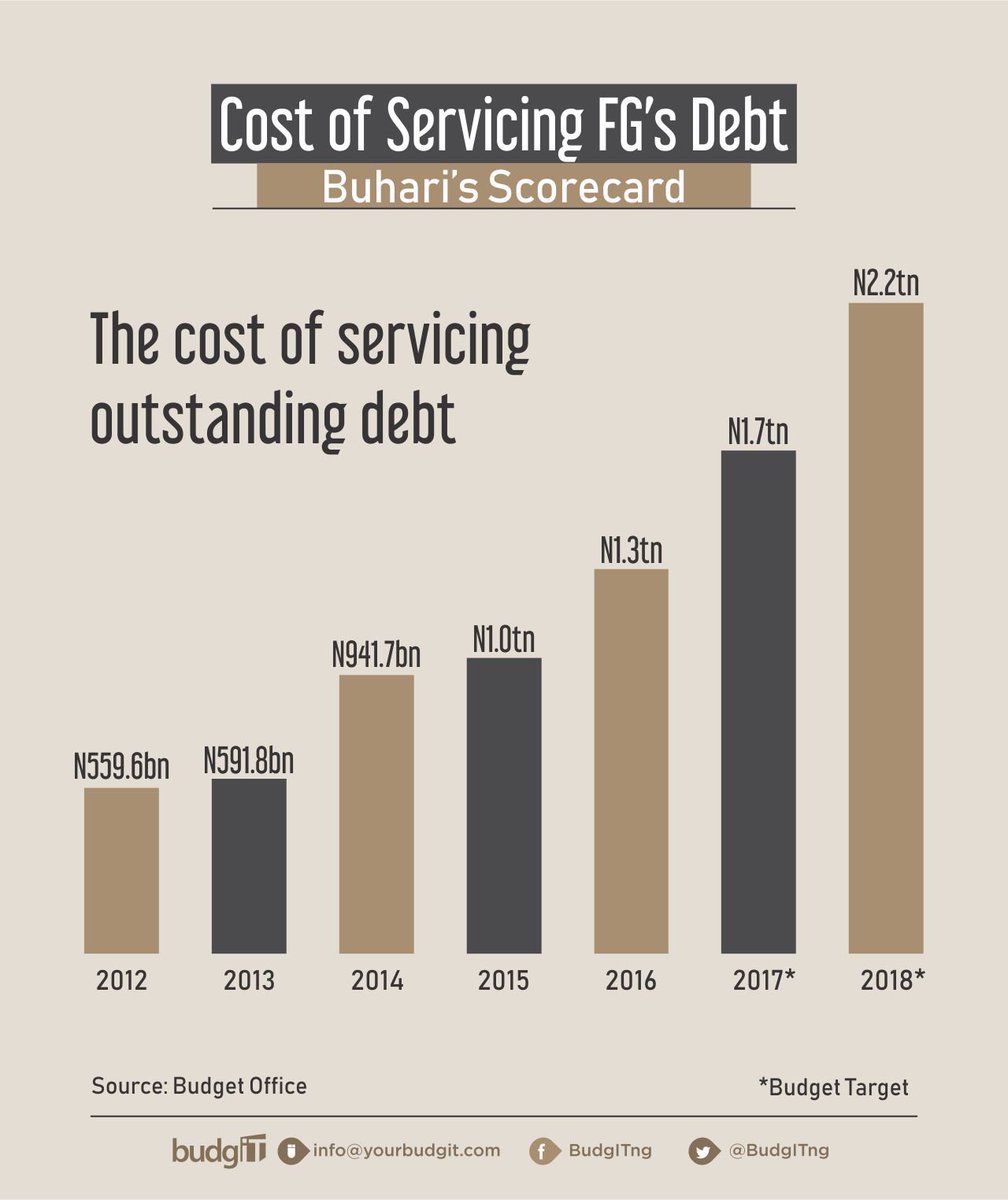

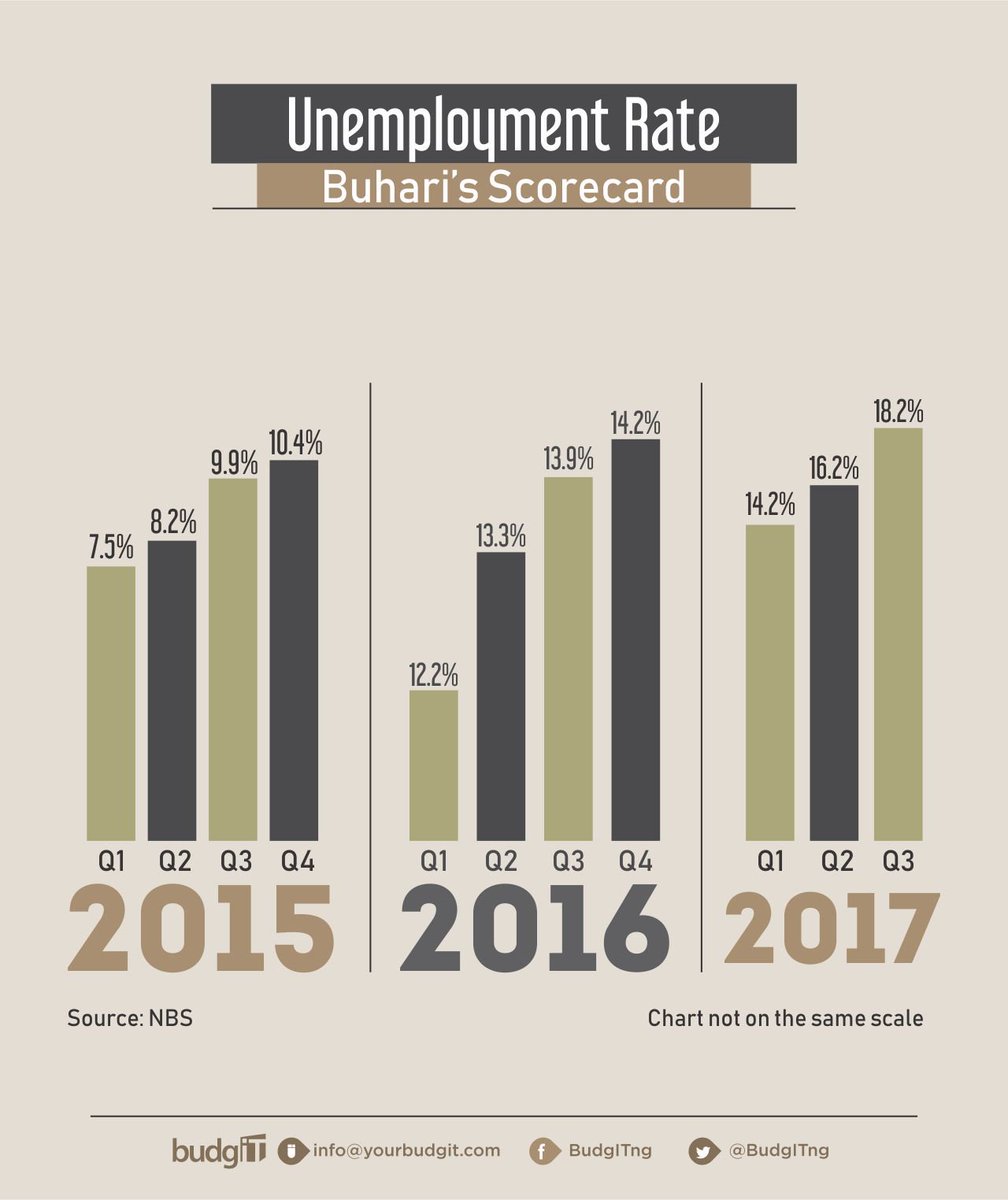

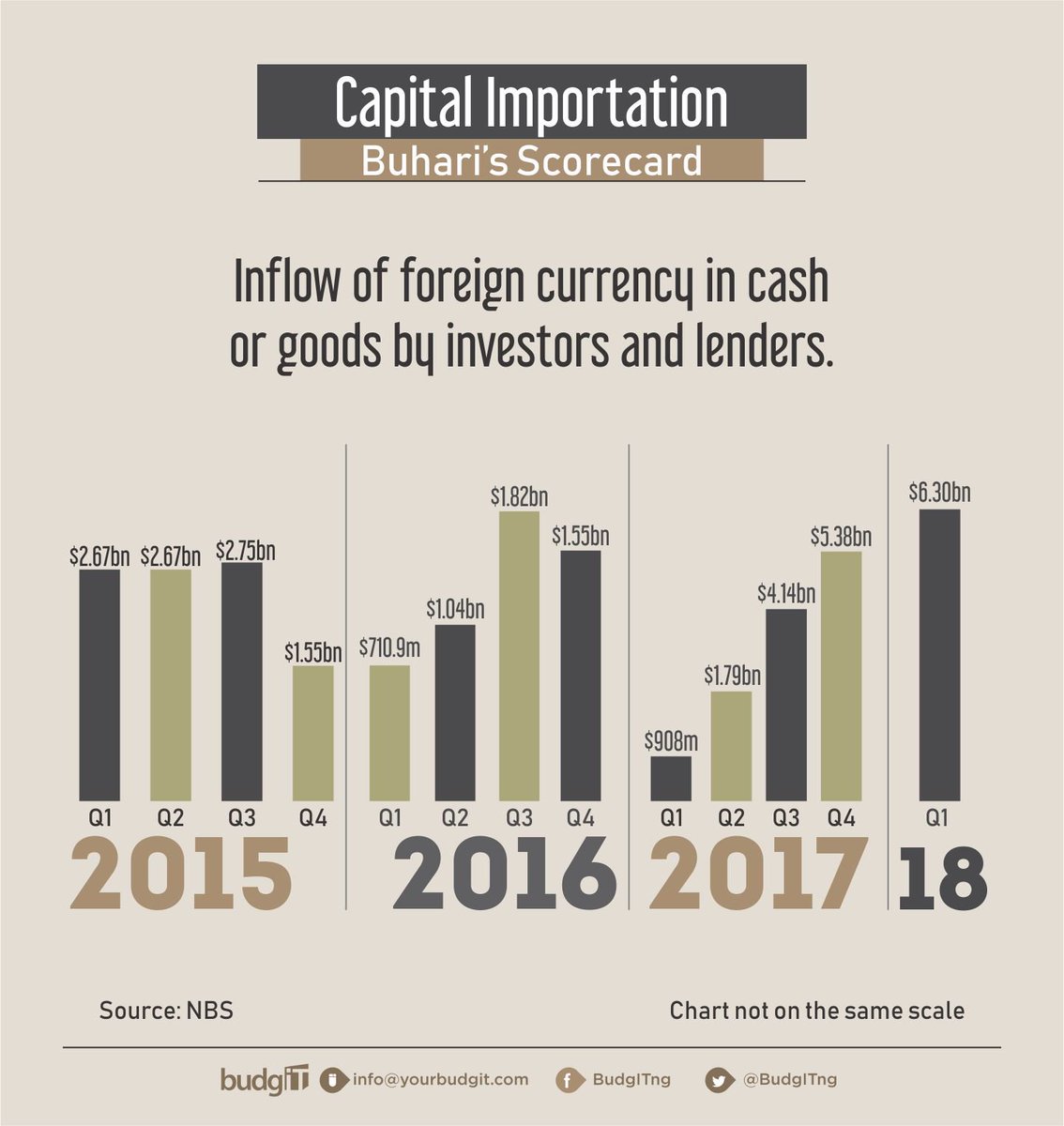

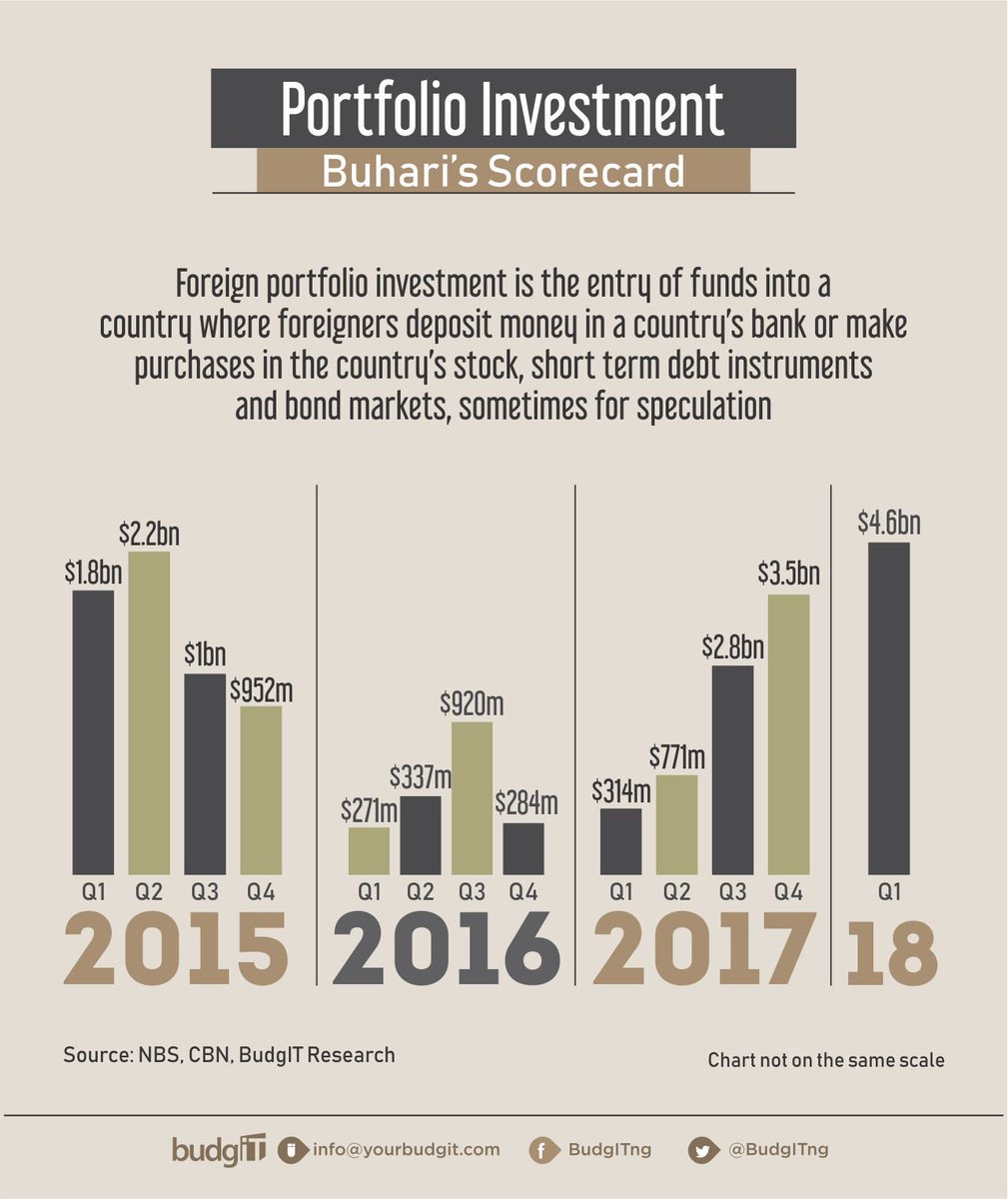

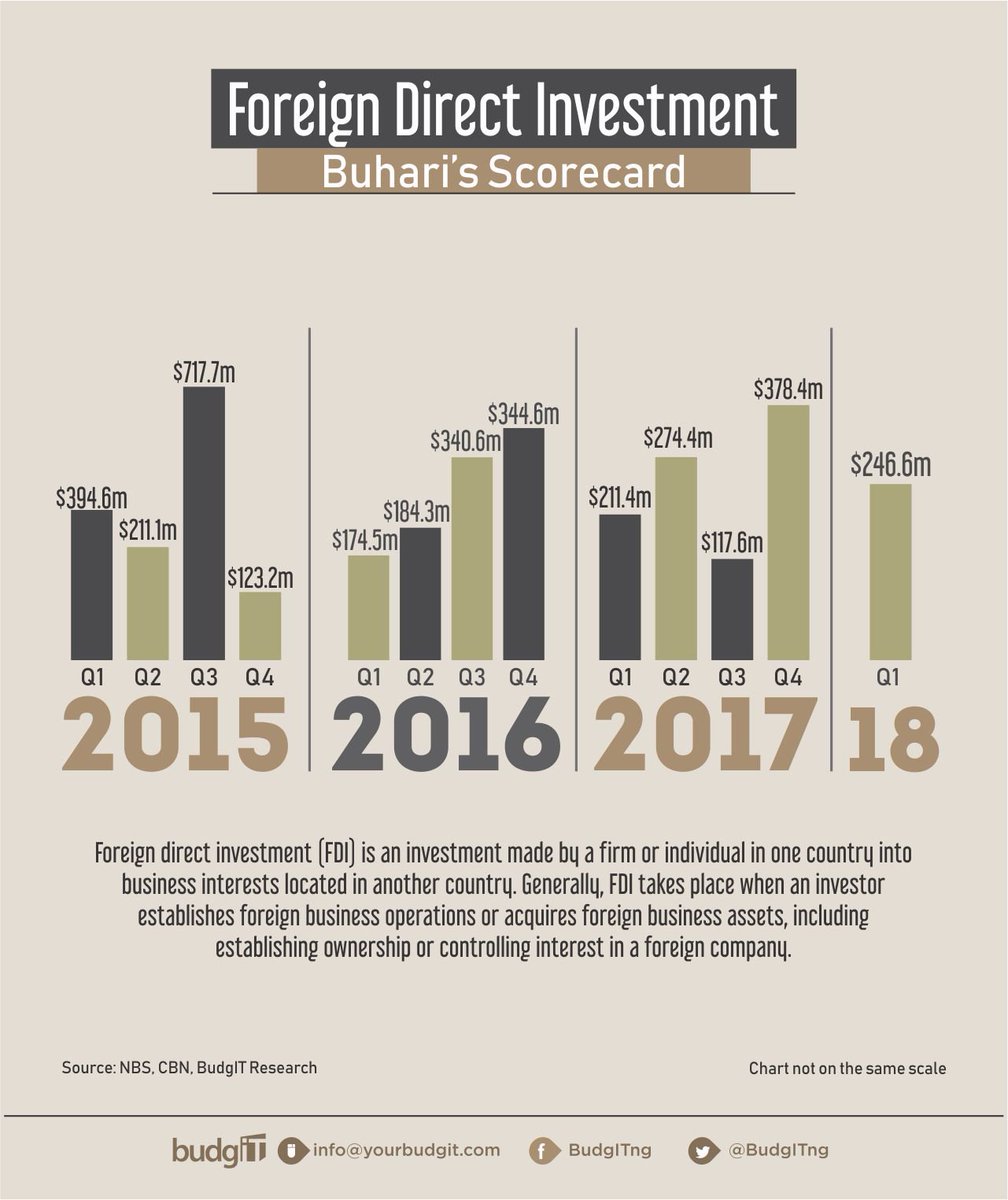

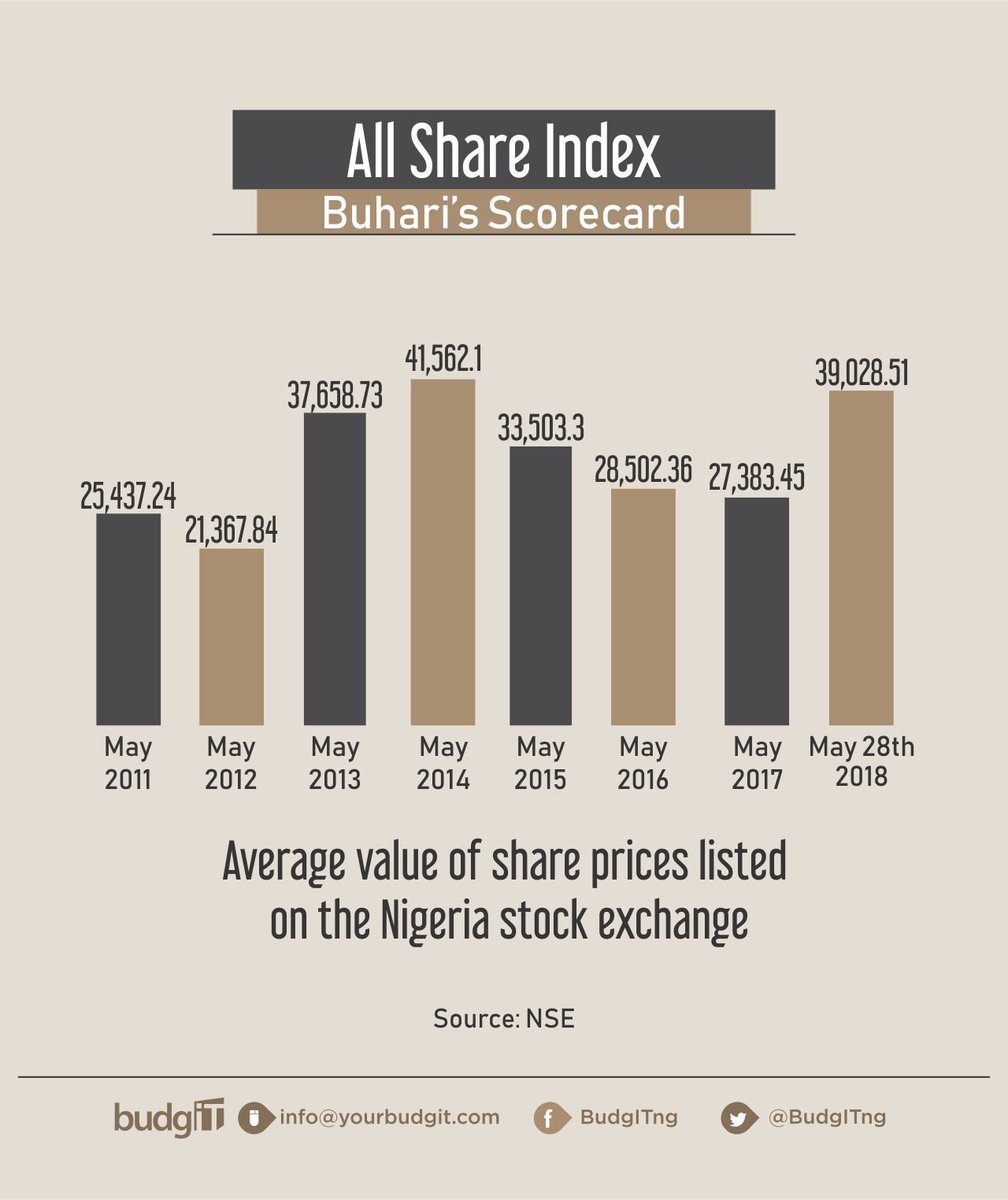

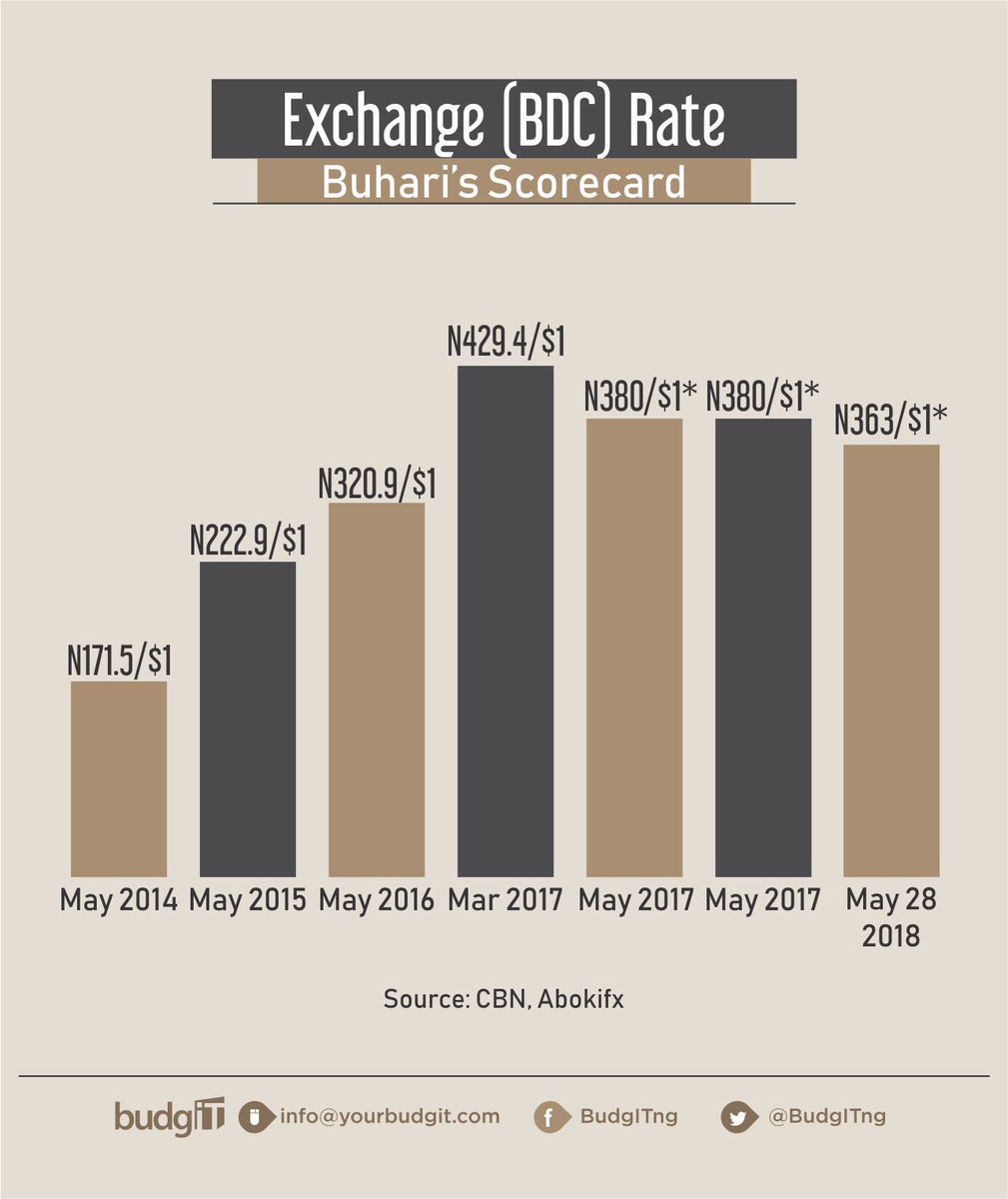

*Charts not drawn to general scale.

#DemocracyDay

*Charts not drawn to general scale.

#DemocracyDay

*Charts not drawn to general scale.

#DemocracyDay

#DemocracyDay

#DemocracyDay

#DemocracyDay

#DemocracyDay

What's your take in terms of the performance of the economy?