- I really hate this motherf---ing momentum ignition algo

- so I thought I'd do an in depth look at it

- Starting here, we first see these patterns begin to emerge the first week of March, 2018.

- I believe @ThinkingUSD first noticed it

- Early on algo was sloppier, with a pattern, but less clearly defined

- We see evid. of algo tweaking. Big barts, little barts, varying frequencies.

- it was refined to what we see now, on R with more uniformity

- I believe there are 3-4 variations built on the same pattern with a few minor differences

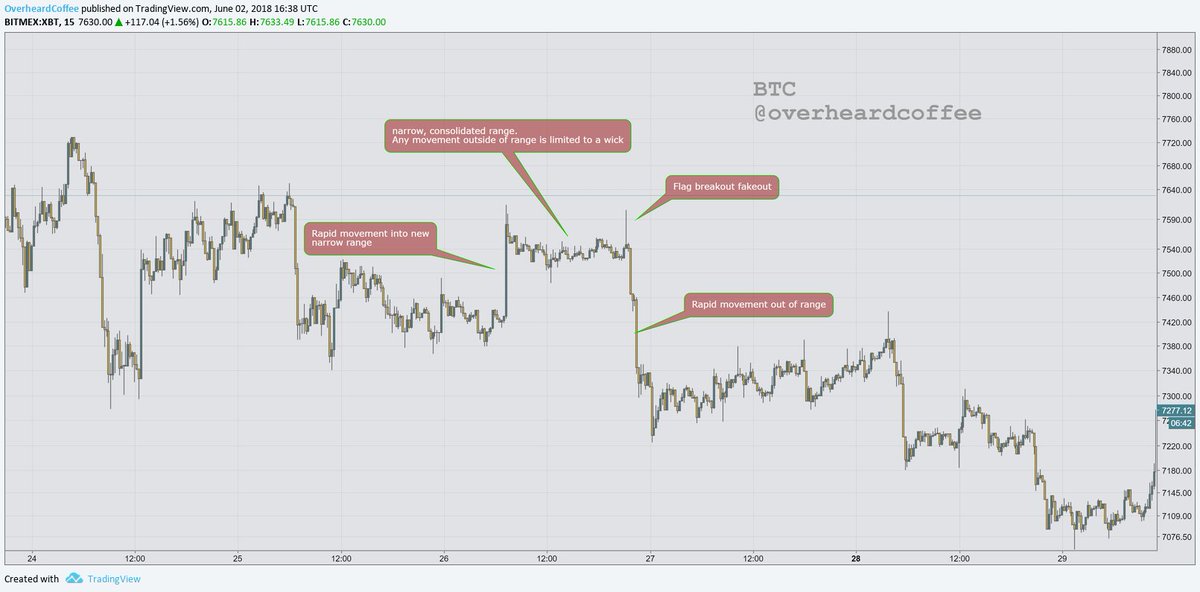

- Here are some key pieces

- It turns the chart into a series of rectangles.

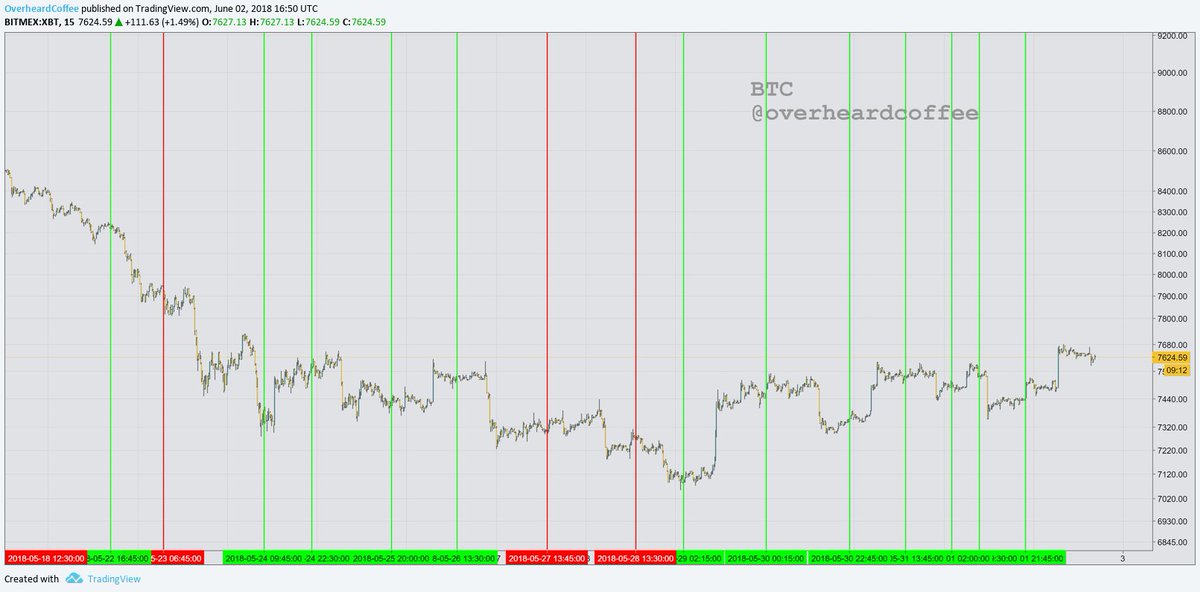

- Between May 1 and May 31

- 44 "bart" patterns identified by my best judgement, using the 15m tf

- Each marked with a vertical line in center

- Green if pattern reversed, Red if pattern continued in original direction

- Tally was then taken, analysis to come

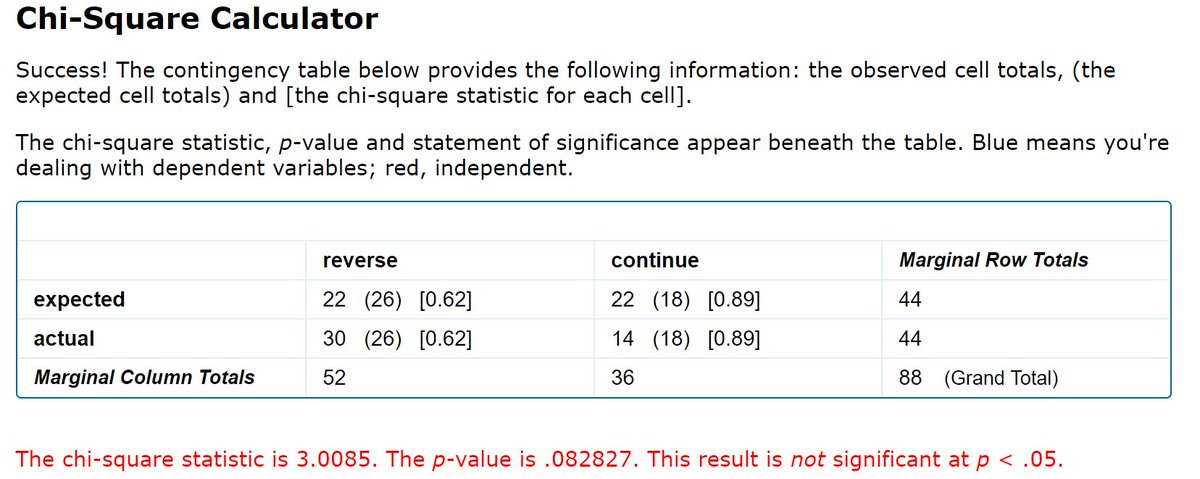

- 44 total barts IDd

- 30 reversals (eg Up, sideways, Down)

- 14 continuations (eg Down, sideways, down)

- These numbers suggest a 31.8% chance of continuation

and a 68.2% chance of reversal.

- Assumes that the expected is 50/50 (not exactly true in a strong directional market)

- P-value says that there is a 92% chance these results are not random.

- refinement of pattern likely means refinement of algo; someone with a lot of money is invested in profiting off of short tf markets.

- I am unsure how or if this affects the high tfs (>4hr)

- Bot is running on bitmex.

- Trading barts IS EFFECTIVE with a 2/3 success rate

- Barts + trapped in options range = trading hell

- I think its likely competing algos will case unexpected behavior in the markets in the future as more and bigger players enter the space.

- LEARN RISK MANAGEMENT