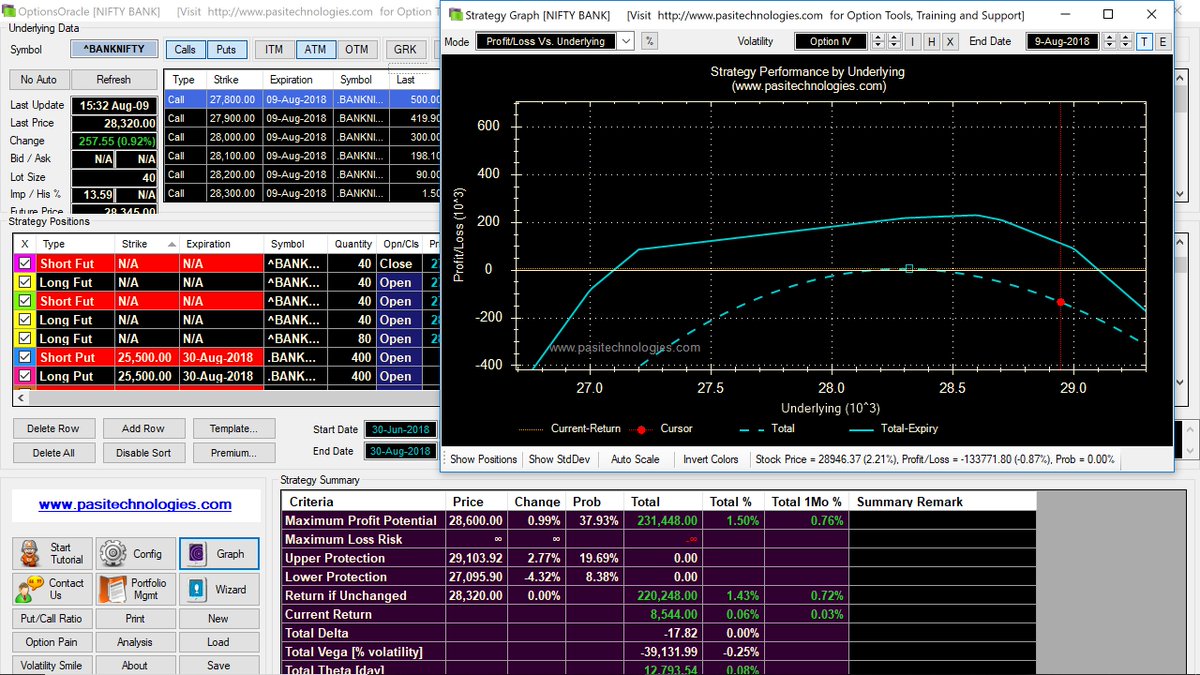

Buy 1 future

Move 25500PE to 26000 and 26500 half and half

Buy back 3 28000CE

Sell 3 27000PE

Dont want to pump more Capital into the Trade at this stage.

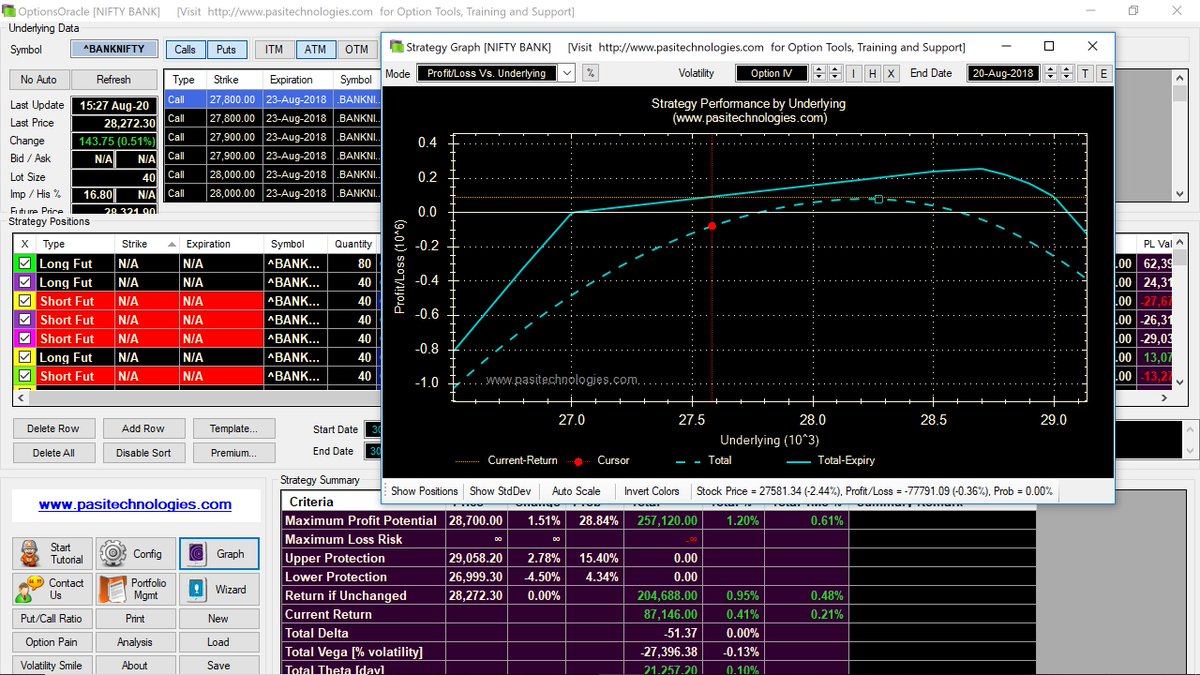

Sold 3x28300C

Bought 1 Future

Sold 2×27000PE

Moved 400 25500PE to 26000 and 26500PE half and half

Generated 18k Premium and increased Capital in Trade by 1.8 lacs

In the Process moved BE on CE Side up by 130 points and P&L will remain unaffected upto 28000

6x26000PE to 26500

5x26000PE to 27000

Net cost 27k. Now left with only 8x28300PE.

Month has been very challenging to say the least

1x26000PE 3x28300CE

24x26500PE 5x28500CE

9x27000PE 12x28600CE

6x27200PE 5x28700CE

So 40 Short PE and 25 Short CE. Net Short 65 lots . Investment about Rs 42 lacs

Long 3 Futures

6x26500PE. 2x28300CE

14x27000PE. 6x28600CE

19x27200PE. 5x28700CE

6x28800CE

6x28900CE