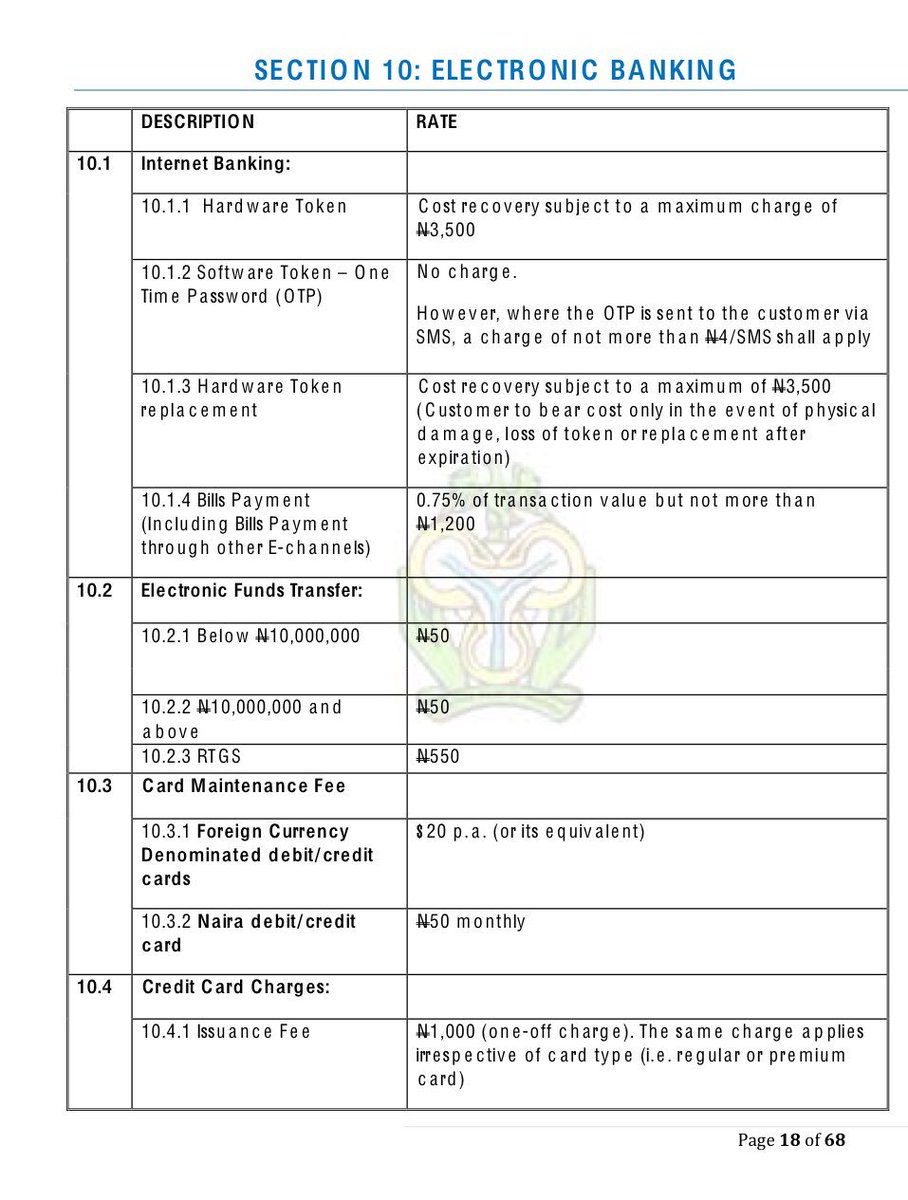

With the proposed implementation of cashless Nigeria, these charges are not arbitrary. Processing Cash is not cheap.

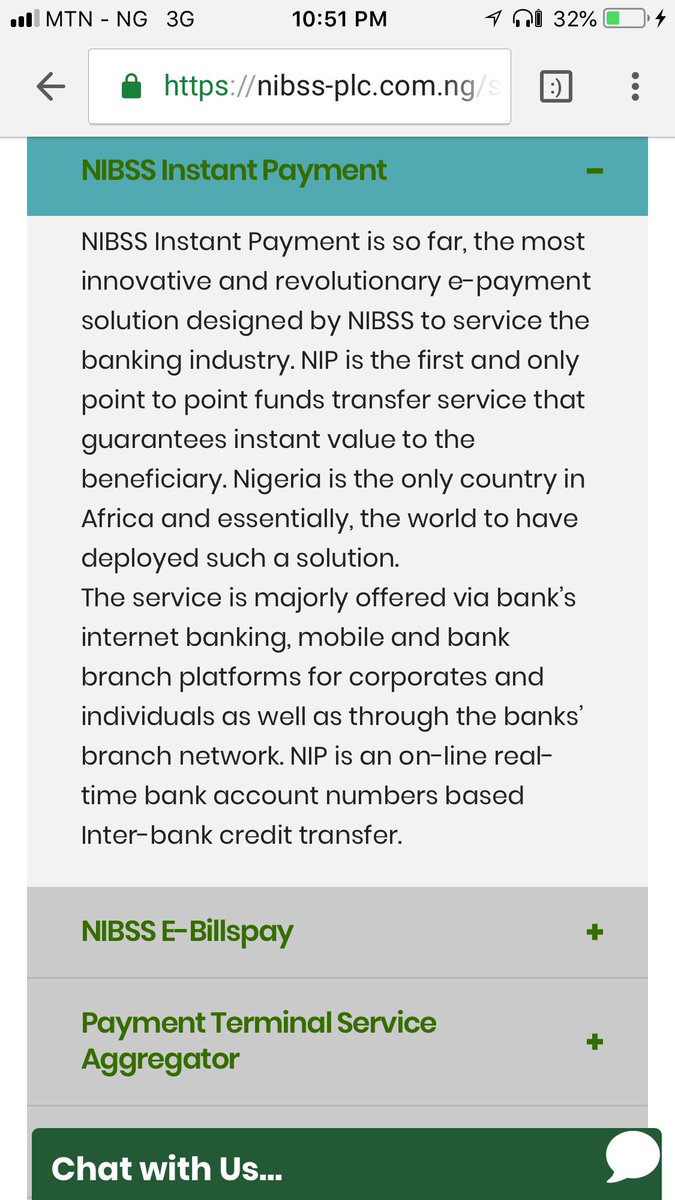

Cash Dumping is the act of paying cash into a bank account and transferring same on the same day via the NIBBS instant payment platform to another bank.

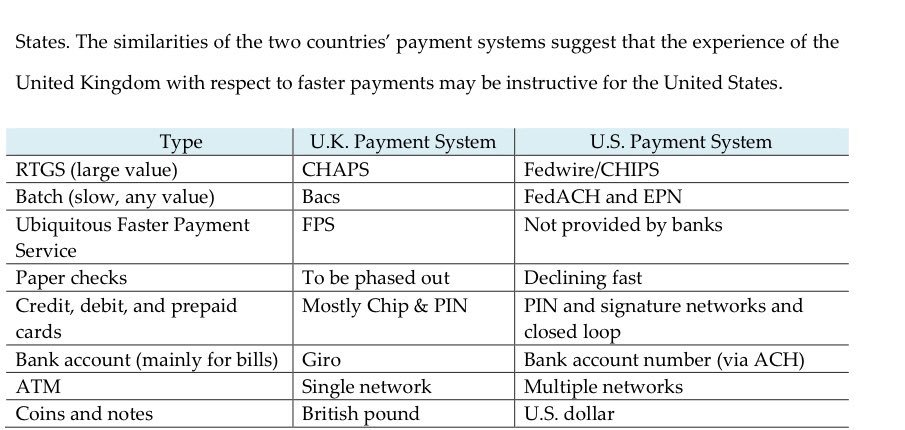

The US Banking System is bigger with more banks & credit unions making it difficult to provide such services.

This ends the thread.