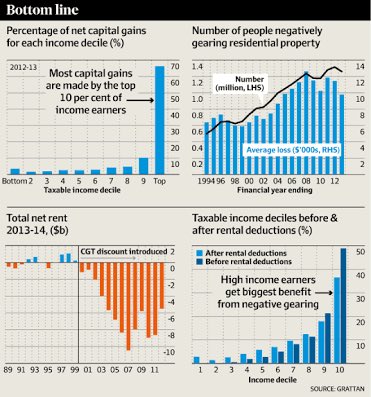

Its fine to charge a capital gains 👉🏼tax on actual profit (ie capital gain) after investment (not primary home) real estate is sold, but not an annual speculative CGT

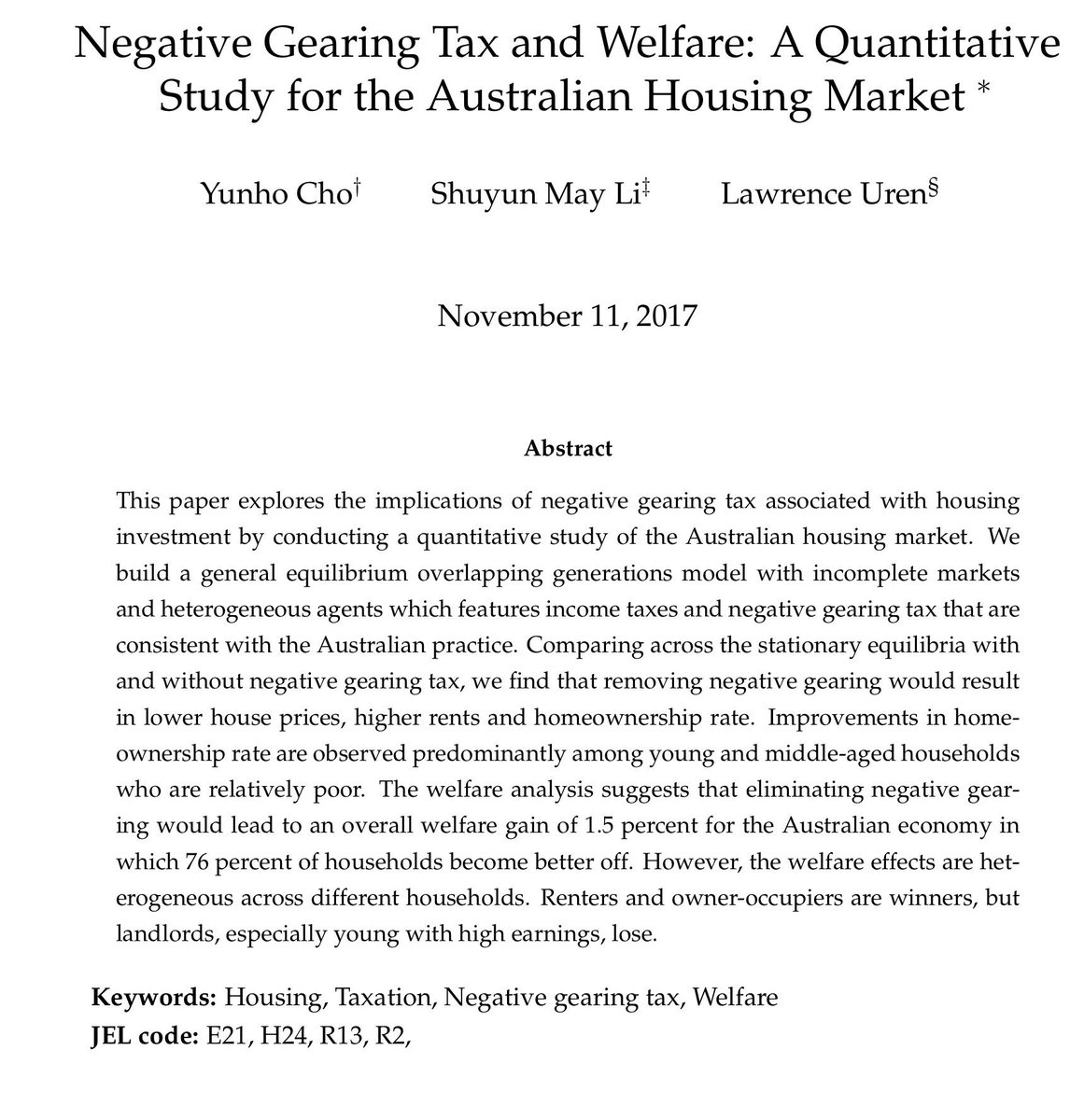

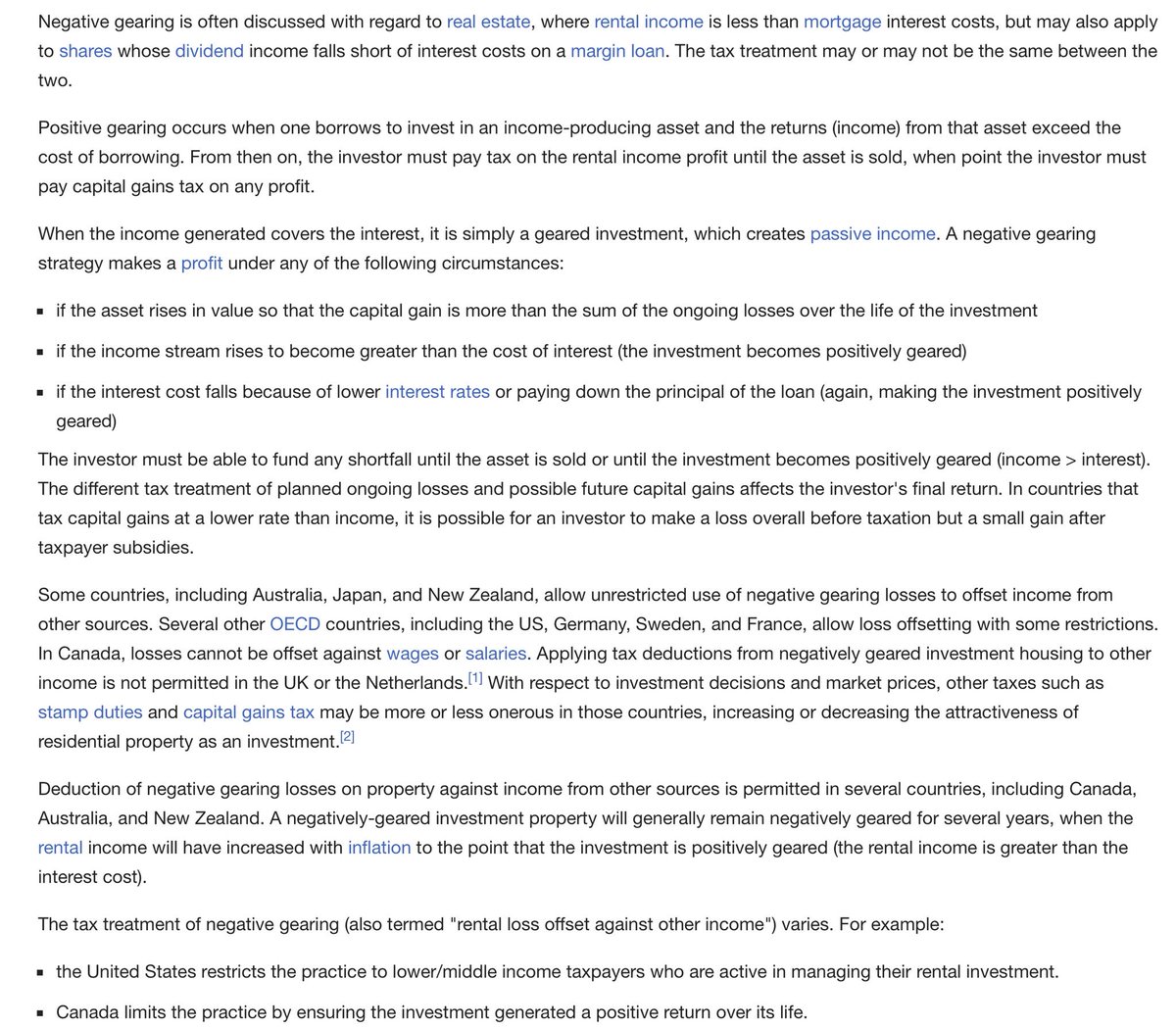

Landlords lose some tax write-off benefits but eliminating neg gearing does not eliminate write off of expenses against income

The overall benefit is positive

rbnz.govt.nz/-/media/Reserv…