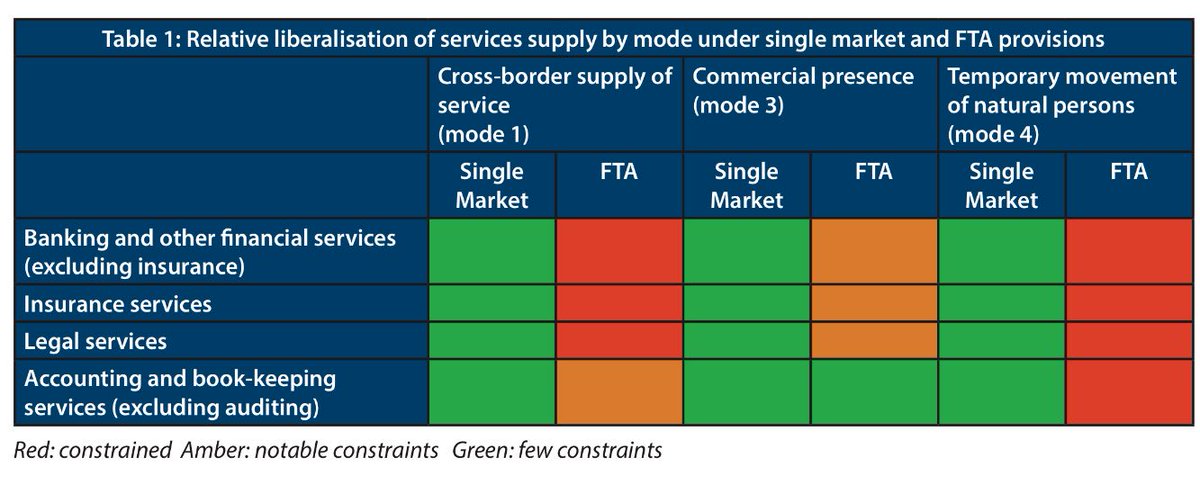

I explore just how much can be done on services if the UK is to leave the single market and take a stab at estimating the impact on different sectors.

cer.eu/publications/a…

Business services would be less affected because of the nature of the industry itself where even within the EU British-based companies have already set up offices across the EU to service their clients.

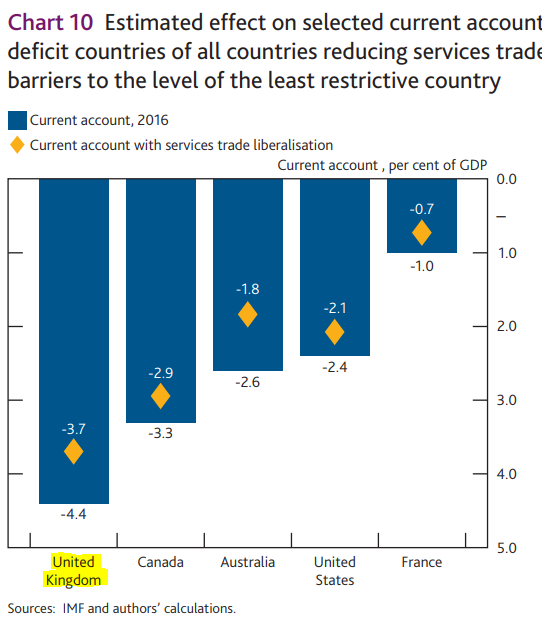

Leaving the single market will probably lead to a shift in services investment out of the UK and into the EU-27. This will have have knock on implications for the UK’s trade balance, jobs and tax revenue.

It’s a bit nerdy, but hopefully it is accessible enough to be useful to those wanting to learn more about services trade (and why liberalising it is so difficult).

cer.eu/sites/default/…