Overall, reasonably good quarter with bitcoin +8% and ether +3%.

Top performer was BNB +180% as Binance keeps expanding its offering at a rapid pace. Also LTC +100%.

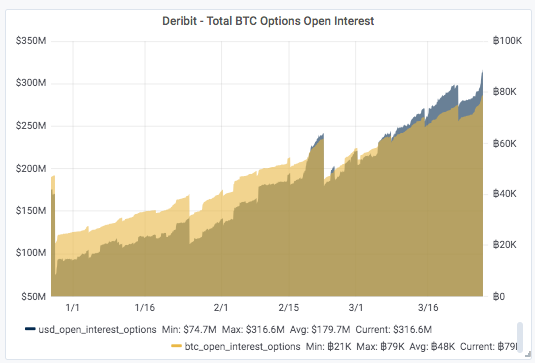

Total open interest before Mar19 expiry is 2x the OI before the Dec18 expiry: $300mln

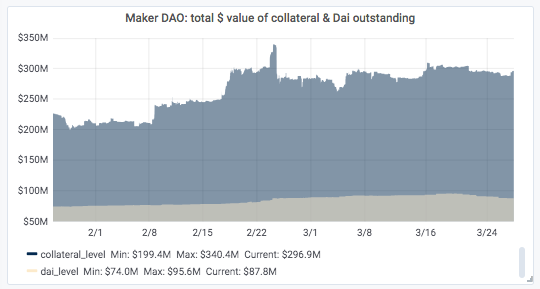

@MakerDAO could be on its way to change margin trading. It is already well passed the experiment level with nearly $300mln worth of ether locked in CDPs against $87mln DAI issued