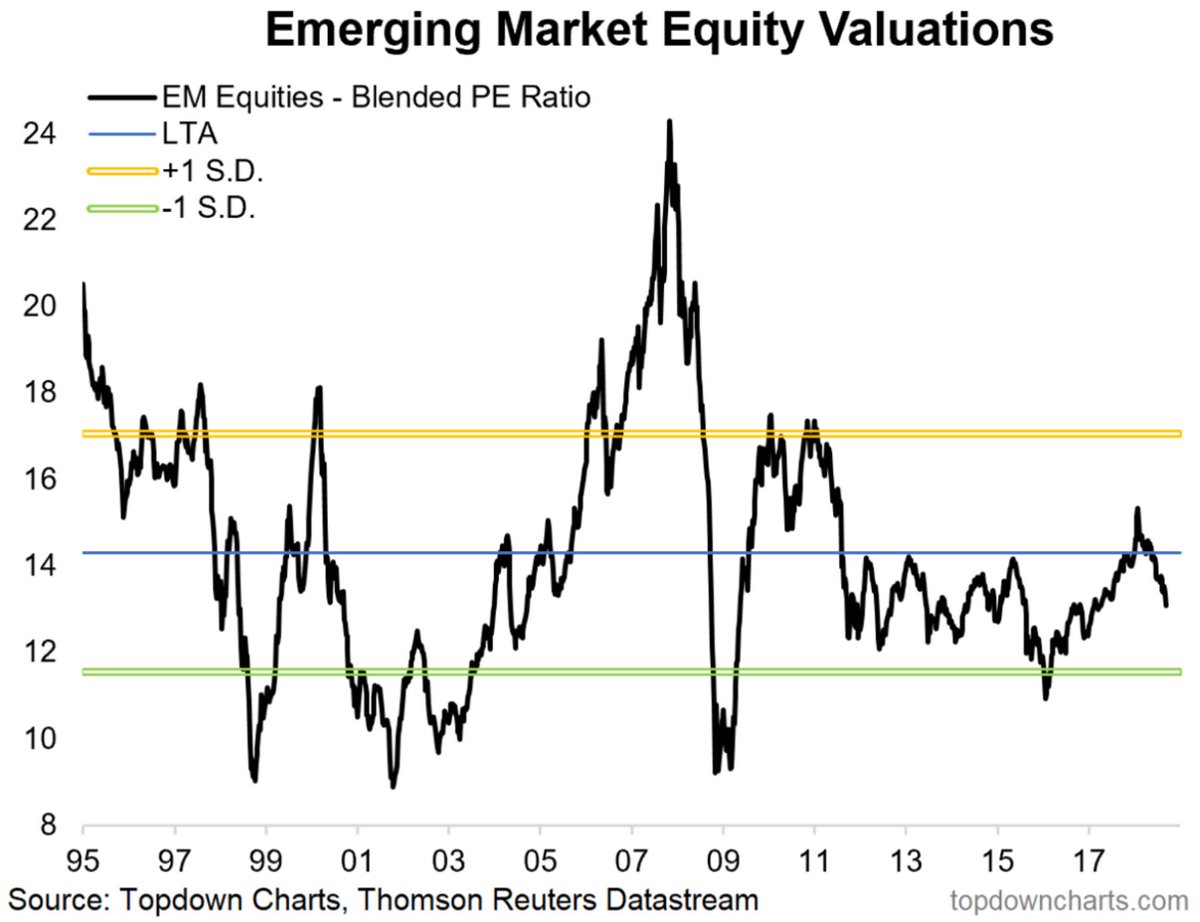

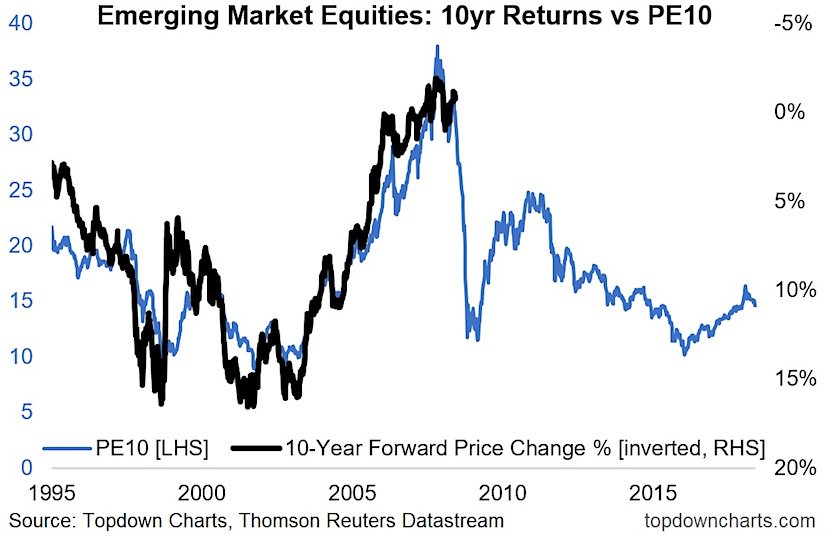

because EM debt & equity inflows are +$250B and oil price over threshold...look at Argentina & Turkey fissures, first signs of US $ melt-up pressure, this in turn,

raises risk of a contagian EM credit event

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!