Here's my breakdown, with links to sources, of why Adani's Carmichael pit doesn't make sense: (thread)

bloomberg.com/opinion/articl…

I don't have a Soundcloud to promote so the best thing I can do is write an article! 😀

You can download and change the orange cells to input your own assumptions.

Adani have promised they'll fund it off their own balance sheet, but it's quite hard to see how this is possible.

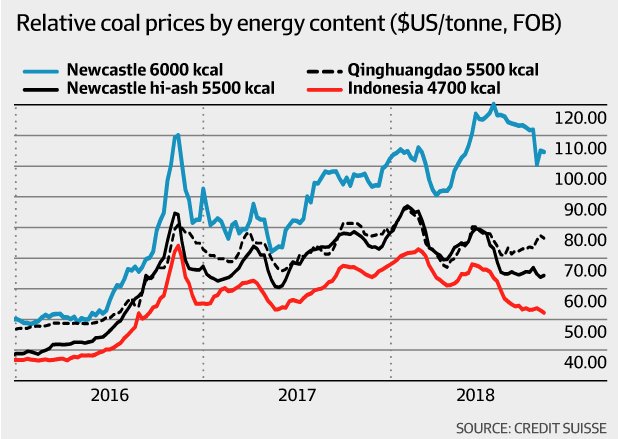

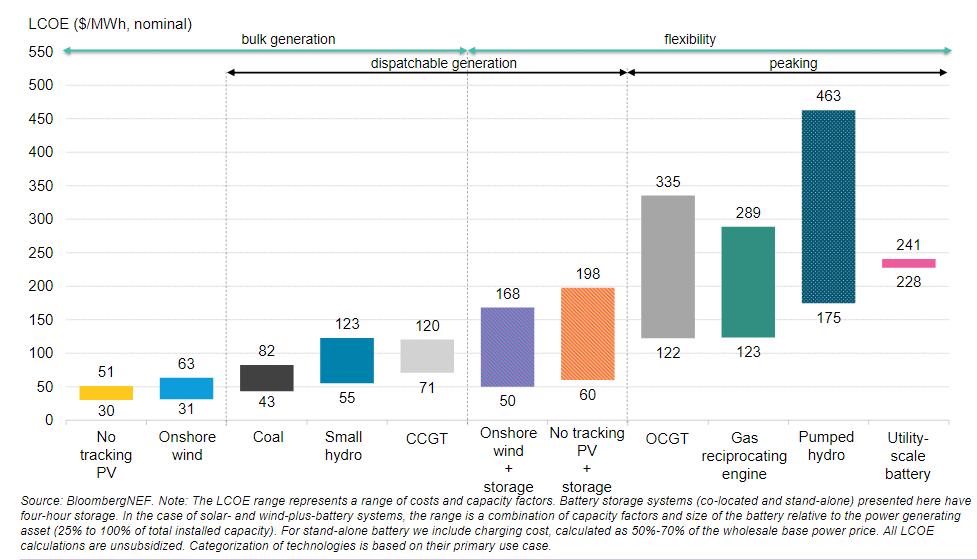

If you look at the bottom of that Google Sheet you'll see some rough calculations for the cost of coal per megawatt hour, based on the assumptions at the top about mining costs etc.

This, again, just doesn't stack up.

Carmichael stage 1 would be ~25mt CO2e, stage 2 ~70mt CO2e.

Australia's coal and LNG exports total 1,200mt CO2e, and domestic emissions are 600mt CO2e. Read more here:

bloomberg.com/opinion/articl…

bloomberg.com/opinion/articl…

melbourneminingclub.com/wp-content/upl…

It was all Adani, Gina Rinehart, Clive Palmer, GVK, and other random investors.

We saw just this week that one of the projects close to Carmichael has been put on hold.

theguardian.com/environment/20…

BHP on Wednesday said coal power may be "phased out, potentially sooner than expected": bloomberg.com/news/articles/…

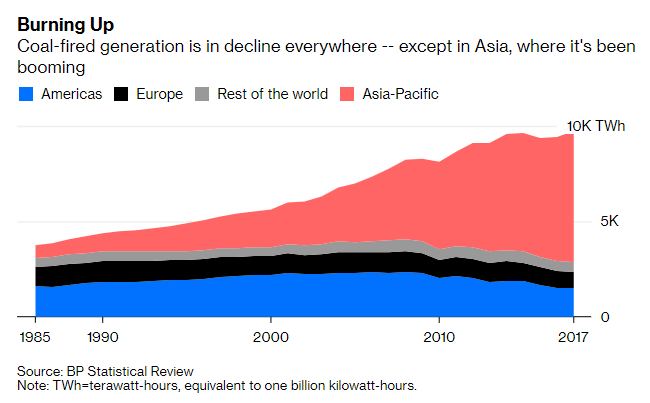

But this is a dying industry and it can't support whole new coal basins going into production.