Saudi Arabia has only about a third of the natural gas we thought it did. #oott

bloomberg.com/opinion/articl…

For comparison, Exxon Mobil has iirc the biggest gas reserves among independent oil companies, at about 51 trillion cu ft.

The kingdom's own reserve estimate comes in a whole Exxon Mobil's-worth lower, at 234tr cu ft.

But wait! Aramco has a separate, lower figure: 186tr cu ft, another Exxon Mobil below the government number.

A load of that gas will never be sold. Instead it will be flared off, or pumped back underground to drive out more crude, or burned as fuel onsite, or simply lost to leakage because it costs too much to recover.

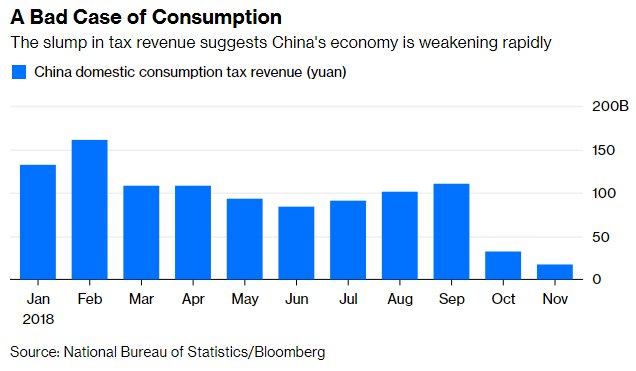

It's currently no. 7 after the EU, U.S., Russia, China, Canada, and Japan. It should overtake Japan in a year or two.

40% of middle eastern gas reserves are held by Iran. Qatar has another third. Riyadh is on a near-war footing with both

It has the biggest exploration budget of oil majors after PetroChina and ONGC. Most of that is now going to gas.

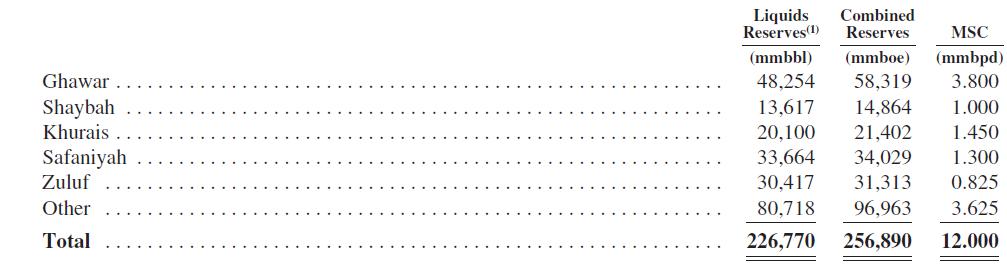

But exploring and developing gas -- especially the sort of offshore and unconventional pure-play gasfields that Aramco wants to develop -- is much more expensive than just sticking another derrick in its giant Ghawar oilfield.

Most of the gap between the 283tr cu ft and 234tr cu ft figures is probably natural gas liquids.

So it doesn't affect the supply-demand balance for natural gas outlined above.

Add in the four other main oilfields and you're at about 46% of gas reserves as so-called associated gas, mixed in with crude.