#WIMC19 1

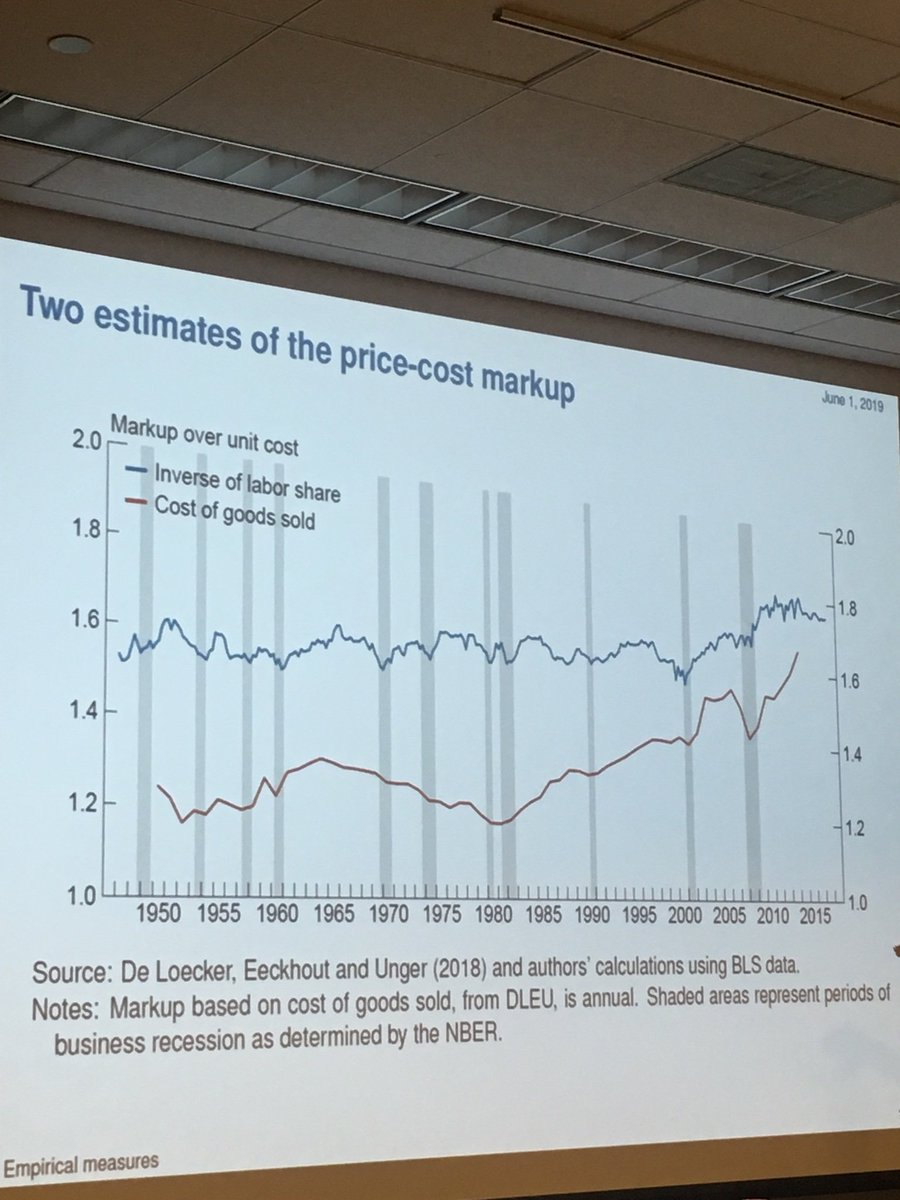

Q: is behavior of price markups consistent with sticky-price NK models?

#WIMC19 2

1) constructs a new measure of price markup

2) estimates the unconditional cyclicality of markups

3) analyzes the cyclicality of markups conditional on supply and demand shocks

#WIMC19 3

Use of labor margin bc:

1) 0 or small adjustment costs on worker hours

2) labor inputs and wages paid are well-measured

3) lots of estimates on elasticities of substitution bween labor and capital

4) answer to critiques in paper

#WIMC19 4

Estimates of price-cost margins and detrended price markups in graphs.

#WIMC19 5

#WIMC19 6

How to measure capital utilization? Three different versions:

1) constant utilization (at odds with standard NK)

2) Shapiro’s workweek of capital

3) Fernald’s utilization of capital and labor

#WIMC19 7

The latter are all over: some measures tell us about procyclicality, some about countercyclicality.

#WIMC19 9

We now look at the response of markup measures to 4 types of shocks:

1) monetary policy

2) government spending

3) TFP

4) investment-specific technology

Results in graphs below.

#WIMC19 10