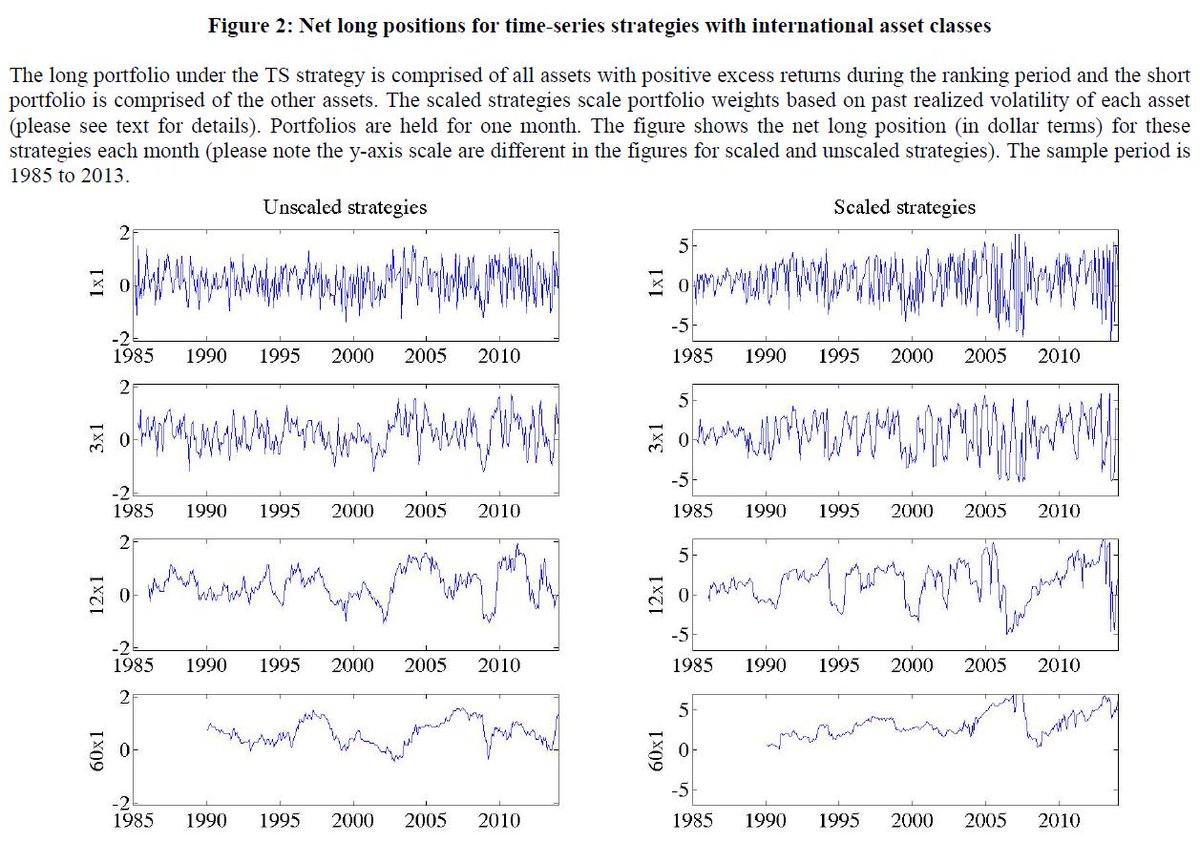

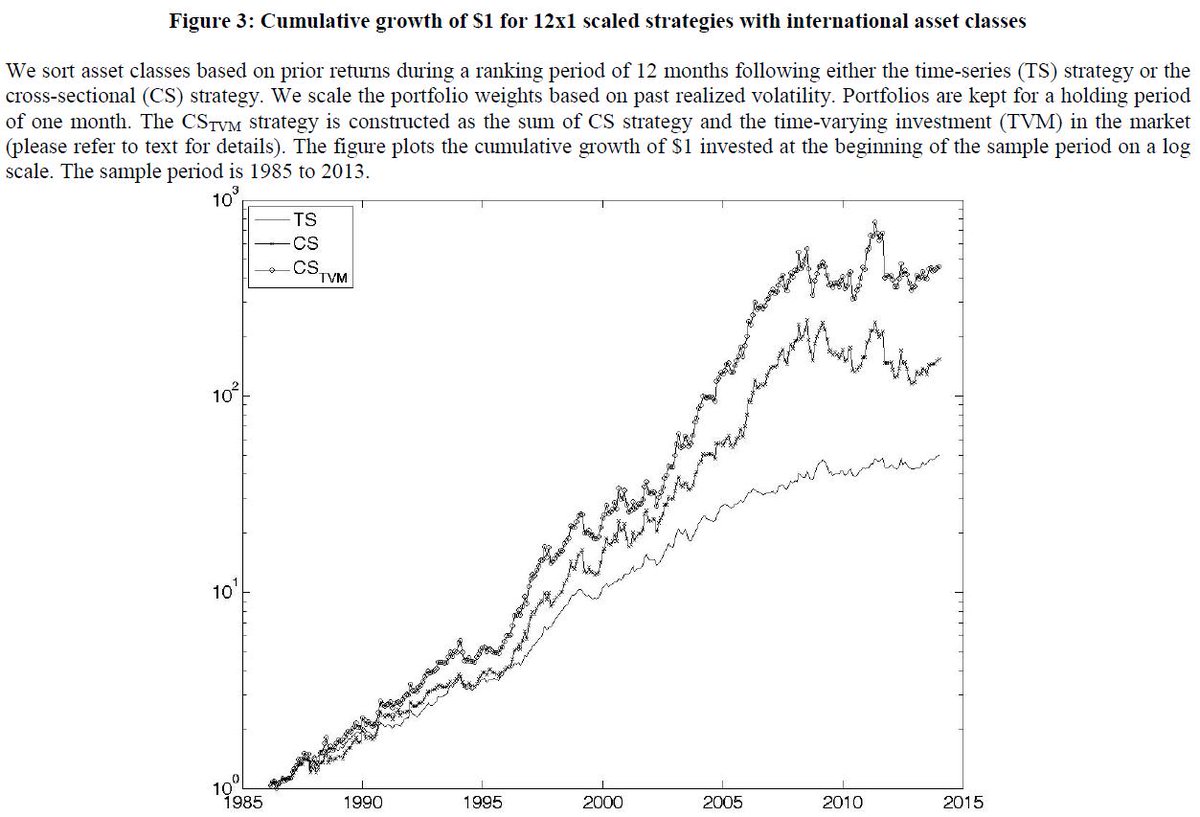

"The difference between the performances of TS and CS strategies is largely due to a time-varying net-long investment in risky assets."

papers.ssrn.com/sol3/papers.cf…

This is consistent with short-term reversals being an intra-industry effect, not a broad stock market effect.