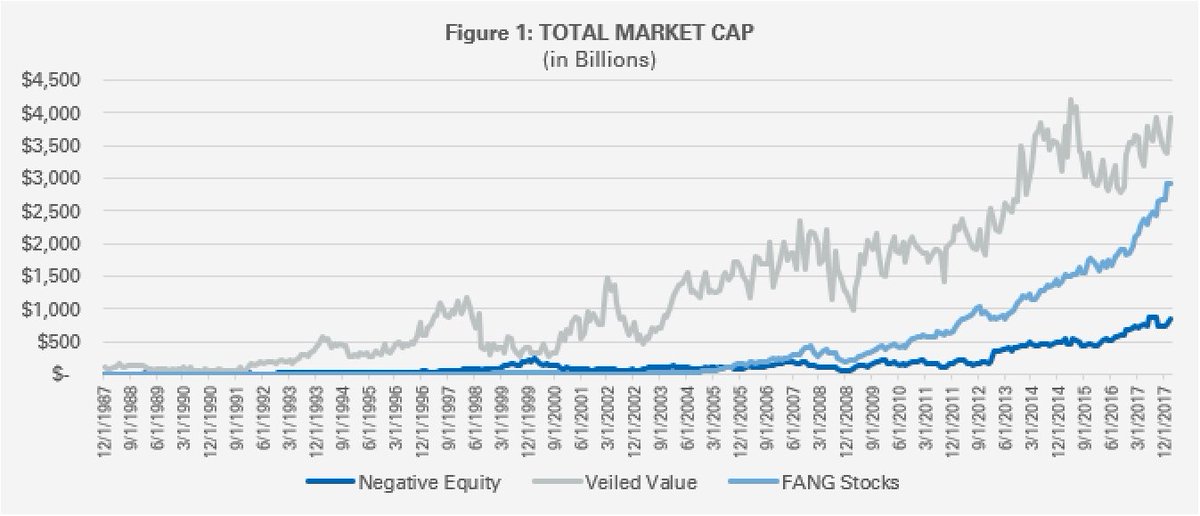

"...respected value investors frequently emphasize: free-cash-flow (FCF) is better than other fundamentals in the measurement of value. I’m going to test that conclusion in the factor space..."

Be prepared to think.

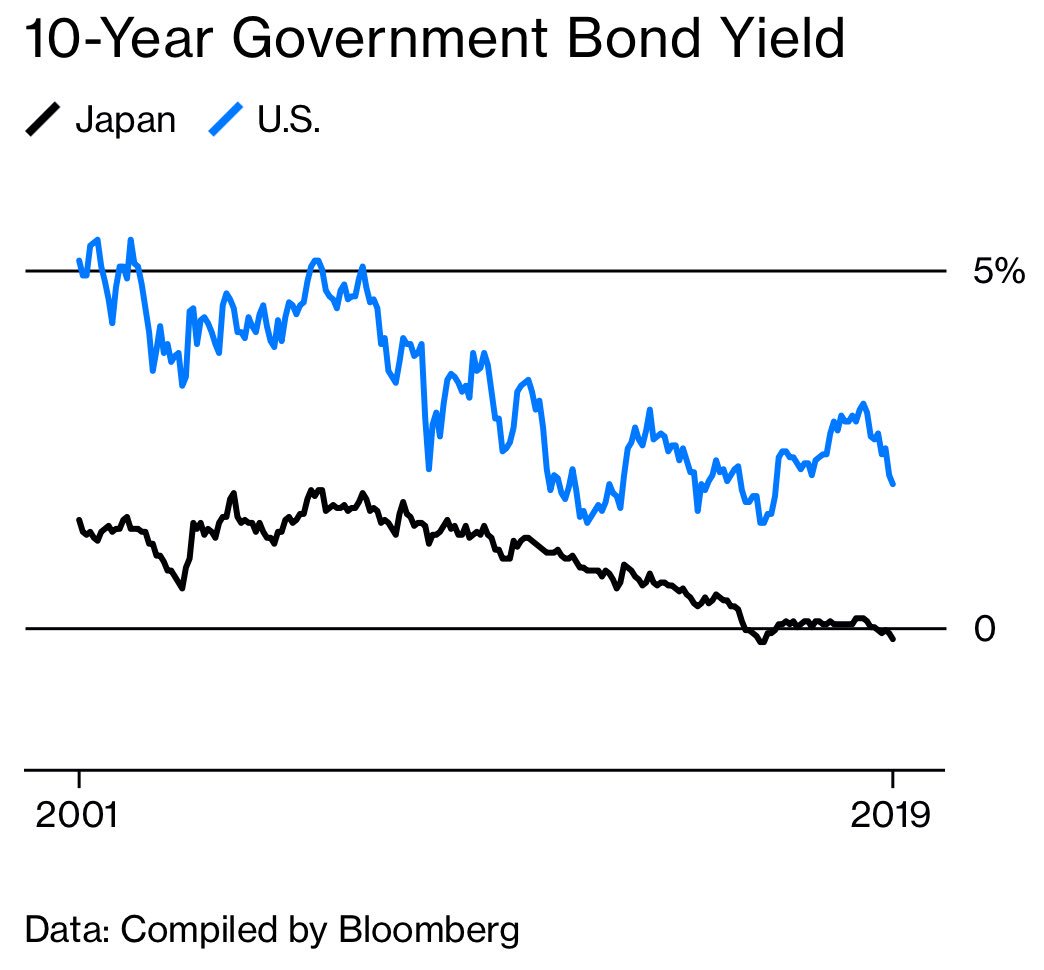

"*Expected* long-term cash flows, discounted by the cost of capital—not reported earnings—determine stock prices." expectationsinvesting.com/pdf/earnings.p…