I hope this will help you to increase your knowledge. 😊😇

So let's start #Megathread_ChartPatterns

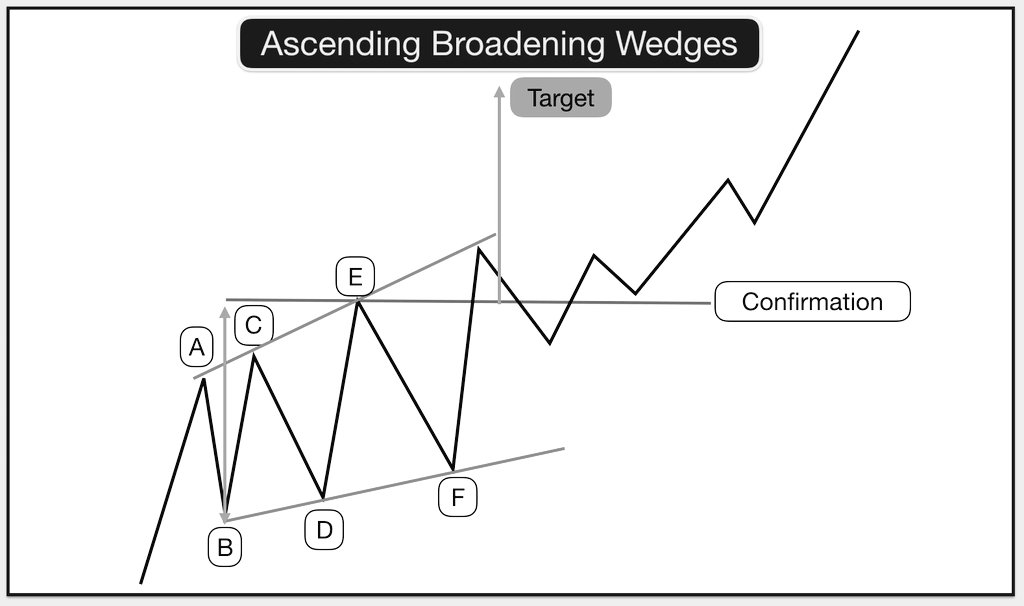

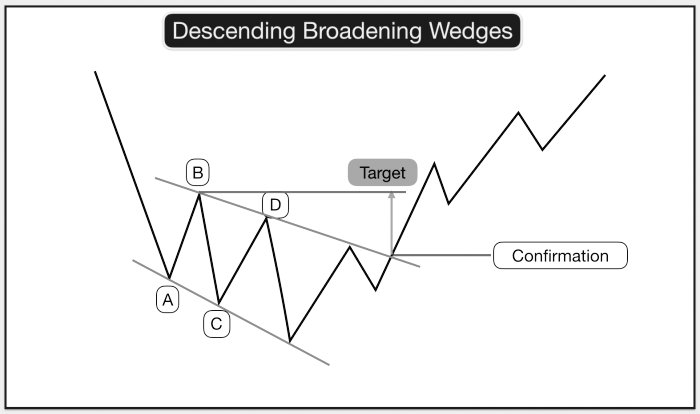

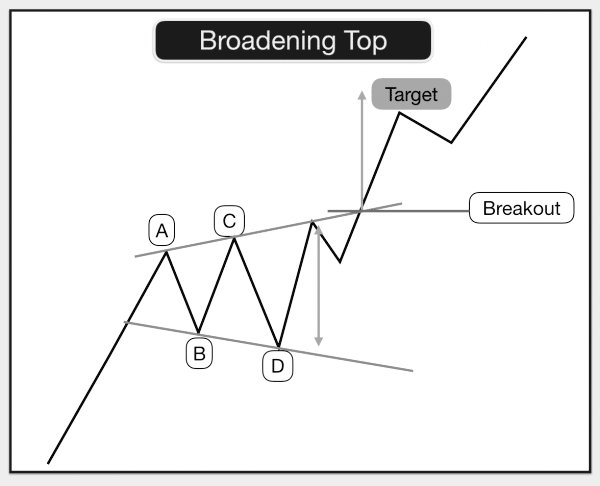

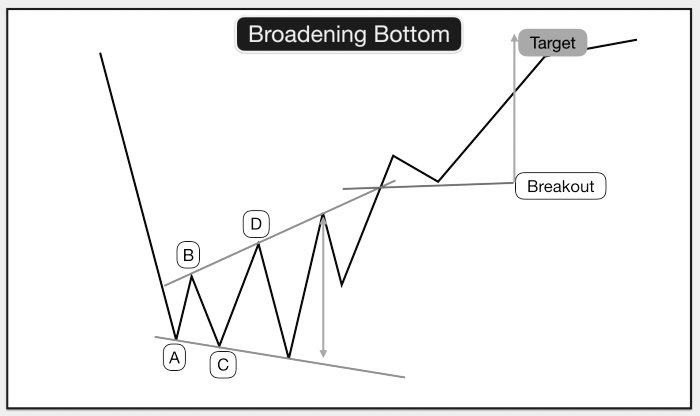

👉Types of #Broadening_Patters

- Ascending/Descending

-Top/Bottom

👉Identifying patterns

-Shape wid HH & LL.

-Prices follow 2 trend lines top one slopes up & the bottom 1 slopes down.

-Touches, Should've at least 2 highs & 2 lows,

#Megathread_ChartPatterns

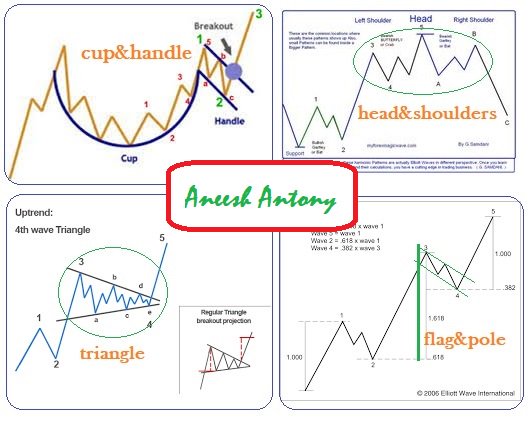

Types of #CupWithHandle_Pattern

-Bullish/Bearish cup

Identifying

-The cup should be “U” shaped

-Handles form in upper half of cup

-Cup lips near same price

-There s'ld be a substantial increase in vol on breakout resistance.

#Megathread_ChartPatterns

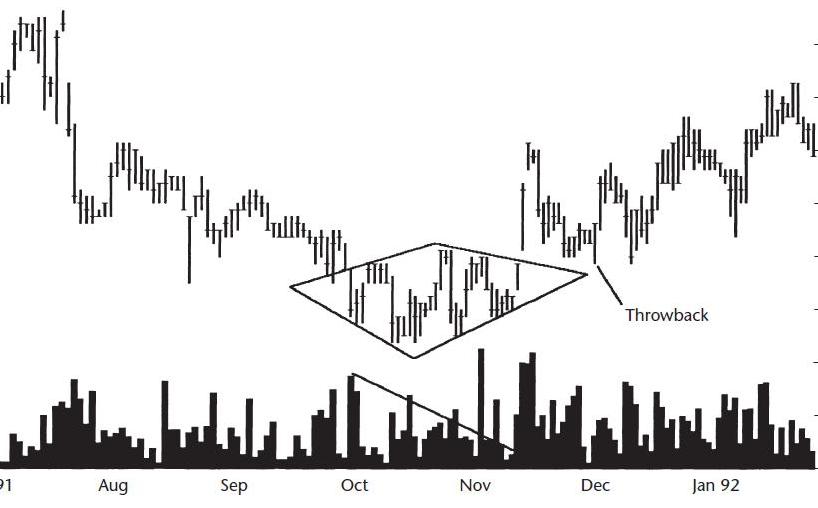

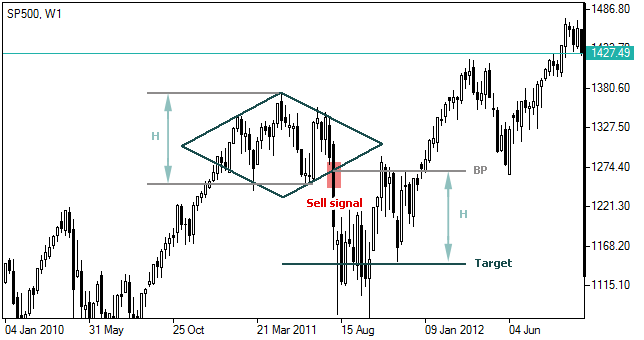

#Diamond_Bottom_pattern forms after a downward

price trend.

Identification

-Prices form higher highs and lower lows in the first part of the

pattern then lower highs and higher lows. (See Img 4 dtls)

#Diamond_Bottom have low break-even failure rate

#Megathread_ChartPatterns

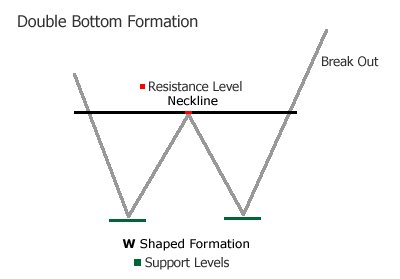

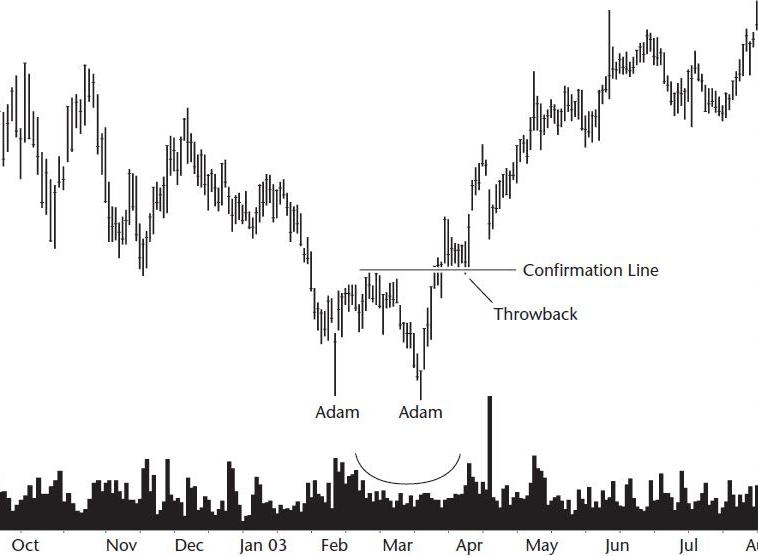

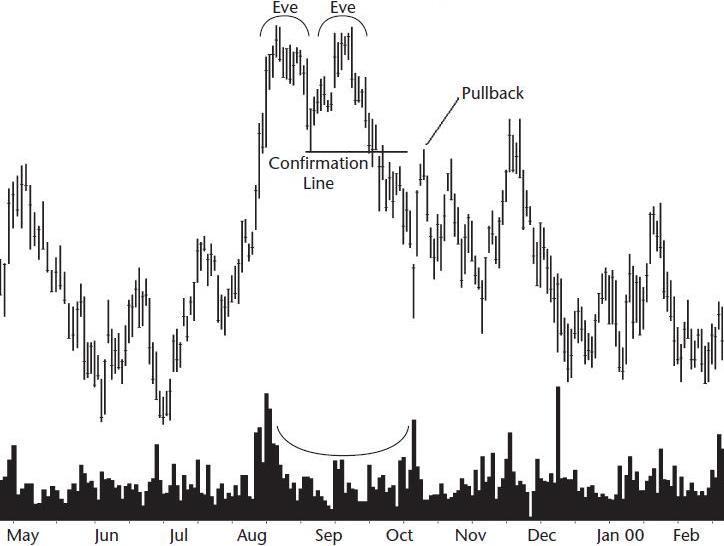

#Double_Bottom_Adam2

Identification

-Narrow/V-shaped Bottom,1day spikes

-Vol:Usually higher on d left bottom thn d right

-The highest high between the 2 bottoms. A close above d confirmtion point is d breakout & confirms d pattern as a valid bottom

#Megathread_ChartPatterns

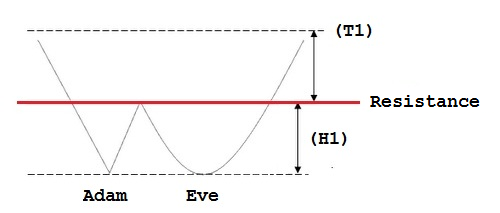

#Double_Bottom_Adam_n_Eve Breakout is upward.

Identification

-DB, Narrow, V-shaped, left bottom (Adam) 1/2 day spike. The right (Eve) appears rounded & wider

-lower right bottom perform better

-volume heavier on the left bottom than on the right.

#Megathread_ChartPatterns

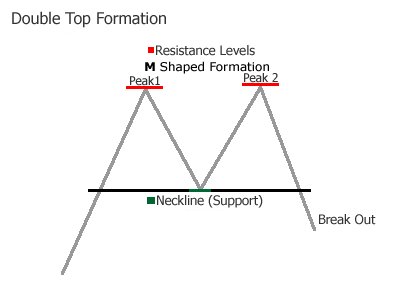

#Double_Top_Adam2 Short-term bearish reversal

Identification

-top narrow price spikes, inverted V’s. Both should appear similar

-VOL:higher on d left but vol. trends downward frm peak2peak

-Confirmation is a close below d LL between the 2tops

#Megathread_ChartPatterns

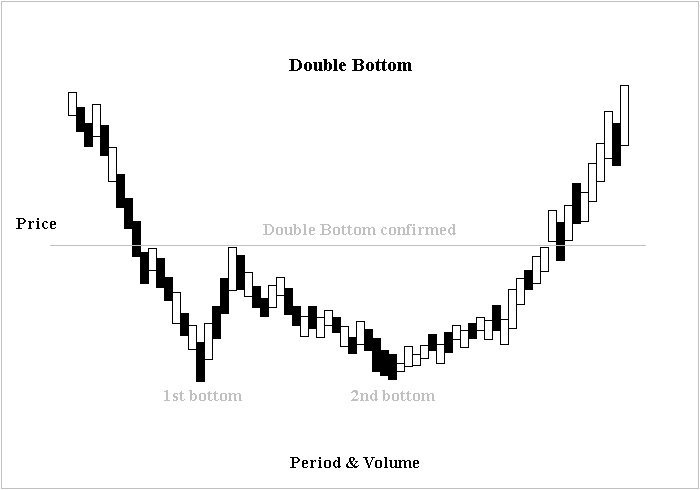

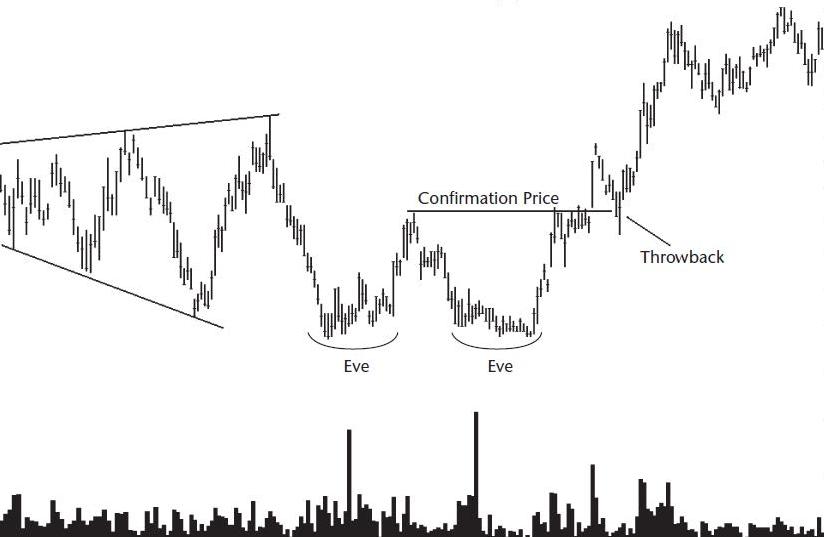

#DoubleBottom_Eve2 bullish reversal

Identification

-Prices trend downward 2 d pattern & shouldn't drift below d left bottom

-Eve bottoms R wide, rounded turns, not narrow price spikes, not V shaped.

-Vol:Usually higher on the left bottom than right

#Megathread_ChartPatterns

#DoubleTop_Eve2

-short-term bearish reversal

Identification

-2 peaks at about the same price level

-Both Eve peaks should appear rounded and wide, not made of a single, narrow price spike.

-Vol:Usually higher on the left bottom than right

#Megathread_ChartPatterns

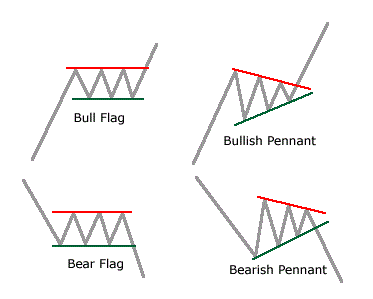

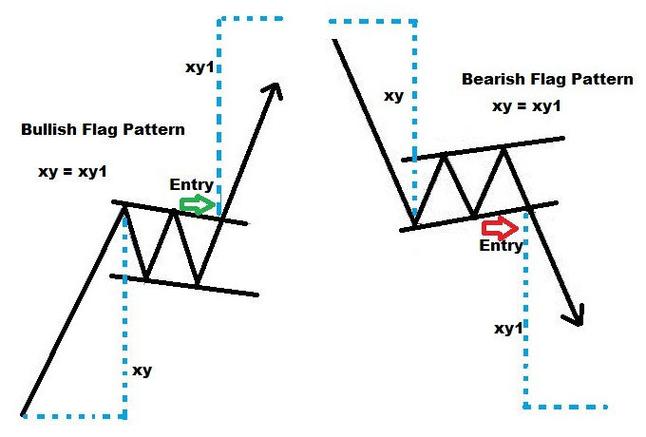

#Flags

-Short-term bullish/Bearish continuation

Identification

-2 parallel trend lines bound the price

-Vol: usually trends downward throughout the formation

#Megathread_ChartPatterns

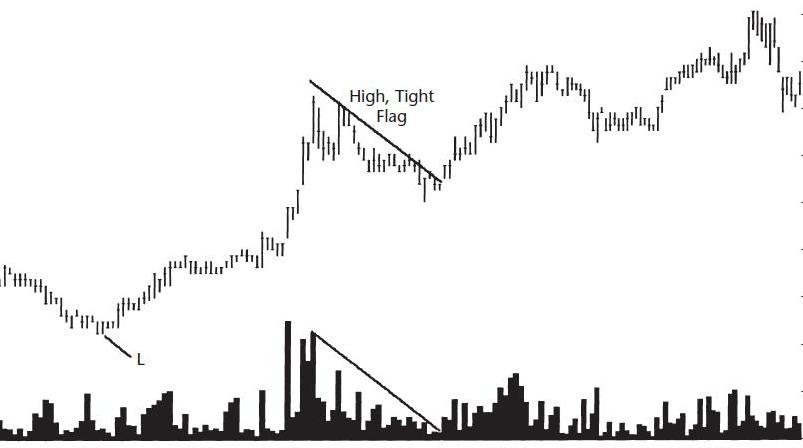

#Flags-#High_n_Tight

-Short-term bullish continuation

Identification

-Locate a consolidation area, where prices pause in the prevailing uptrend near where price doubles from the trend start.

-Select patterns with a falling volume trend & U shape

#Megathread_ChartPatterns

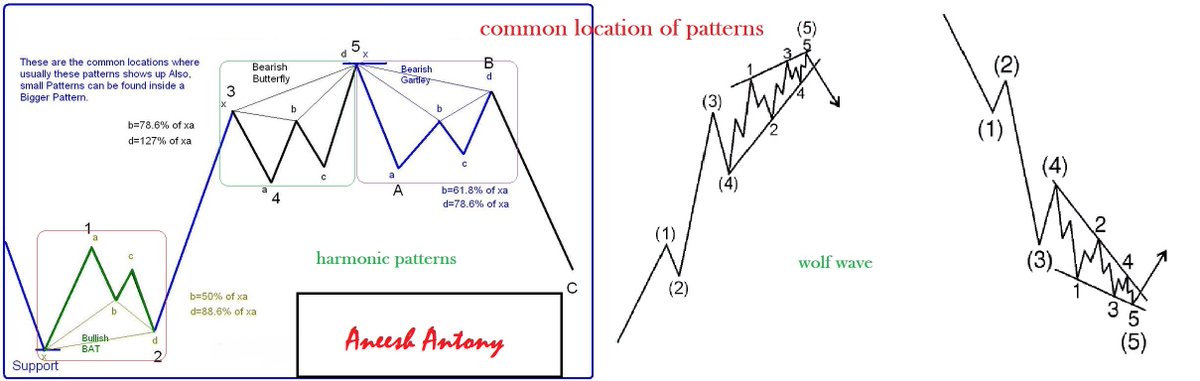

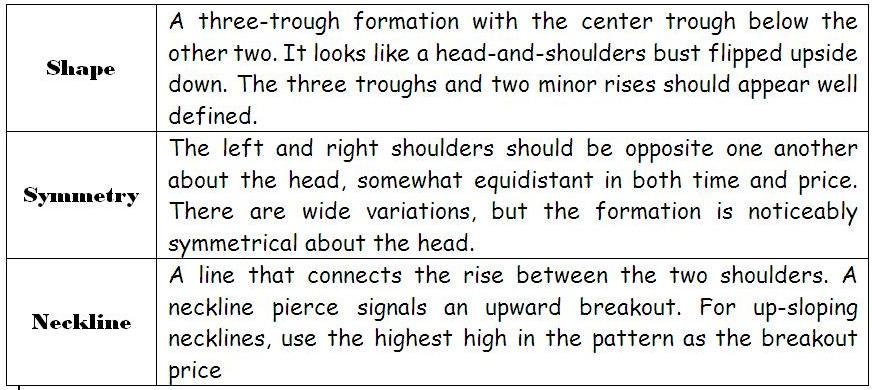

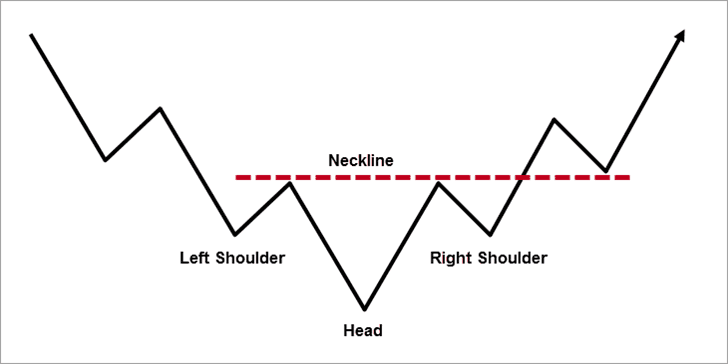

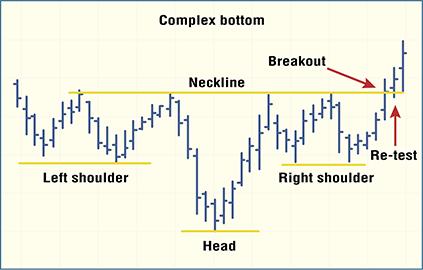

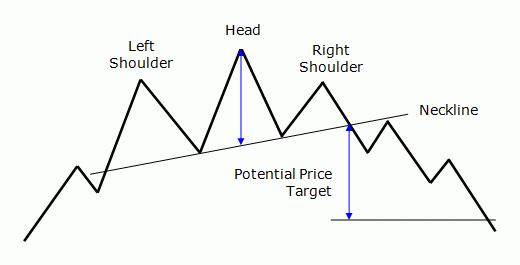

#Head_and_Shoulders_Bottoms

-Short-term bullish reversal

Identification

-see img for details.

-Tall & narrow pattern perform better than do their short & wide counterparts.

(All rights belong to their respective owners)

#Megathread_ChartPatterns

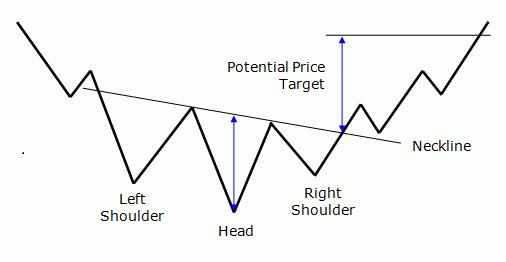

#Complex H&Sb

-Short bullish reversal

Id

-A CH&SB wid multiple shoulders,multiple heads or both

-The shoulder should bottom near d same price, b nearly d same distance frm d head & look similar

-brkout:when price closes above d down sloping neckline

#Megathread_ChartPatterns

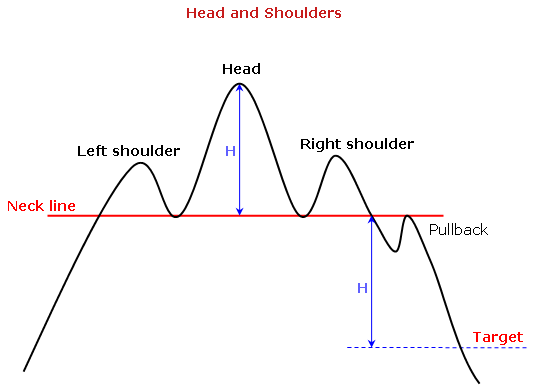

#Head_and_Shoulders_Top

-ShortTerm BearishReversal

Identification

-The H&S top usually appears @ d end of a long uptrend

-A 3-trough formation with d center though above the other 2

-The 2 shoulders appear @ same price level

-Downward breakout

#Megathread_ChartPatterns

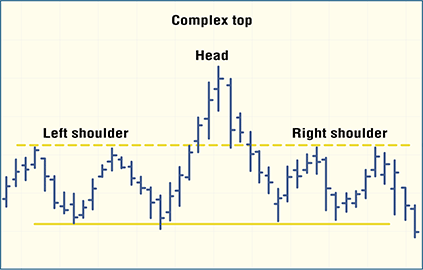

#Complex H&STop

-Short BearishReversal

Identification

-A CH&ST with multiple shoulders,multiple heads or both

-The head is higher than d shoulders

-The neckline joins d lower lows from left 2 ri8 shoulders

-brkout:when price closes below neckline.

#Megathread_ChartPatterns

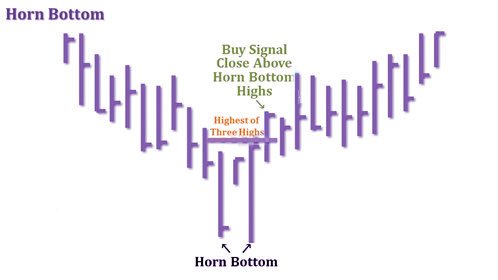

#Horn_Bottoms

-Short term bullish reversal

-Horns are visible on weekly charts

-It should mark the turning point of a downward price trend

-The pattern becomes a valid horn bottom when price closes above the highest high in the 3-week pattern.

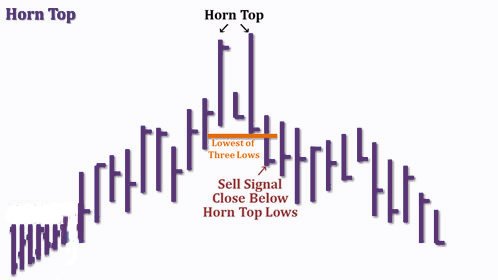

#Megathread_ChartPatterns

#Horn_Tops

-Short term bearish reversal

-Use the weekly chart to facilitate identification

-Confirmation occurs when price closes below the LL in the chart pattern.

-Pullbacks are rare for horns

#Megathread_ChartPatterns

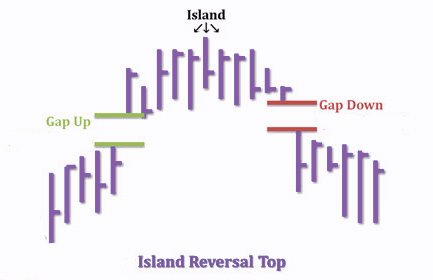

#Island_reversal_top

-Downward Breakouts

-Short term bearish reversal

-price separated by a gap up and then gap down

-The gaps appear at or near the same price level but are typically not the same size.

-Volume is usually high on the breakout day

#Megathread_ChartPatterns

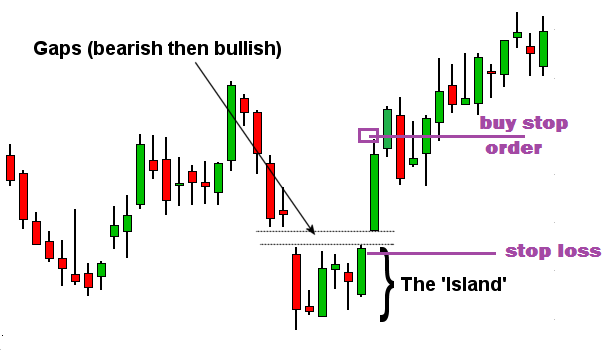

#Island_reversal_Bottom

-Upward Breakouts

-price separated first by a gap down and then gap up

-Select tall or wide patterns in a bull market, narrow ones in a bear market

-Trade with the general market trend: upward breakouts in a bull market

#Megathread_ChartPatterns

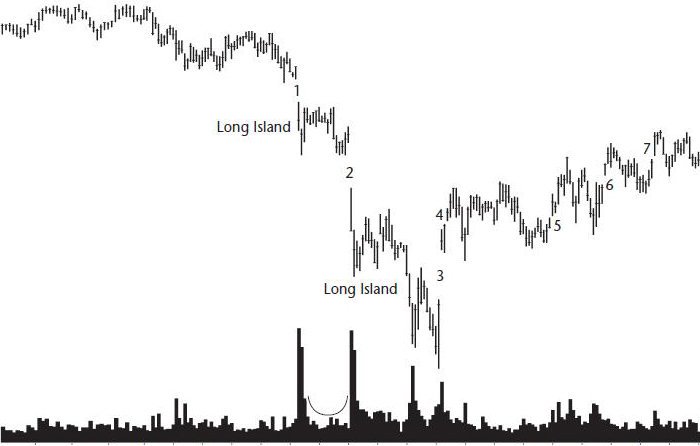

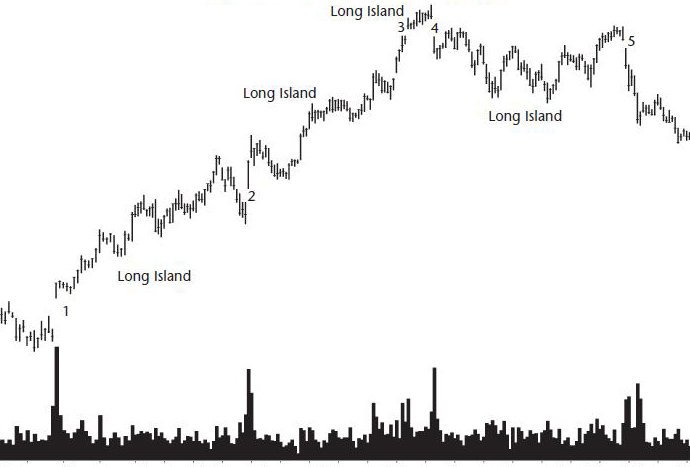

#Island_Long

-Long islands r continuation pattern

-2 gaps with different price

-Gaps should b long n wide,Avoid short

-large price gaps mean better performance

-Tall patterns perform better than short

-day after the 2nd gap is the breakout day

#Megathread_ChartPatterns

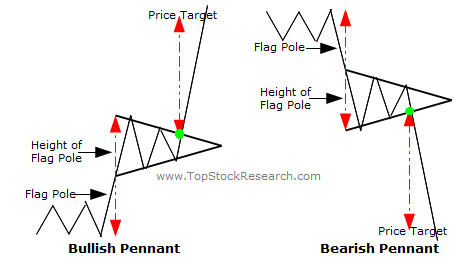

#Pennants

-Bullish/Bearish Pennants

-Bullish:It is formed in an uptrend

-Bearish: It is formed in an downtrend

-Pennants r 4 swing traders, not 4 investors

-price is consolidated between the 2 tapering converging trend line forming triangle pennant, b4 d pattern continues

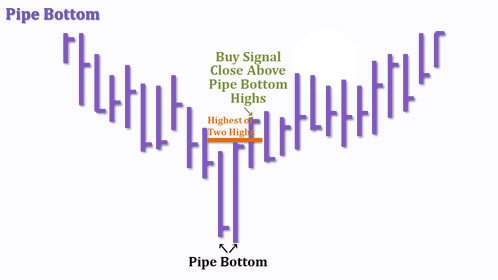

#Pips_Bottom

-ShortTermBullishReversal

-downward price spikes on weekly chart

-Locate 2 downward price spikes that r next to each other

-Brkout-when price closes above the highest high in the pattern

-Pipes do best when d volume trend is downward

#Megathread_ChartPatterns

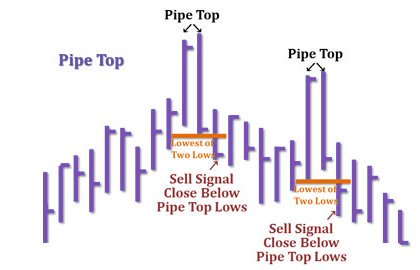

#Pips_Top

-Short Term Bearish Reversal

-Downward Breakouts

-easy to spot on weekly chart

-Brkout-when price closes below the LL in the pattern

-Always wait for price to confirm the pattern, that is price

must close below the lowest low

#Megathread_ChartPatterns

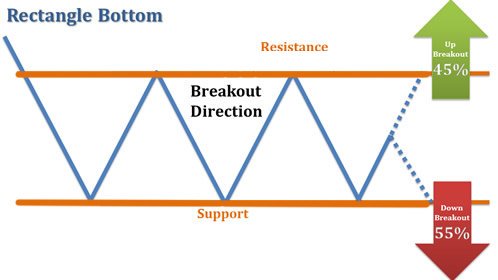

#Rectangle_Bottom

-Bullish Rev/Bearish Continuation

-Prices trend down to the formation & then oscillate between 2 horizontal lines

-Downward price trend

-Atleast 2 touches of each trend line r required for a valid rectangle

-Vol. usually downward

#Megathread_ChartPatterns

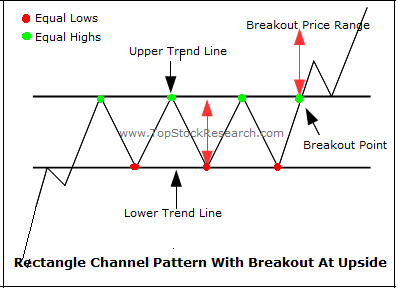

#Rectangle_Top

-Rising Prices trend & oscillate between 2 horizontal lines

- required Atleast 2 touches of each trendline

-Horizontal Upper line act as Ress & lower line act as a Supp

-If rectangle is tall enough, 1 can do scalping between T lines

#Megathread_ChartPatterns

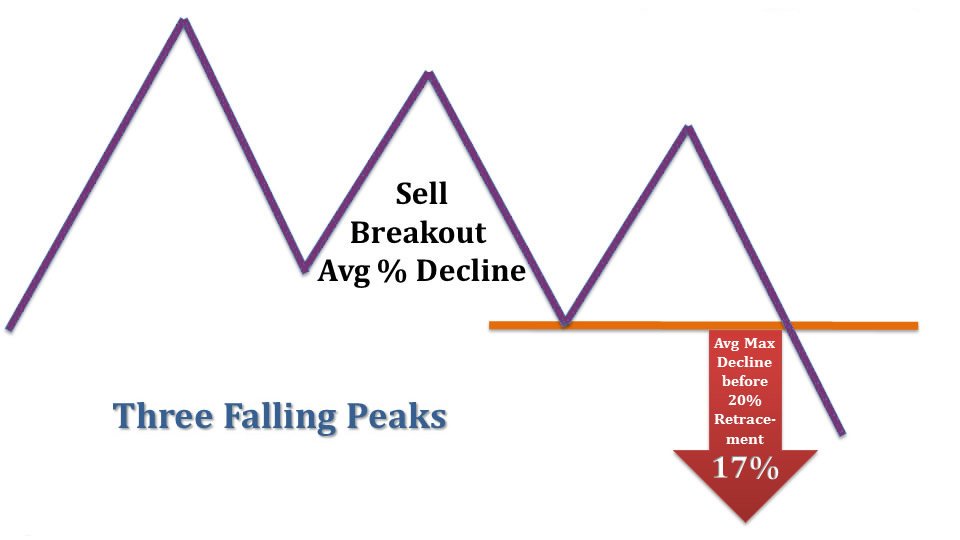

#ThreeFallingPeaks

-bearish reversal

-3 peaks need not follow a straight down-sloping trend line

-The 3 peaks should appear similar in size & shape

-The pattern becomes valid when price closes below the

LL

-Be4 trading, check support zones

#Megathread_ChartPatterns

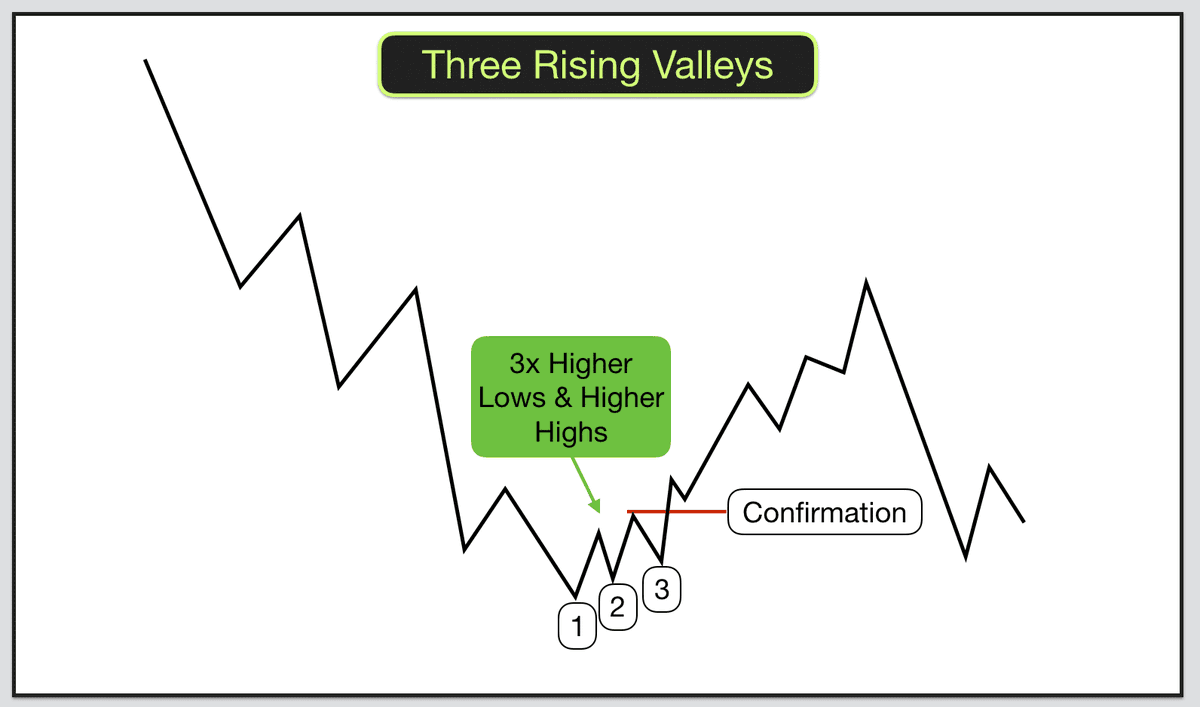

#ThreeRisingValleys

-bullish reversal

-Look for 3minor lows in a row, usually found in an uptrend

-this pattern is quite good in bull market

-Confrm-when price closes above the HH in the pattern

-1 can also use a down-sloping trend line

#Megathread_ChartPatterns

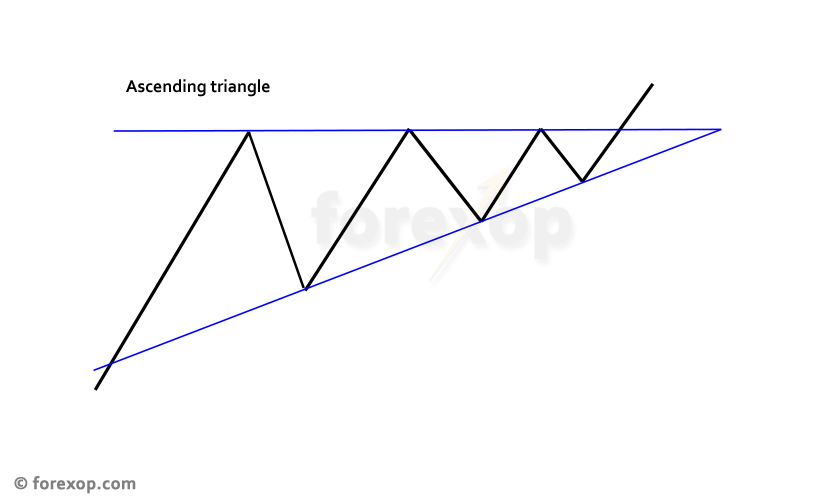

#Triangles_Ascending

-2trend lines-top1 horizontal & bottom1 sloping up

form a triangle pattern

-Prices rise up to & fall away from horizontal line at least twice

-Prices decline 2 & rise away from an upsloping line

-premature breakout is possible

#Megathread_ChartPatterns

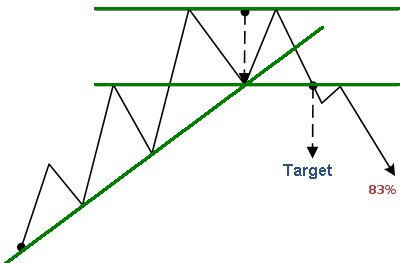

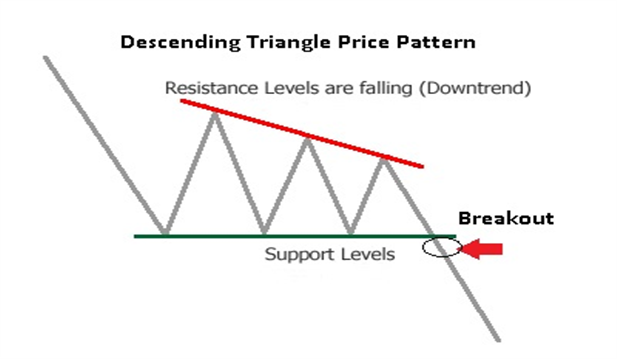

#Triangles_Descending

- Triangle shape with horizontal bottom & down sloping top

-Horizontal support line-A horizontal base acts to support prices

- Down sloping top trend line 1 can call resst. line

-Brkout confrm- Prices usually move down quickly

#Megathread_ChartPatterns

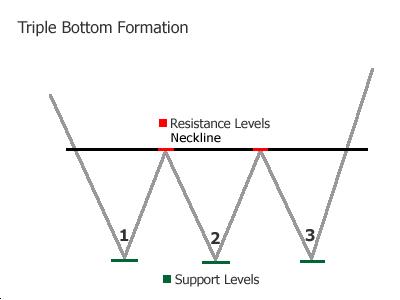

#Triple_Bottoms

-bullish reversal

-Three distinct minor lows at about the same price

-Narrow patterns perform better than wide

-usually large enough to be visible on weekly charts

-Confirmation:Price must rise above the HH in the formation

#Megathread_ChartPatterns

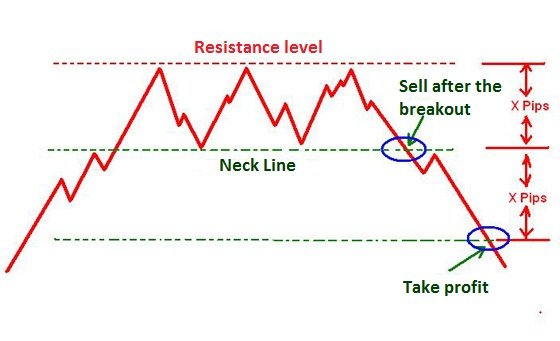

#Triple_Top

-bearish reversal

-3 tops should be near 1another in price

-Triple tops wid U-shaped vol perform best

-Prices must decline below the LL in d formation

-An upsloping trendline drawn connecting the valley lows can also serve as confrmtion

#Megathread_ChartPatterns

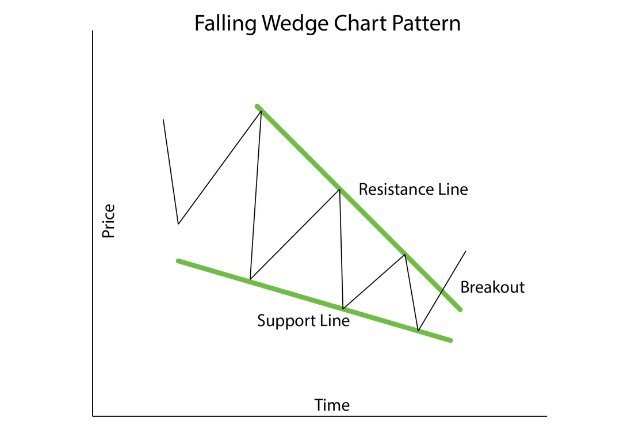

#Wedge_Falling

-Draw 2 trendlines, 1along the tops & 1along the bottoms

-pattrn creates several minor highs& minor lows

-min 5 touches necessary to a gud formation

-Vol usually downward until the breakout

-can breakout in any direction,wait 4 that

#Megathread_ChartPatterns

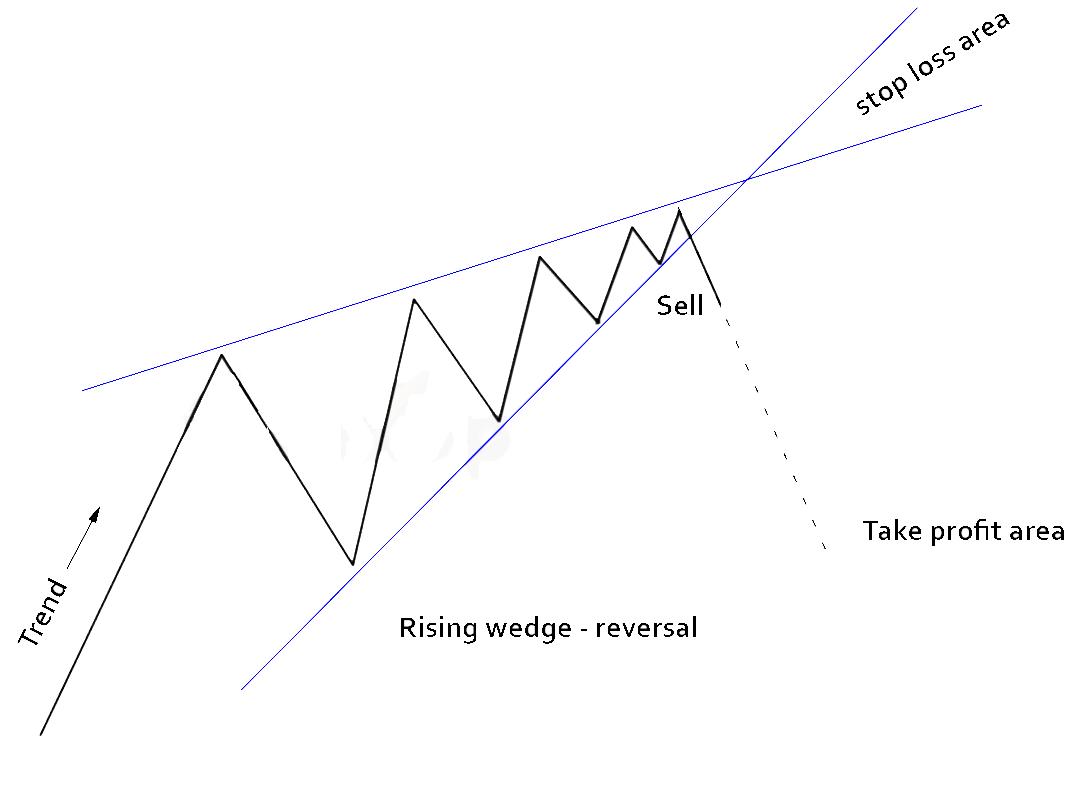

#Wedge_Rising

-Draw 2 trendlines

-resistance : upward sloping upper line

-support: upward sloping lower line

-both trendline should have a definite upward slope

-Wait for the breakout for successful trade

-if u missed, short after a pullback.

#Megathread_ChartPatterns

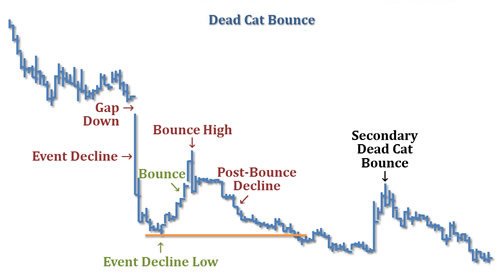

#Dead_Cat_Bounce

-The D high is below the prior day’s low, leaving a price gap on the chart

-usually On the negative news, price gaps down

-Prices bounce up, recovering much of what they lost during event decline

-Wait 4 d bounce 2 peak & then sell

#Megathread_ChartPatterns