1/ The best categories are flexible

2/ The best founders are solution agnostic

3/ The best companies are ambitious beyond their vertical

A thread…

There are many motivators, but the most critical one is financial.

Assuming a $350 LTV for luggage alone, they’re looking at $10B in sales. With a 30% contribution margin, that’s $3B in leverageable income.

In America.

Ever.

Bear with me.

Build the tech. Maintain the tech. Get tech margins.

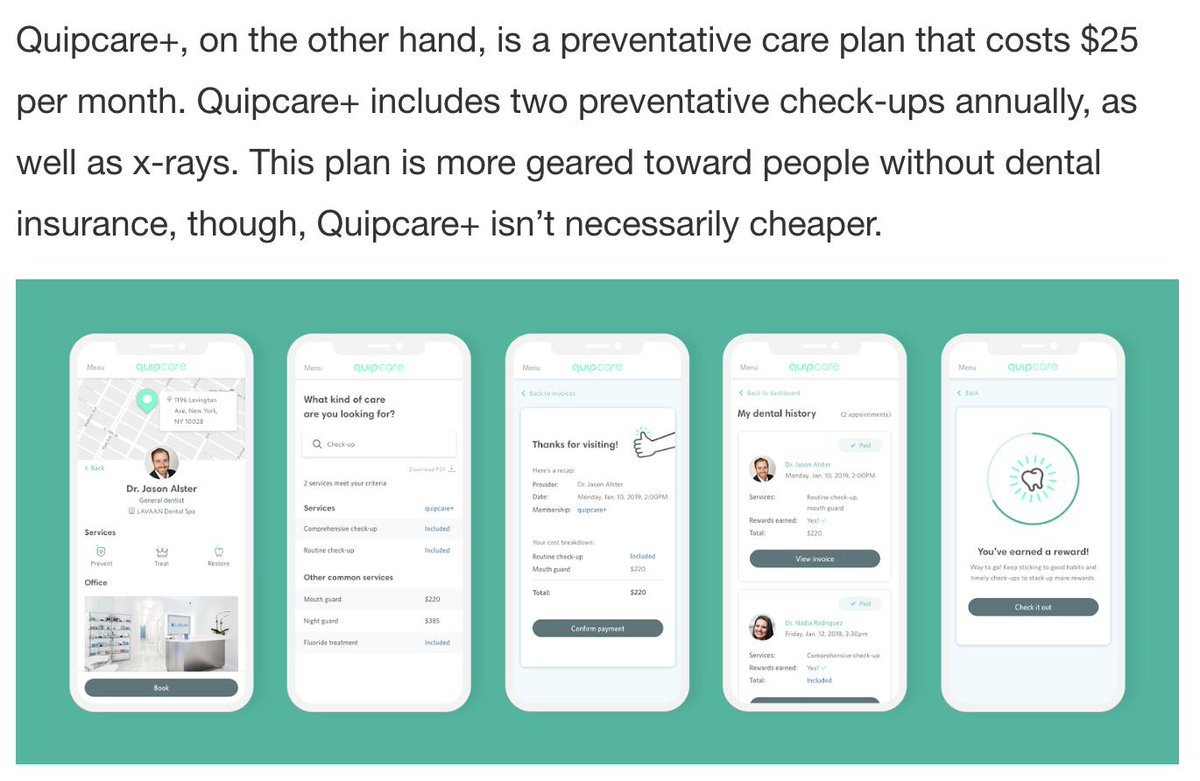

@GetQuip bought Afora and has begun selling dental insurance in NY.

@WarbyParker could sell vision insurance - much more scalable than offering eye exams.

Viewing CPG alone as the avenue to billion $ revs is an unsophisticated view of the market.

Travel (Away): luggage > wellness CPG > travel insurance > airport lounges >

Vision (Warby Parker): glasses > vision insurance > contacts >

Oral Health (Quip): toothbrush > dental insurance > dentist chains > teeth aligners (?)

1. What’s considered “fashionable” is ephemeral and constantly shifting

2. Substitution is unavoidable - wardrobe brands change even in the same style

3. Categories and expansion rev are already defined - shirts > jackets > pants > bags > shoes > hats

2pml.com/2019/07/08/soc…

But not all brands are alike. The path of some DNVBs is category dominance. While other categories appear to be destined for the constant churn of micro brands emerging, rising and dying.

Don’t compare water to wine, just because they’re both wet.