cfr.org/blog/imf-still…

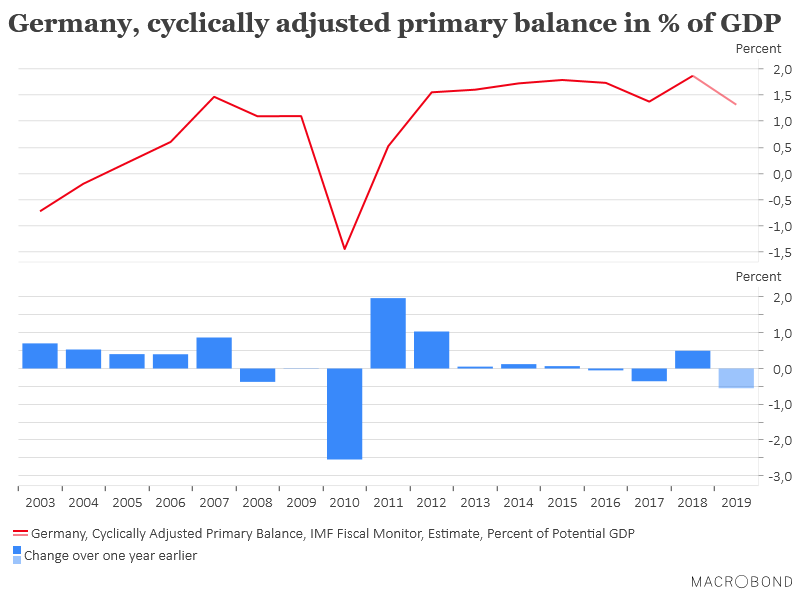

The IMF thinks moving toward optimal fiscal policies would reduce Germany's external surplus by 1.2 pp of German GDP. But this mostly comes from fiscal tightening in Germany's trade partners, not fiscal expansion in Germany

But important ...

See table 3 of this report for IMF's policy recs. "p" is current policies, "p*" is the IMF's recommended policy stance. the difference is the policy gap (in the IMF's lingo)

imf.org/external/np/re…