If you have $100,000 in the bank, and you have zero debt, everyone would agree that you're both solvent and liquid. 1/

A drug deal might need cash.

Paying your rent typically requires money in your checking account.

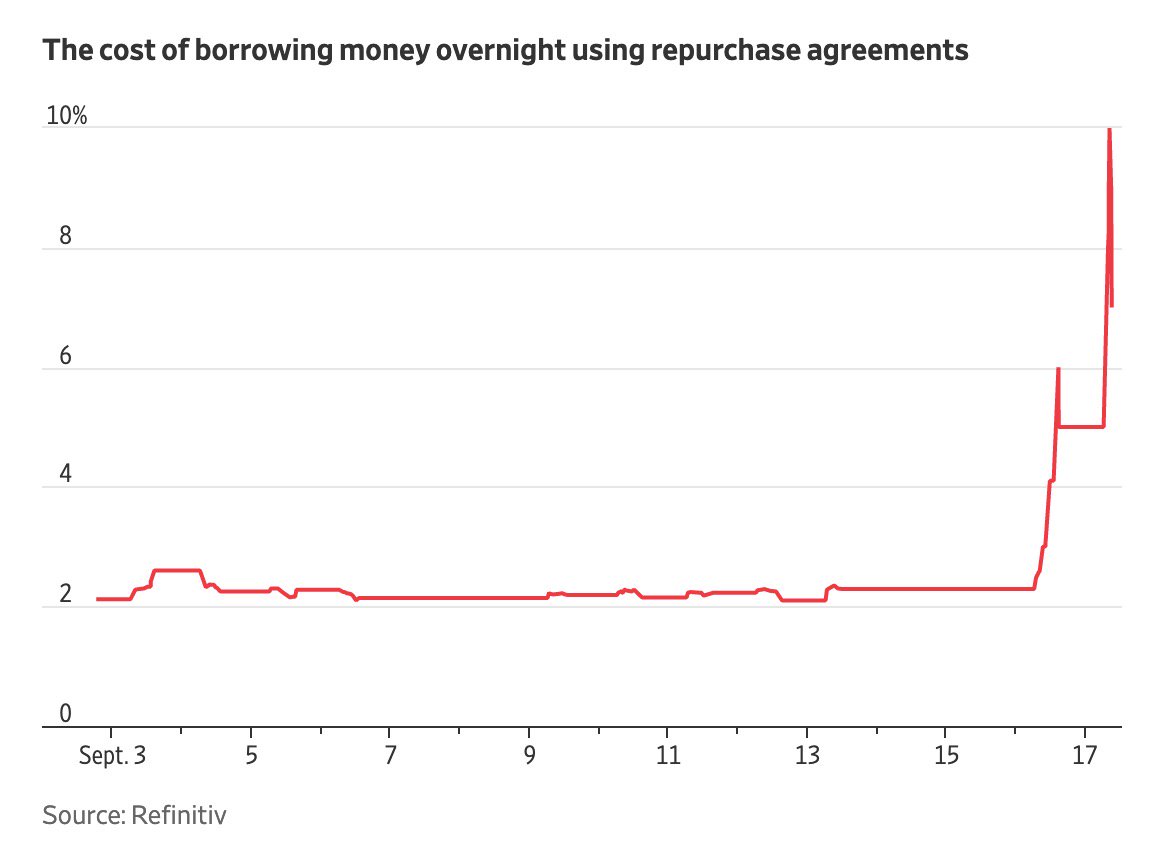

A bank-to-bank transfer is done via reserves 7/