In July, WeWork had a $47 billion valuation.

Now it's putting an official pause on its IPO to focus on improving its core business. Here's a look inside the brief but chaotic history of the real estate company ⬇️

bloom.bg/2n8Z16g

You start a real estate company

You buy fancy buildings

You rent offices to tenants

You offer them free beer

You charge high rents

You realize this is expensive

You raise a kajillion dollars from investors bloom.bg/2nYBC7u

Even then, things weren't looking good for the real estate company disguised as a tech company bloom.bg/2mZWag3

🔰Members: 220K

🔰Locations: 234

🔰Total revenue: $886 million in 2017

🔰YOY revenue growth: 103%

🔰Operating lease liabilities: $18.2 million

🔴Free cash flow: -$778 million in 2017 bloom.bg/2na8oCB

SoftBank committed $2 billion more toward WeWork, scaled back from what was discussed as a $16 billion investment bloom.bg/2CXUFns

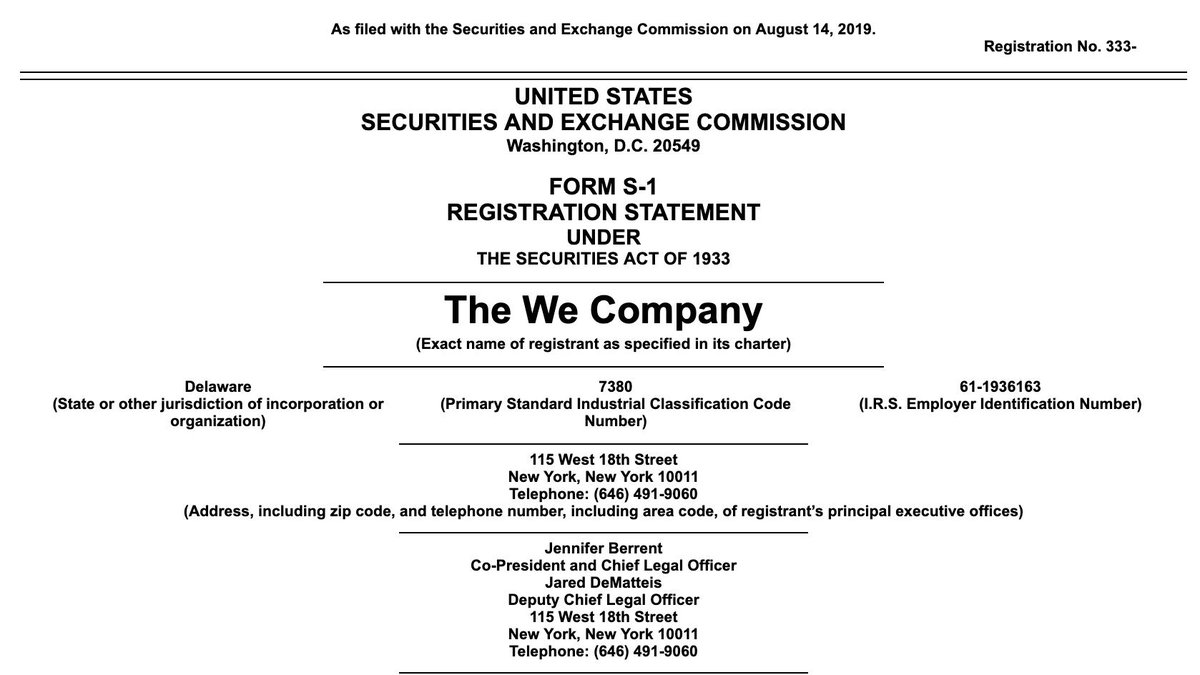

The company rebranded its main business units: WeWork, WeLive, WeGrow. (@matt_levine proposed WeDie -- free beer at the wake! -- but that has yet to happen) bloom.bg/2mjmfpO

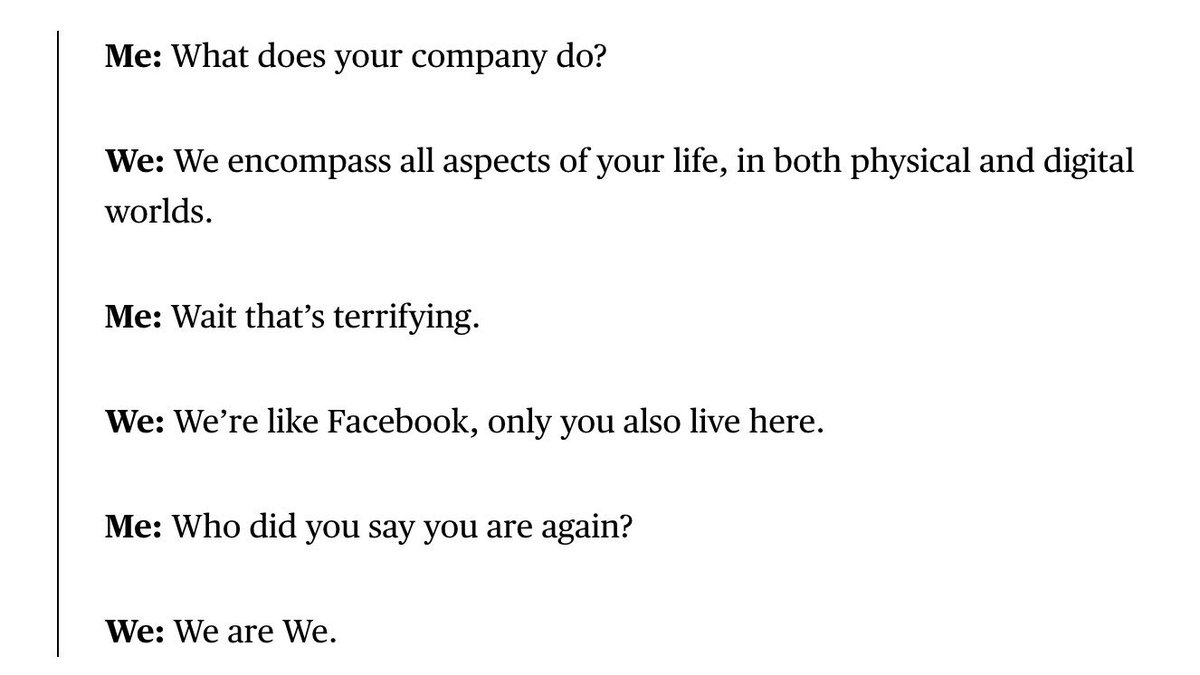

Looking back at it, it's an absolutely terrifying idea bloom.bg/2mjmfpO

Even then, @ShiraOvide knew that WeWork’s "value" was science fiction, determined solely by whatever WeWork and Softbank wanted it to be bloom.bg/2n8Z16g

"It really does seem like a conflict of interest!" @matt_levine wrote bloom.bg/2nSHWh4

@BChappatta wrote: "It’s hard to shake the feeling that investing in WeWork is like walking on thin ice." bloom.bg/2HJDl78

📃The company's intricate relationship with Adam Neumann required 10 (!) pages of disclosures bloom.bg/2nRfsUN

That's partly why he stepped down from his post as CEO bloom.bg/2mllXyK

If the $47 billion WeWork valuation turned into $15 billion, then SoftBank and the Vision Fund may have lost as much as $9.28 billion right out of the gate💸 bloom.bg/2mZdfqt

IPO or not, WeWork now owes nearly $50 billion in lease commitments in the coming years bloom.bg/2mllXyK

Its co-CEOs frantically tried to change everything about WeWork that potential shareholders didn't like bloom.bg/2nTe6sG

In less than two months, one of the most highly anticipated IPOs of the year turned into a cautionary tale for young startups with unproven business models bloom.bg/2oGi2NR