Here’s why it has major implications for the world bloom.bg/2ApupAx

Now, the question is whether the world has enough oil bloom.bg/2ApupAx

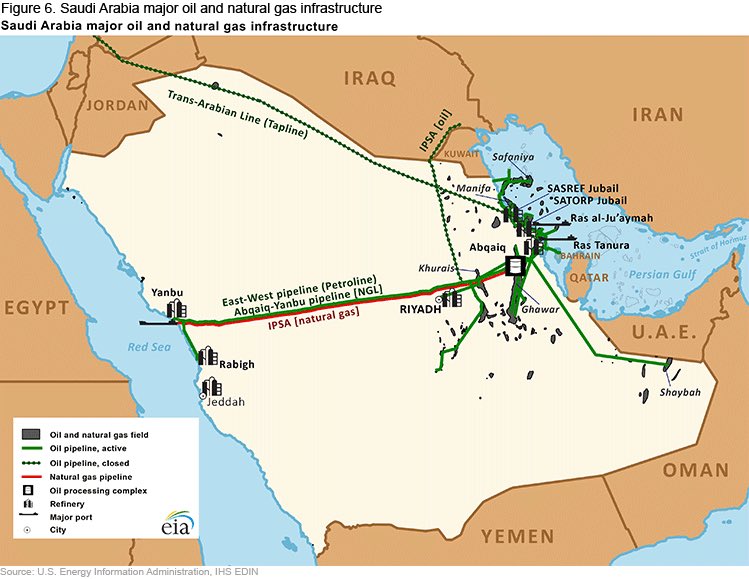

🛢️1990

🛢️2005

🛢️2011

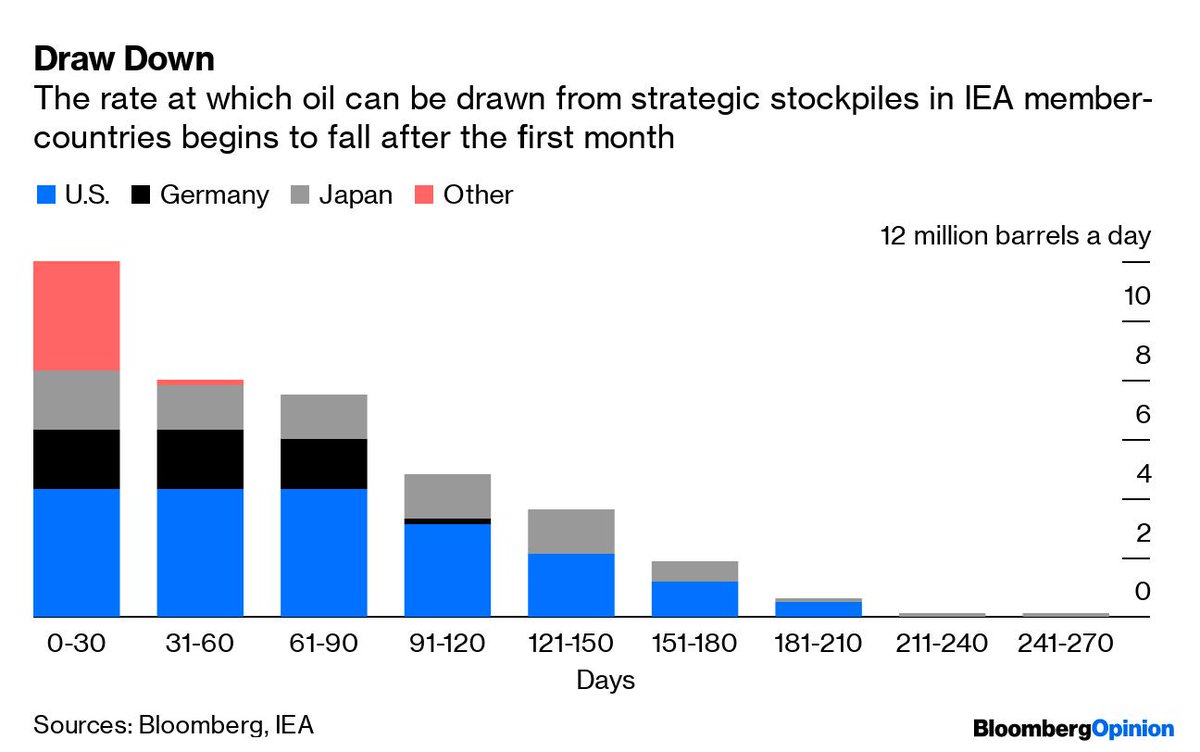

There’s more than enough oil in the stockpiles to cover the loss of Saudi supplies for three months. After that, it gets a bit tighter bloom.bg/2ApupAx

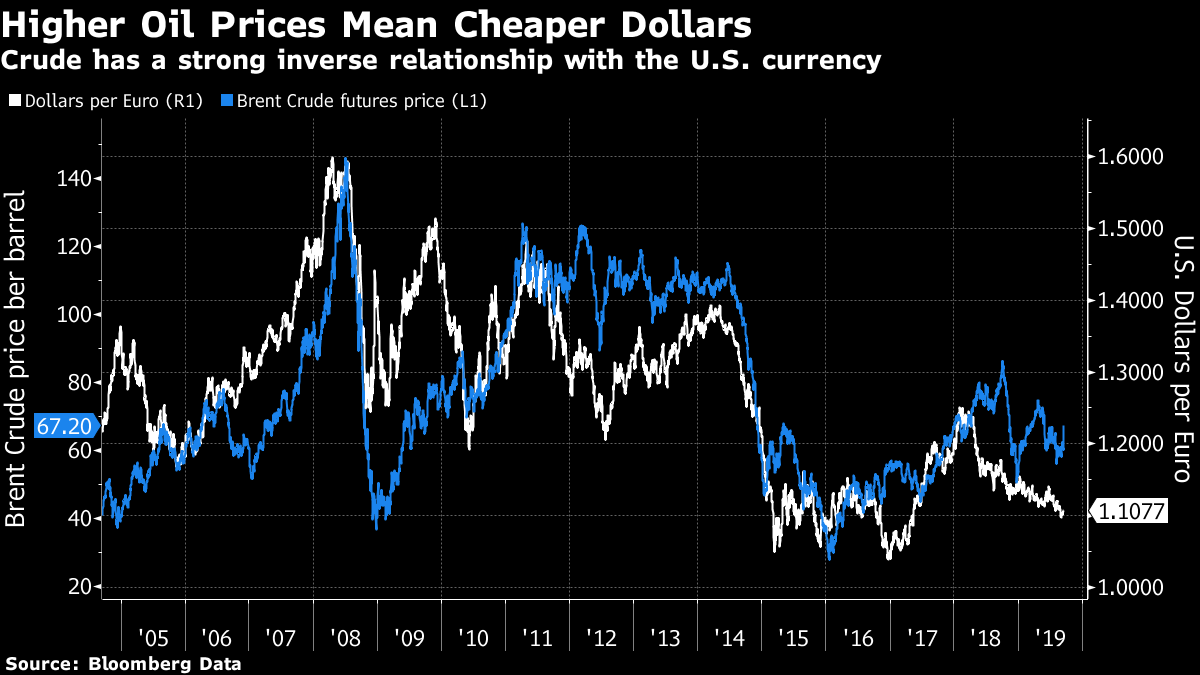

💵The dollar will weaken

📉European markets will take a huge hit compared to the U.S.

✂️The Fed is more likely to implement further rate cuts bloom.bg/2Al2LV5

In geopolitical terms, it might not make a difference: Both groups are proxies for Iran bloom.bg/2Am69PH

The UN General Assembly this week provides a perfect platform to do so bloom.bg/2Am69PH

The danger is that he will find military confrontations overseas a useful avenue for a political boost ahead of 2020’s election bloom.bg/2Al3C8f

What better argument for electrification than the spectacle of a market thrown into chaos by reports of drones taking shots at a single facility most people have never heard of? bloom.bg/2AlRhRx