What is the difference between “cheap” and “mis-priced”?

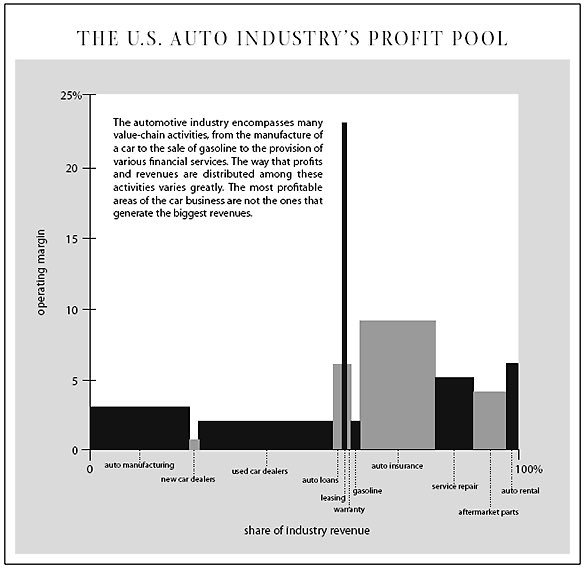

What is the difference between a great business, a good business and a bad business?

How can we evaluate company specific structural mis-pricings that exist?

How can we categorize investment opportunities to improve how we value and define them?

What are the commonly used valuation methodologies and which are most instructive for certain situations?

What is the most effective framework for modeling a business and what are the pitfalls?

How important is it and how do we factor this into valuation?

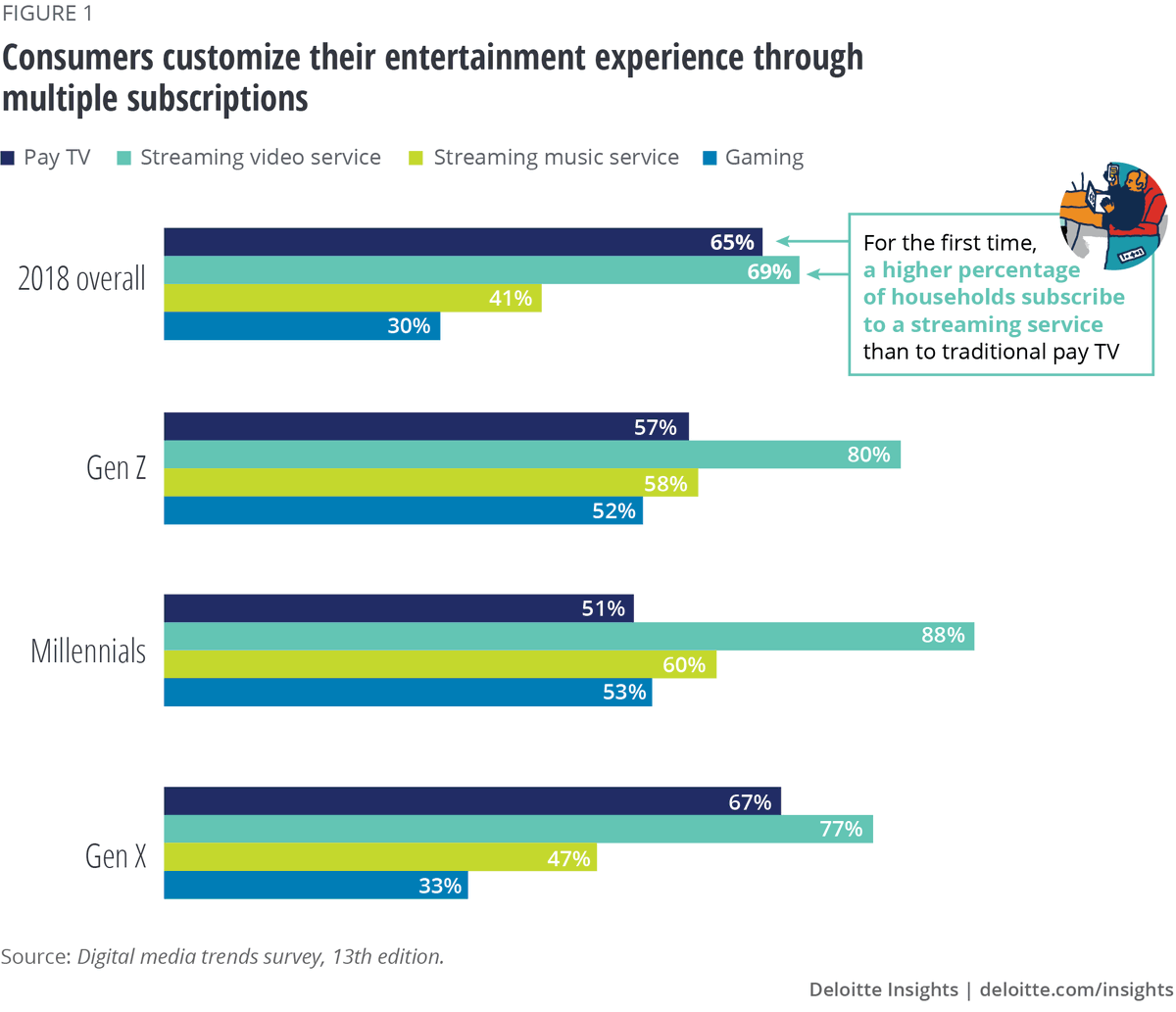

What top-down inputs are instructive for a security analyst?

What lessons have we learned from previous bubbles?

How do we evaluate secular headwinds or tailwinds for industries and businesses? www8.gsb.columbia.edu/courses/mba/20…