Illiquidity is viewed as a disadvantage, usually a one-sided argument from the "stock guys".

They work for a Wall Street shop, so naturally, they'll talk up whatever they know & discredit other ways of investing. However...

And you'll achieve those "unbelievable" returns with a whole lot less risk. Therefore, today I want to discuss just some of the benefits private assets offer.

Volatility is an opportunity for top traders only. It actually hinders performance for most investors.

This is what you want!

I'm not sure about you, but that is not a positive for me. Due to their illiquid & inefficient nature, private assets offer an illiquidity premium.

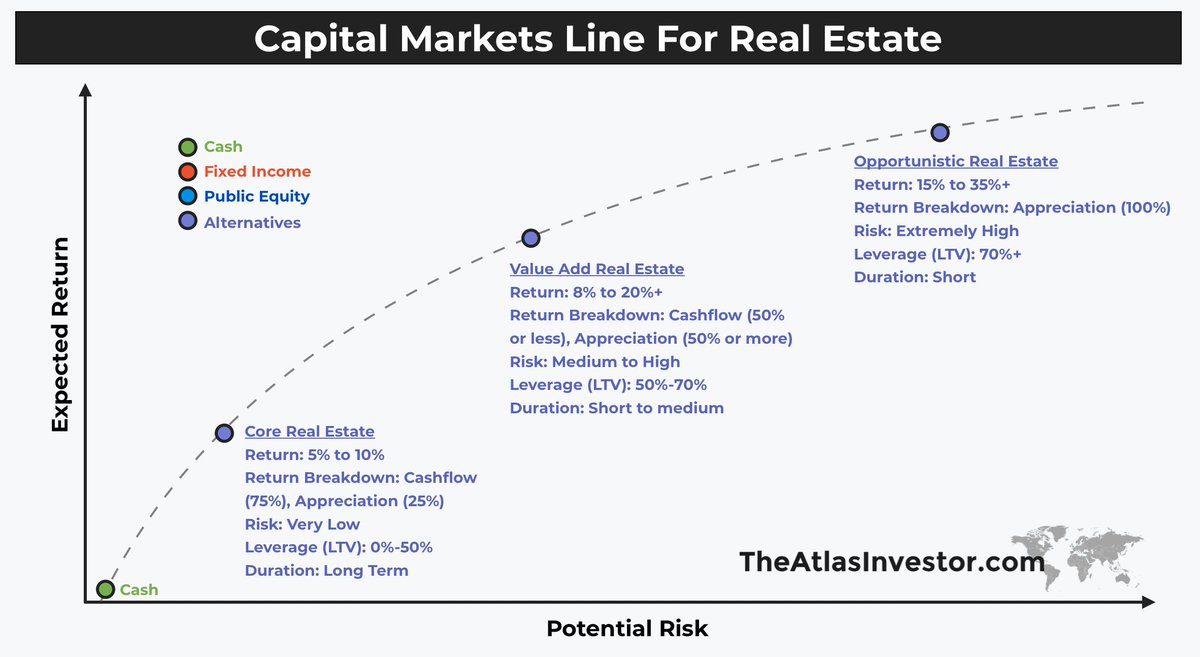

Those focused on private investments have a larger cost of entry, as well as the inability to exit so easily. Market forces have traditionally compensated investors with illiquidity premiums by giving a much higher return.

From my experience, a partnership of owners or families are usually focused on very long term profits.

Not on the next quarter's results (Wall Street nonsense).

Yes, it does. However, ask yourself what does the inability to exit so easily do for you?

Many smart investors, including Buffett, would actually argue it makes you a better investor!

“Only buy something that you'd be perfectly happy to hold if the market shut down for 10 years.” — W Buffett

“An investor should act as though he had a lifetime decision card with just 20 punches on it.” — W Buffett

Therefore, wise negotiators can squeeze a lot out of an asset price by just doing the talking.

Liquid real estate in central Manhattan or Western London means everyone knows everything. However, if...

At times, I've made returns which others don't believe are possible!

I completely agree!

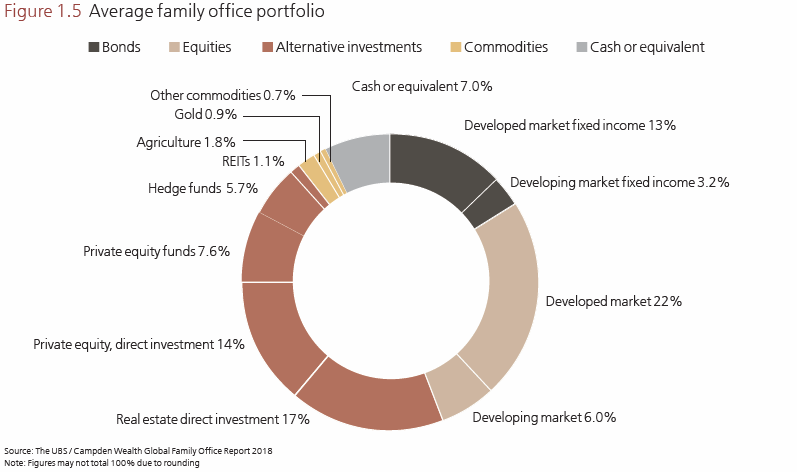

On the other hand, @UBS does a great study of global family offices (super wealth families), focusing on their asset allocation.

• 46% (half) of the portfolio is in illiquid assets

• public equity is 28%, private equity almost tied at 22%

• direct real estate exposure is higher than all bonds

• direct real estate is the 3rd largest asset exposure

I hope this thread has created a more open-minded perspective towards illiquid assets. In 2019 & 2020, it is easier than ever...

Unfortunately, just like their public counterparts, the majority of these "deals" are not very good.

Whether it's public company pick or private real estate opportunities — the deal selection will always be a key!

"Investment success doesn’t come from buying good things, but rather from buying things well.”

As I always say: focus on the business deal over a business cycle. Deal selection is the key!

This will be one of the ways investors will outperform index funds & balanced 60/40 portfolios in the coming years.

However, deal selection will be the key!