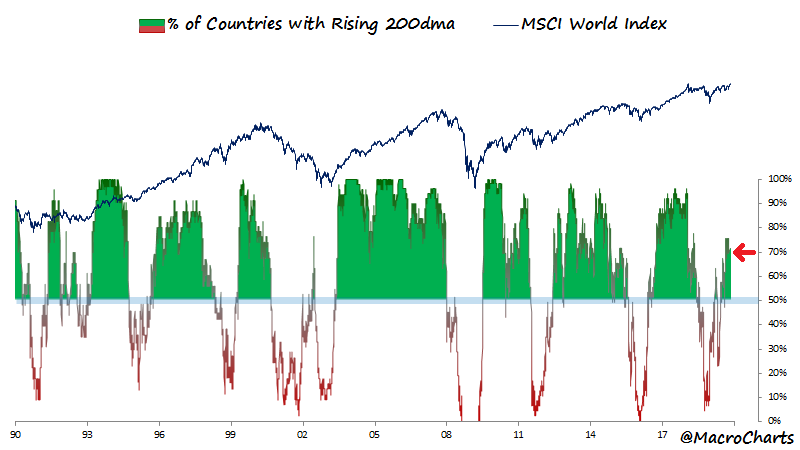

It's nice to see an expanding number of global indices that are entering an uptrend (have a rising 200 day MA). $VT $ACWI

Regards from #kualalumpur

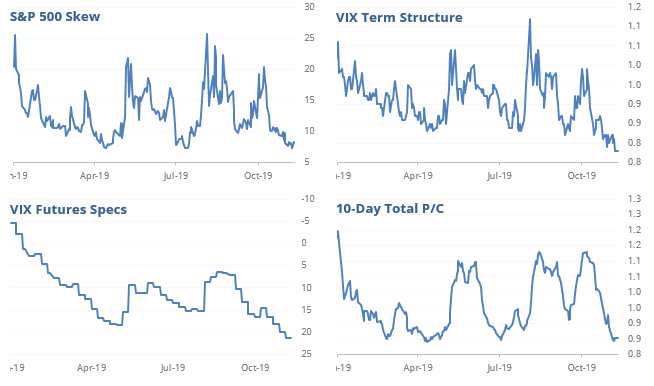

This indicator didn't work well in 2017, but I've followed @sentimentrader advice in both September 2018 and July 2019. Helped my drawdowns!

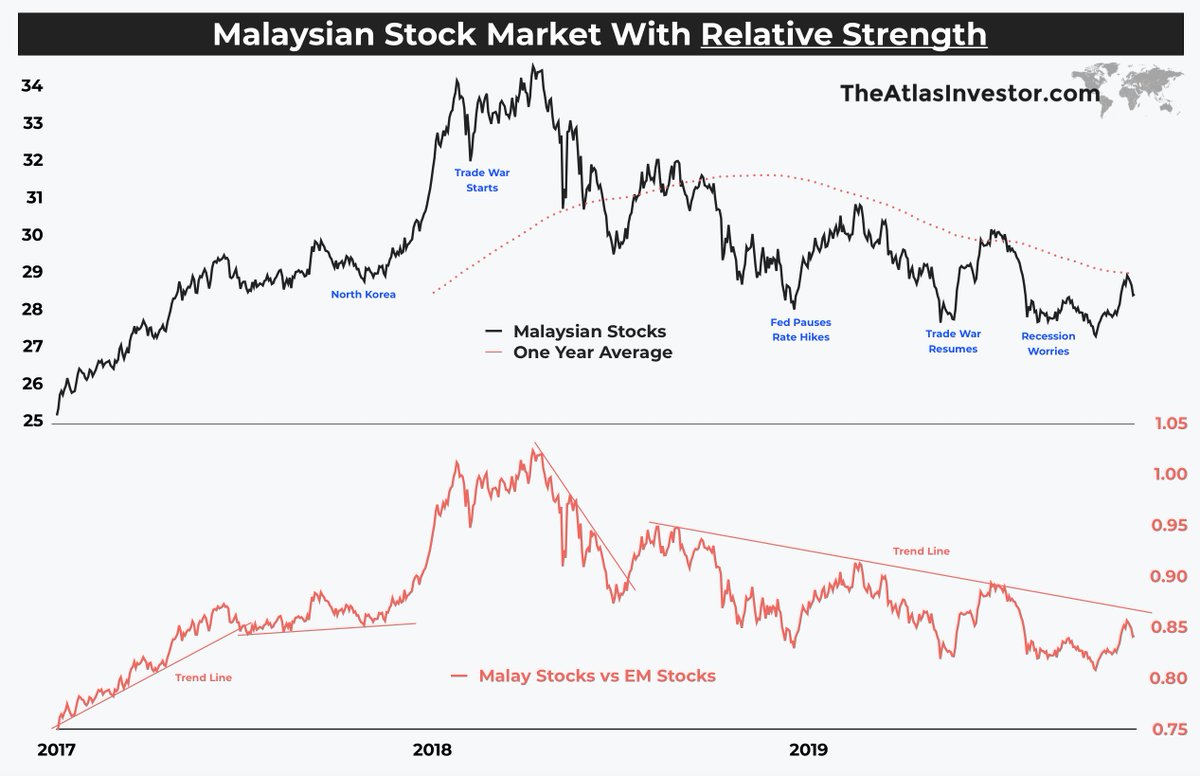

I'm writing this from KL, Malaysia where the stock market still remains below the 1-year moving average and failing to register any higher highs since April of 2018! $EWM