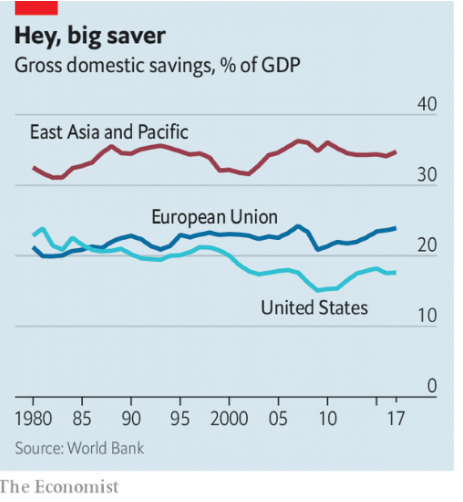

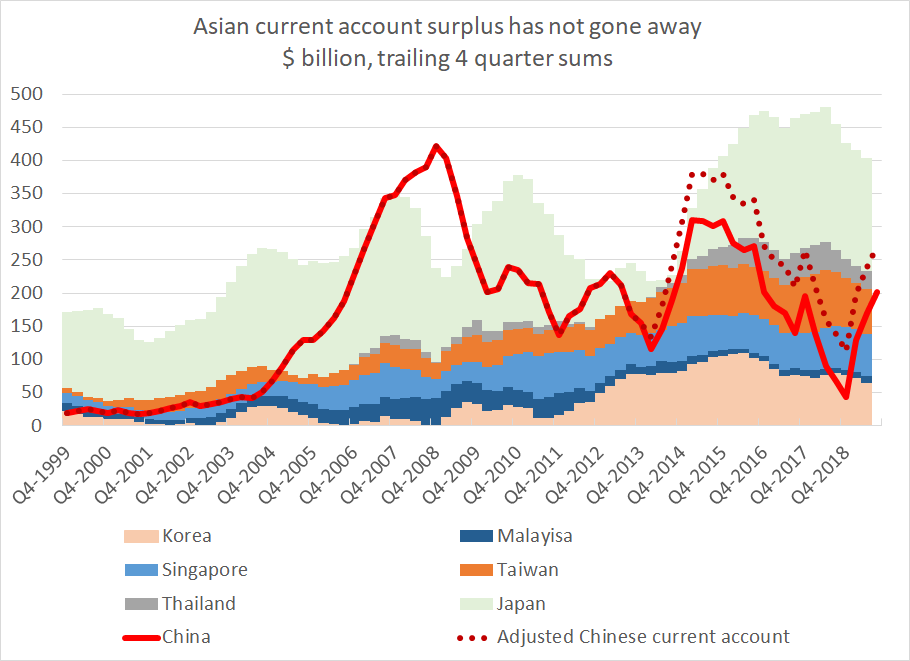

"Over the past five years East Asia’s current-account surplus has averaged about $525bn annually, a touch higher in cash terms than the average in the five years preceding the 2008 crisis."

1/x

economist.com/finance-and-ec…

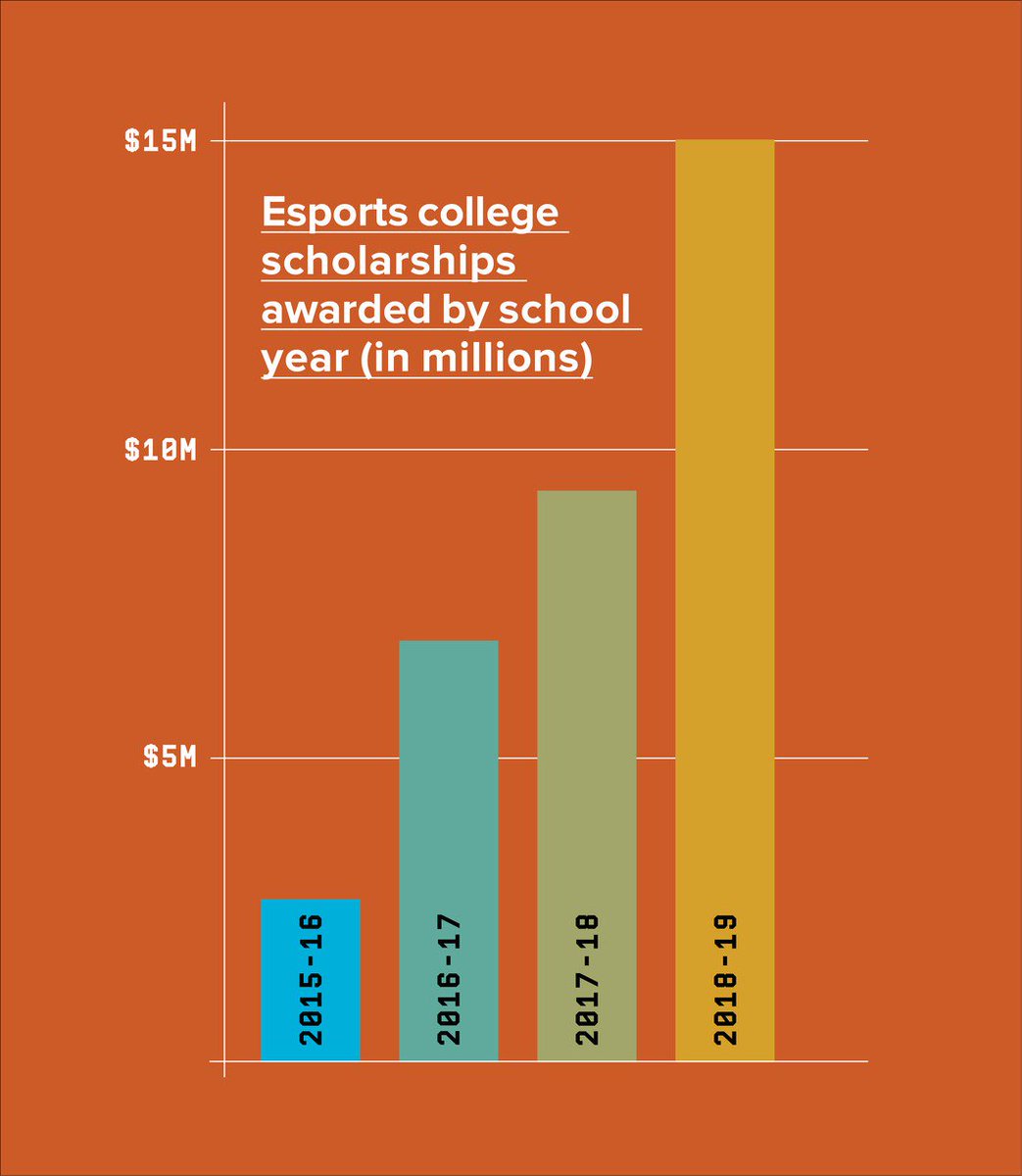

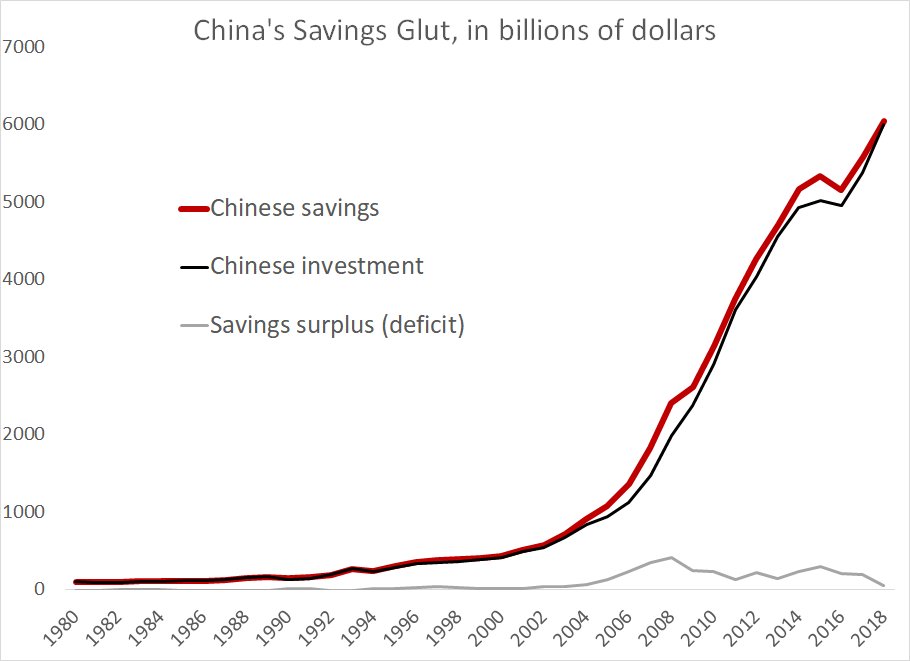

Drawing on World Bank numbers, they put regional savings in East Asia and the Pacific at around 35% of regional GDP (about where it was in the 1990s)

2/x

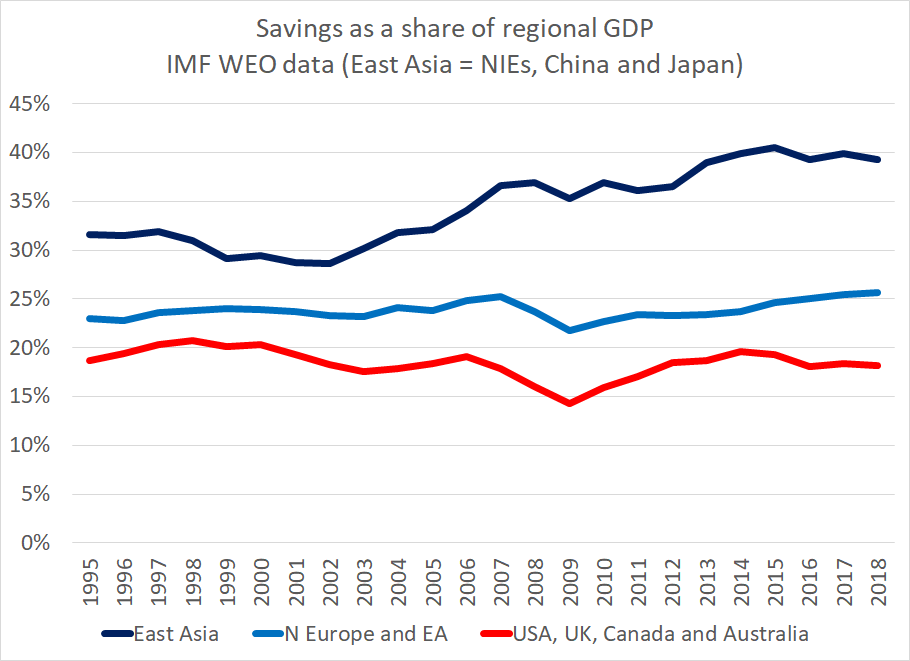

That group's savings is around 40% of their collective GDP -- as high as it has ever been

3/x

4/x

5/x

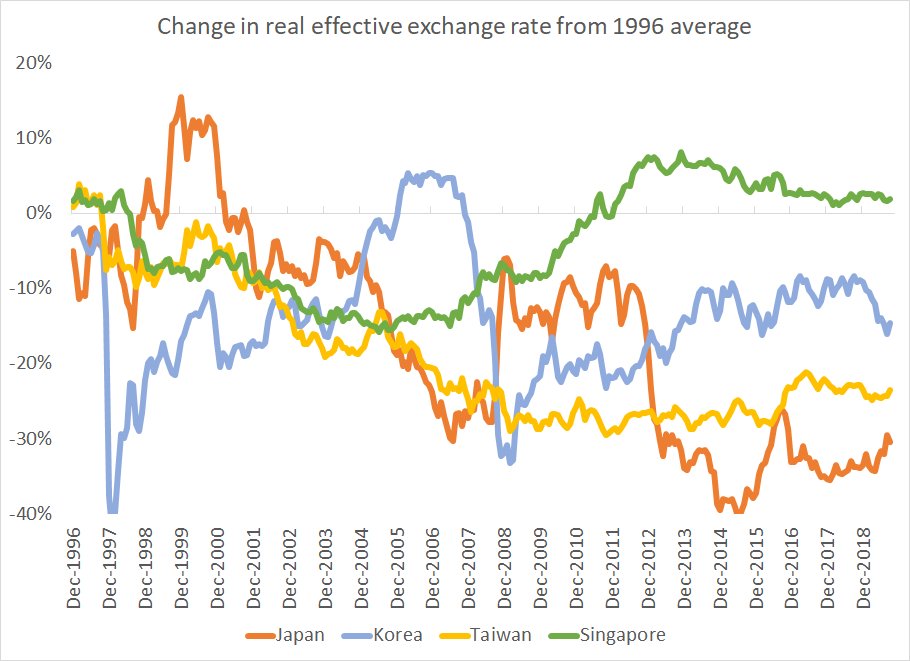

As 2010 is a generous starting point. Try going back to 1996 ...

6/x

7/x

"Some countries have also taken steps to make their role in currency markets more transparent"

8/x

9/x

10/x

(I should note that my central estimate of the size of their undisclosed swap book puts it at ~ 25% of their disclosed reserves. 40% of the upper bound)

10/10