"market value decline is an inevitable consequence of variability"

"market integration of wind and solar is impossible"

WRONG, WRONG & WRONG

THREAD! (1/infinity)

arxiv.org/abs/2002.05209

@flexibledragnet's pithy summary:

"VRE cannibalisation is a policy artefact, not a physical system constraint"

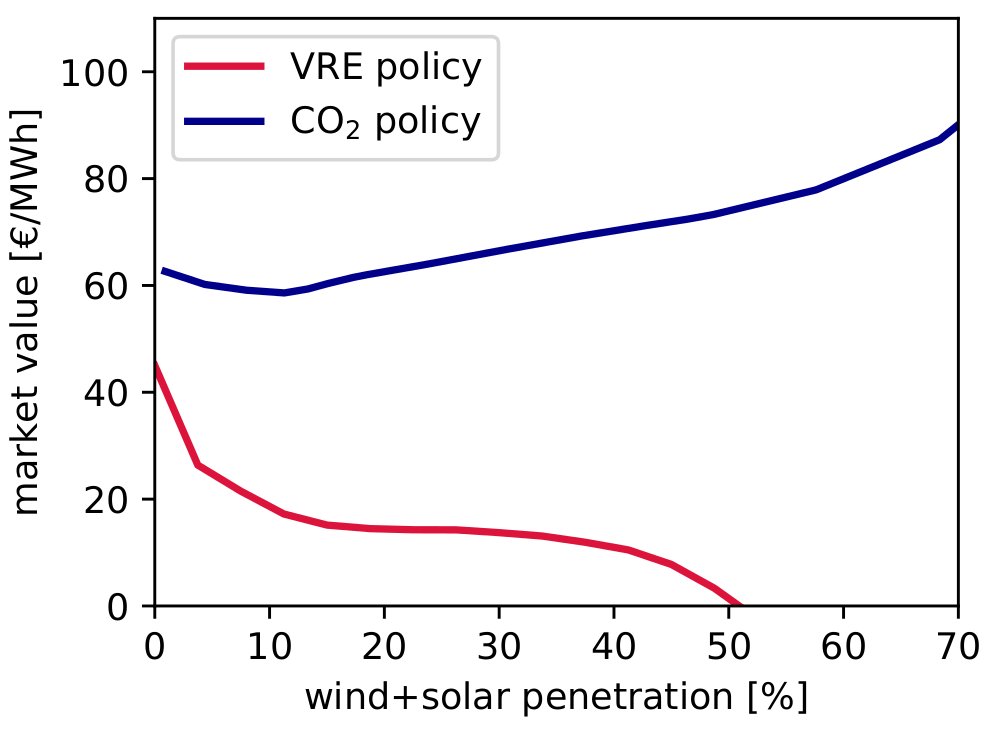

Some studies show that average revenues for wind and solar go down with rising share.

We show that the studies have an implicit assumption that variable renewable energy (VRE) are forced into the system, which depresses prices and their own market value (MV).

No surprises here, it's economics 101.

It can happen for wind and solar, but also for nuclear and coal. Nothing to do with variability (although it can affect rate).

Constraining VRE share forces prices and market value of VRE down; CO2 prices leave zero-profit for VRE intact.

You can also do both and get the best of both worlds.

If you like, sinking market value of wind and solar under a VRE subsidy regime is a consequence of not valuing the low-CO2-ness of wind and solar properly.

No.

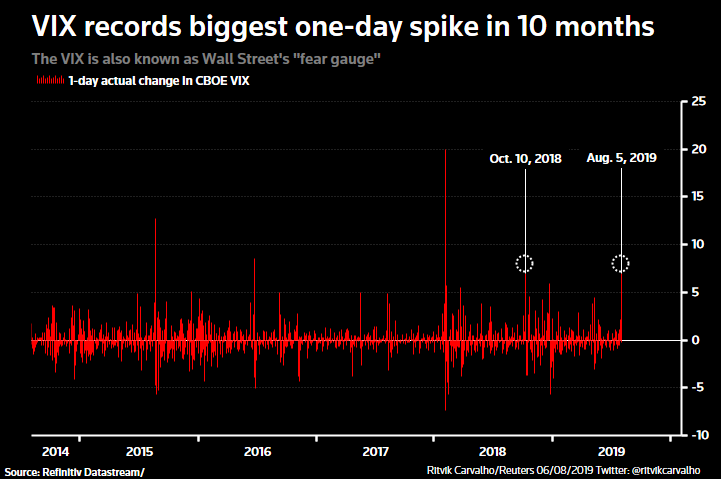

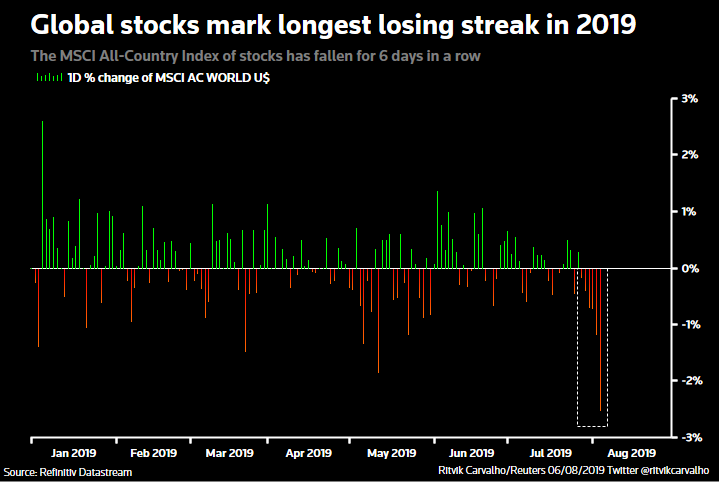

Declining market value is regularly used in the press and in the literature to exaggerate the integration challenges of wind and solar, see e.g. in NY Times

nytimes.com/2017/11/07/bus…

Our conclusion: market value depends too heavily on policy to be a reliable indicator of market integration. Like LCOE, it should be used with caution.

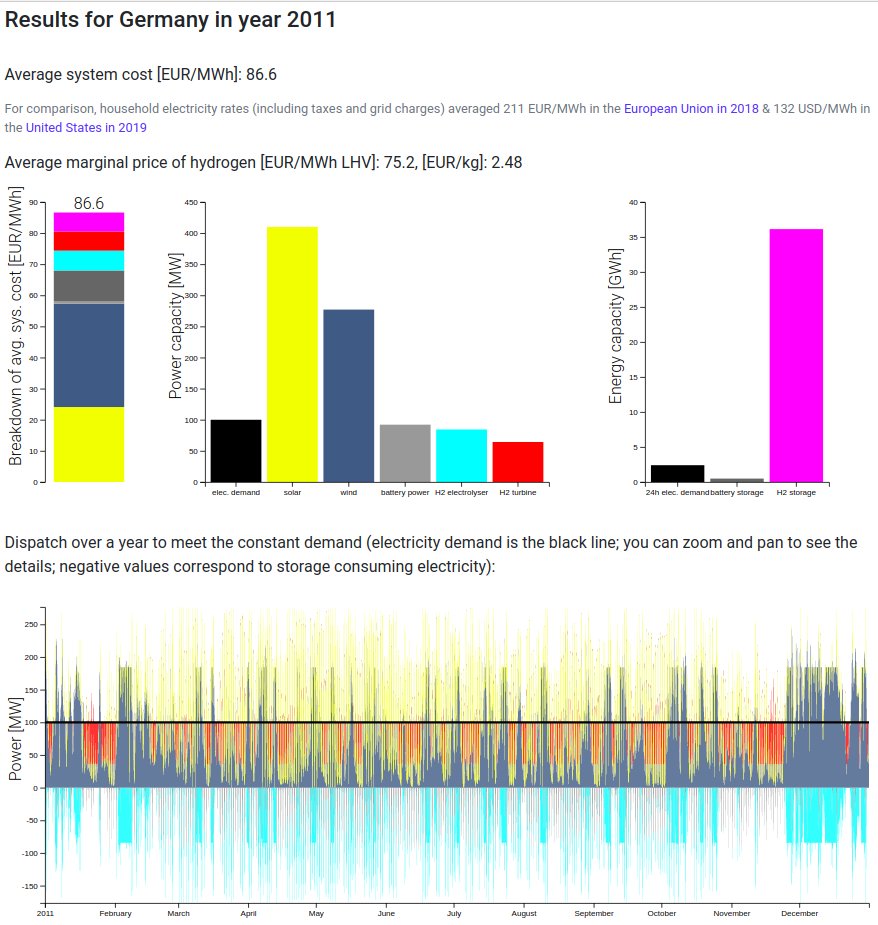

Instead, focus on the total system cost, which is what really matters.

What is market value?

It's the market revenue (sum of market price * generation at all times) averaged over each unit of generation. Measured in money per energy unit, e.g. €/MWh.

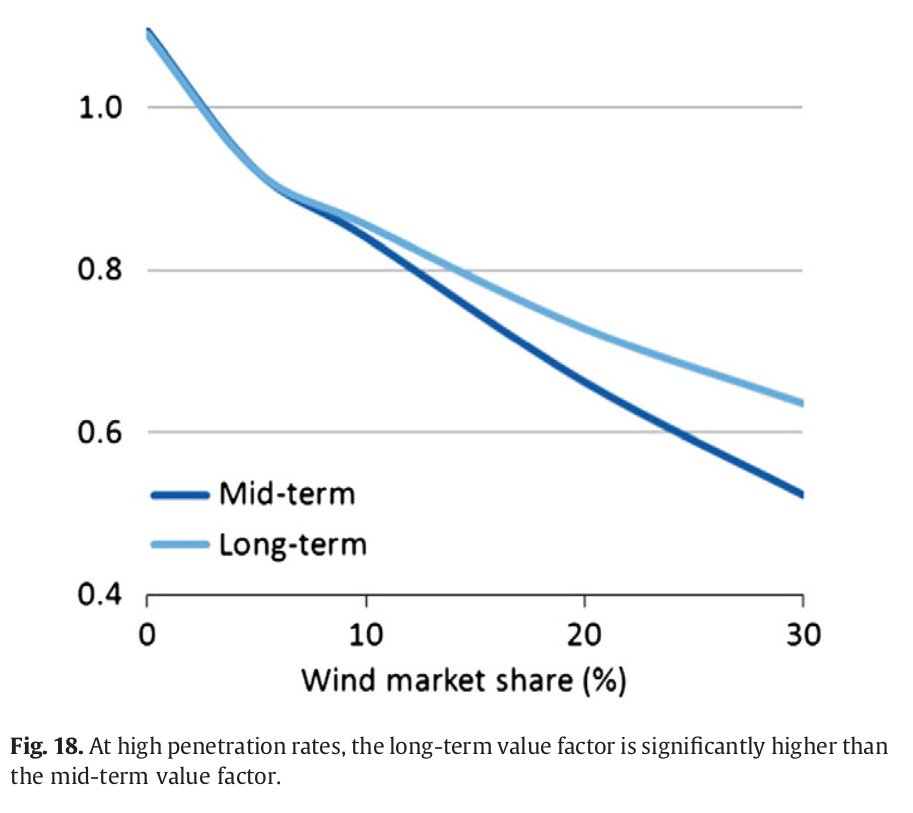

doi.org/10.1016/j.enec…

showed that in a variety of situations (real markets, short- and long-term equilibria), the market value of wind and solar declines when their share goes up.

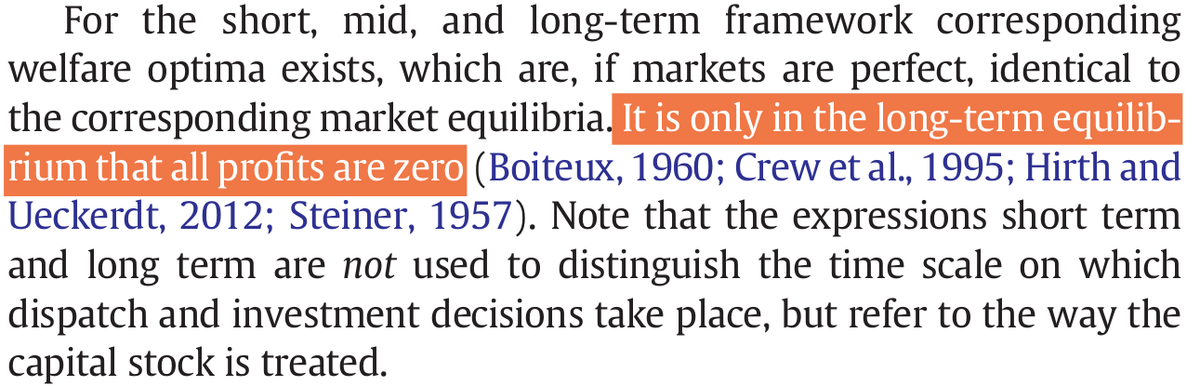

Now, when you hear "long-term", you should smell a rat.

If it makes too much profit, new entrants will outcompete it; if it makes a loss, it will leave the market.

en.wikipedia.org/wiki/Zero-prof…

The zero-profit condition is broken.

By what?

It turns out that to arrange a wind share higher than the equilibrium level for the simulations, a constraint on wind share has been introduced.

The fact that constraints can distort the zero-profit condition seems to be under-appreciated among modellers.

This is what is happening in these MV studies, and it borders on economic tautology: forcing a commodity into a market makes prices go down.

It's NOT an inherent fact about wind and solar, and applies to nuclear & coal too.

Not necessarily. Total system costs are stable; VRE subsidies lower investor risk & keep financing costs down. The costs of the subsidy can be passed to consumers.

Can we stop MV dropping?

Sure! Replacing the VRE subsidy with a CO2 price or budget will do it.

Let's refocus the debate on the system cost of low-CO2 systems and stop fretting about market value.

Market value is an artefact of policy choices.

/End