So we add the known constant u[x(t)] to δu, and that indeed leaves us with u[x(t+δt)].

But why are we allowed to do that?

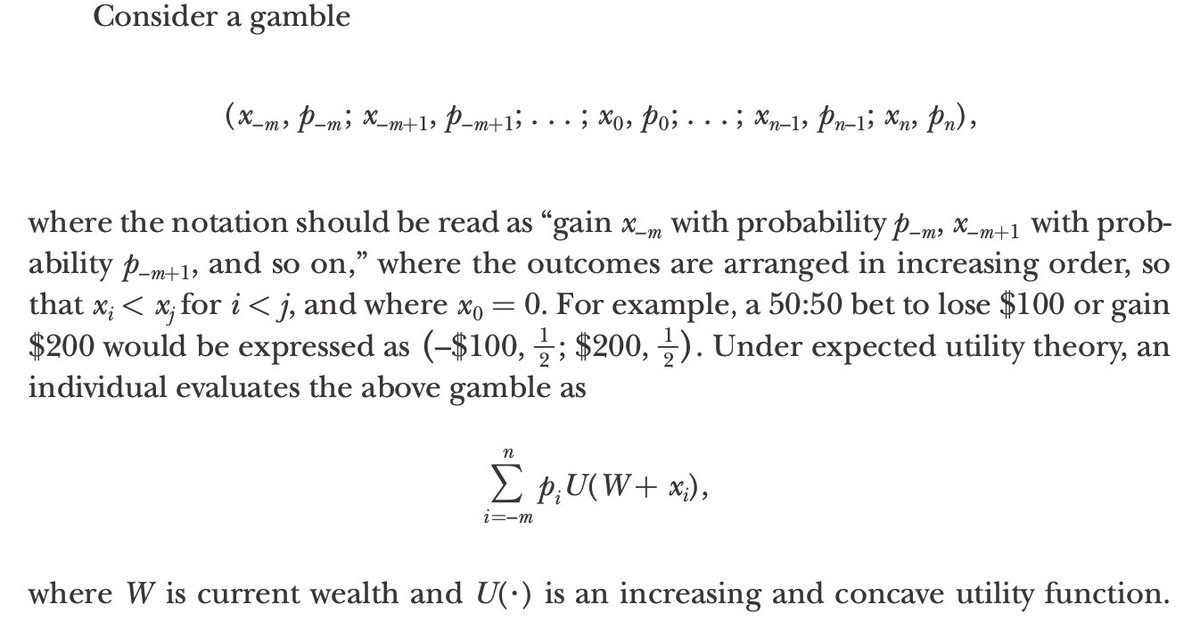

E(δu) > E(δu’)

for utilities u for one gamble and utilities u’ for another gamble.

But u(δx) is ill-defined without specifying x.

Descriptions of prospect theory often wrongly say that EUT has no reference-level dependence.

An improved EUT decision criterion would be

E(δu)/δt.

If u(x) is chosen so that it grows additively over time (unlike x itself), then it is an ergodicity transformation, and E(δu)/δt is the properly defined time-average growth rate of wealth.

Yes, of wealth itself!

Without:

utility function

discounting function

probability weighting function

subjective perception of time

value function

moving kinks for losses and gains

…

It’s both fascinating and deeply disturbing to stumble upon such a complete foundational re-imagining of a centuries-old field of formal human inquiry.