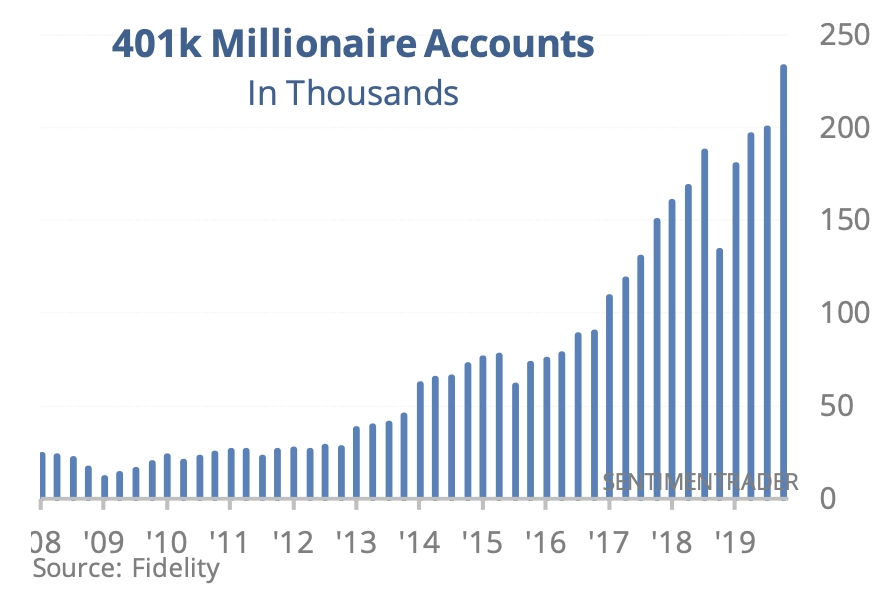

The stock market CAGR is a gross return while the mezzanine debt investments I'm discussing are a net, after-tax, return.

Side by side the gross returns were 12% vs 18.7% CAGR. Never mind — let's go with it anyway.

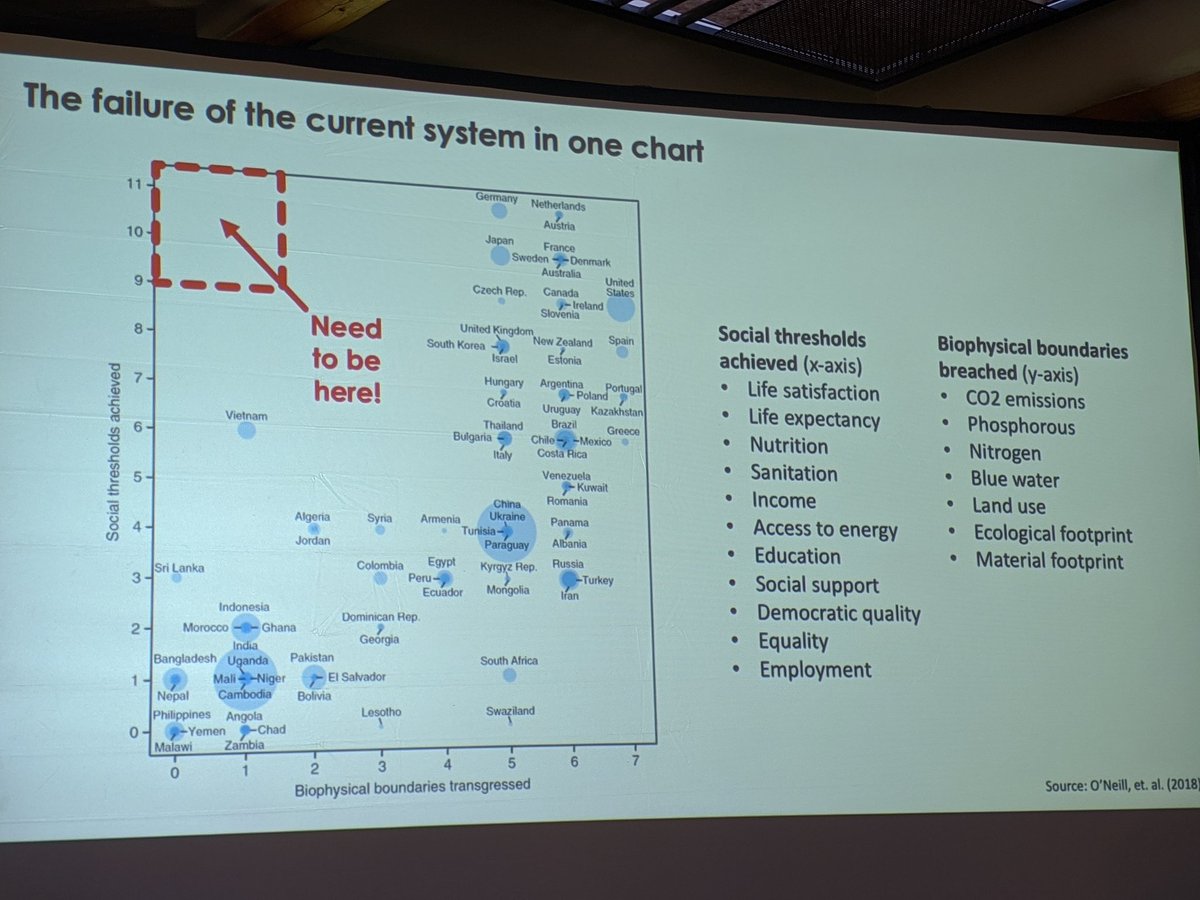

While the global stock market performed well in 2019, in hindsight, it could have very easily played out another way.

After all, before the Fed's monetary policy pivot, it was looking like 2019 was a bear market year.

While we weren't extremely bearish — like many others — we understood that money can still be made if invested wisely and with proper protection.

Now, if the stock market declined by -20%, as it did in the last quarter of 2018 or the way growth stocks came...

Of course, one might panic & crystalize the loss or stay hopeful the price will make a comeback. That is beside the point.

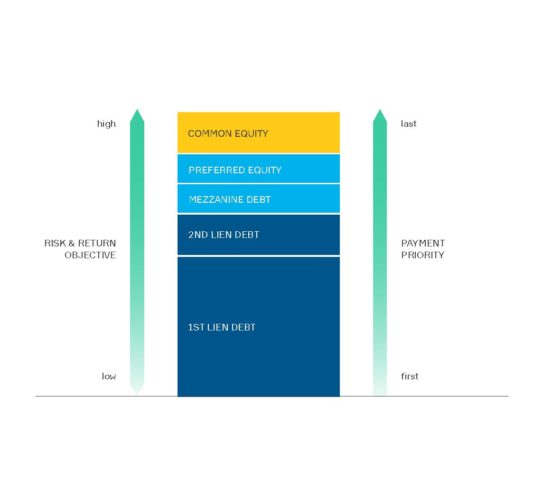

The point is: there is no downside protection owning stock, share or equity in any asset class.

One has to ask, how do you continue performing as the recession risks rise?

We all have different strategies.

As the old saying goes, you can't have your cake and eat it too.

This investment cycle is now approaching 11 years in the US, so we are overdue for a recession.

Some of the asset-backed senior debt deals we are now entering have very strong downside protections -40% to -50% & potential returns of 7-11% p.a.

Until recently, our portfolio also...

Recent disclosure right here: