bloomberg.com/opinion/articl…

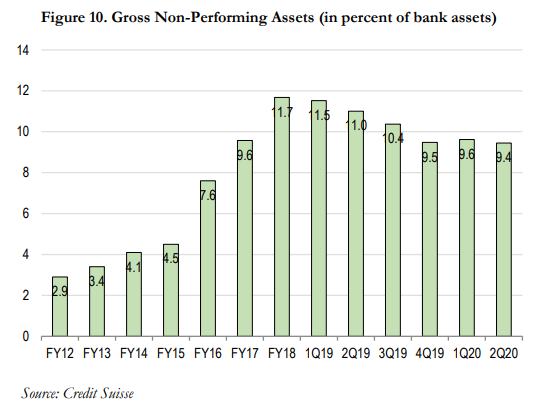

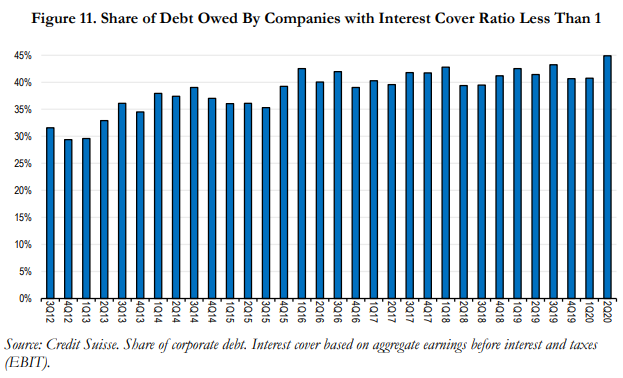

@arvindsubraman and Josh Felman have a new paper in which they say the big problem is a wave of bad real estate loans clogging up bank balance sheets (sound familiar?).

hks.harvard.edu/sites/default/…

An easy way to do this would be QE. Have the central bank print money and buy housing-backed loans from banks. Of course, India's inflation is already rising, so this could risk stagflation...

In the meantime, India could make a big push to encourage more urbanization.

Agricultural productivity would go up. Wages would go up. And banks would have a new boom to encourage them to lend.

Bailing out the banks and pushing for urbanization are two policies that are worth a shot.

(end)

bloomberg.com/opinion/articl…