@verdadcap has kindly shared a timely serving of #FoodForThought on #Crisis #Investing - Go grab a serving here: mailchi.mp/verdadcap/cris… It holds general & specific ideas 2 consider but the summarisations of past crisis are perhaps the most illuminating..a few takeaways..(1/10)

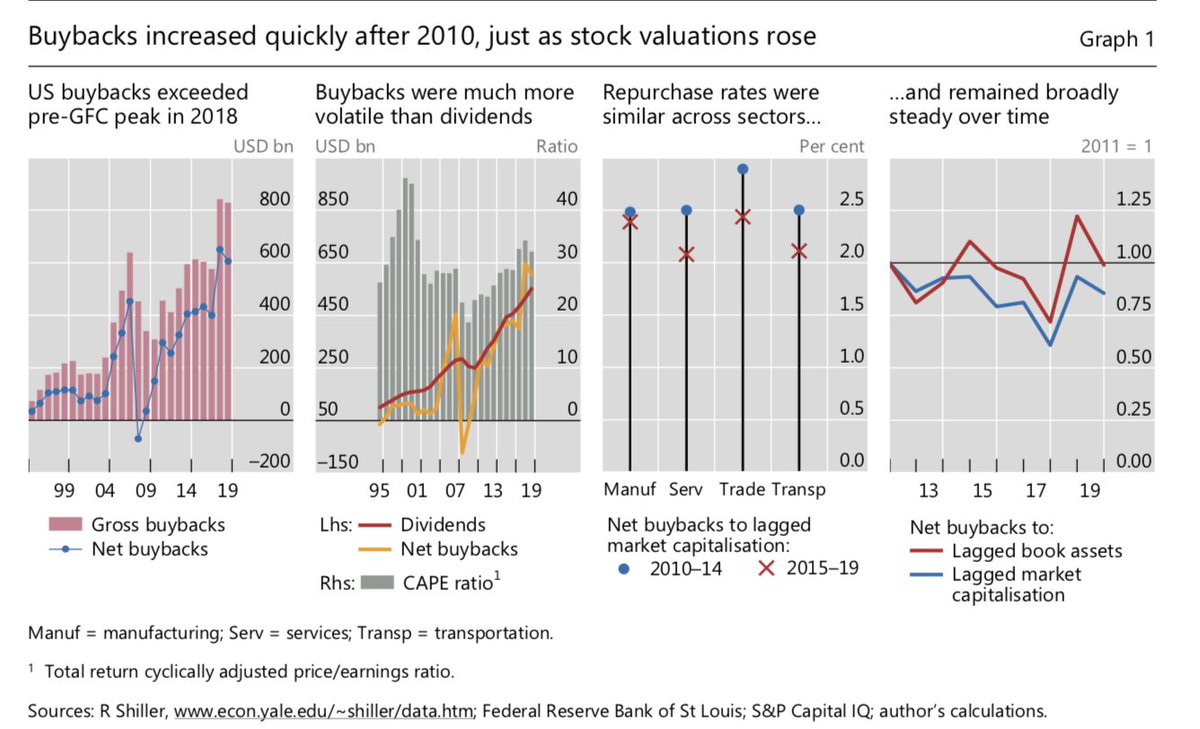

2/10 So where do you deploy funds in a time of #crisis? #Investing with those super connected #PE guys with long time horizons wld appear optimal but they tend to do their buying to the sound of violins when credit is cheap & plentiful...

3/10 #Investing in a #Crisis - the best opportunities may be unearthed in listed mid-size companies with solid 'boring' businesses tht has remained somewhat unloved in the euphoria in the good times...

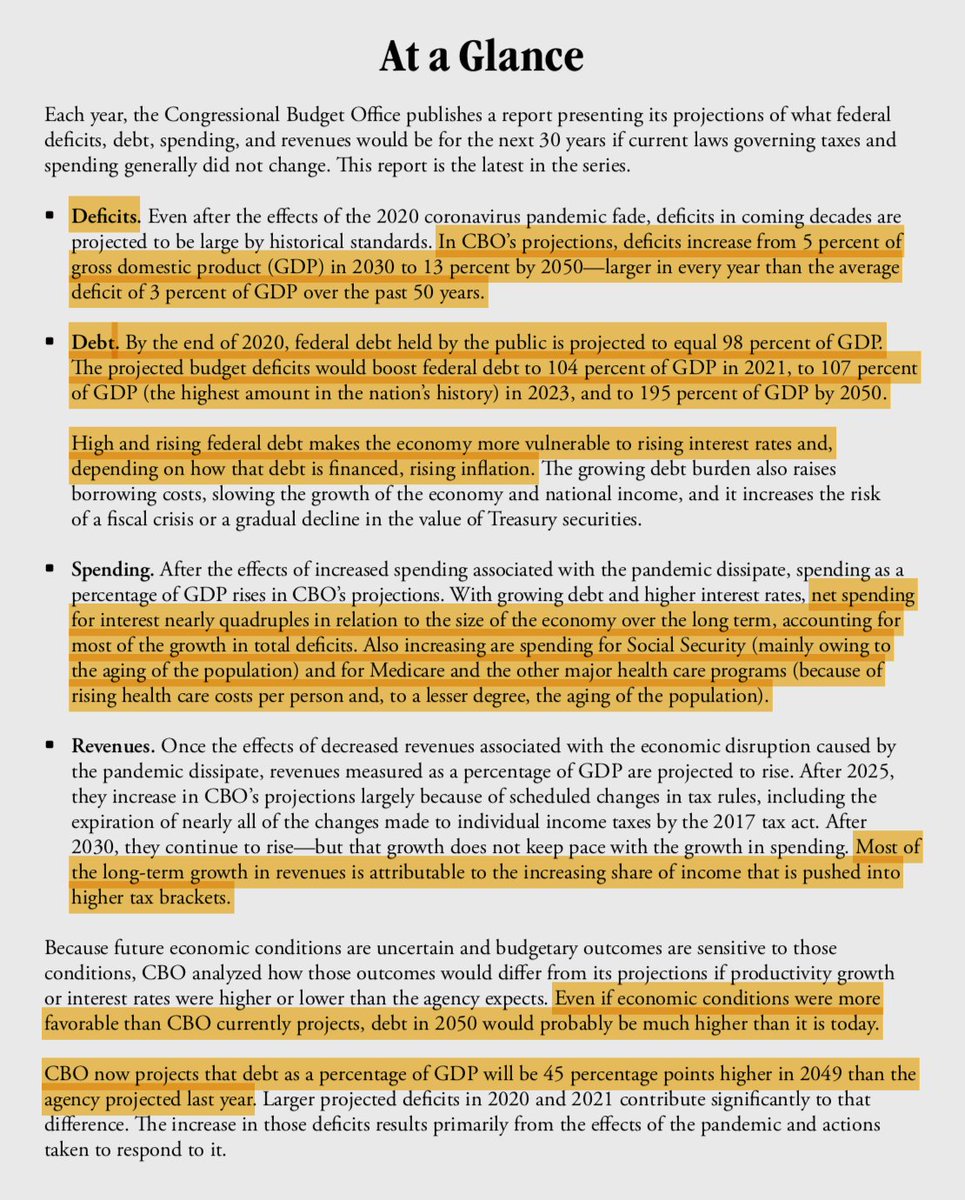

4/10 #Crisis #Investing requires confidence & cash..As 2 the saying; "Liquidity is a coward, it's never around when you really need it." Rational confidence comes from having done the work & being prepared..As @verdadcap states; "Fortuna eruditis favet."

5/10 #Crisis #Investing - A look at #FixedIncome, Remember: "The defining feature of high yield, decreasing incremental returns to #risk, still exists in a crisis. The tipping point is just pushed further down the ratings spectrum."

6/10 A voyage through the major financial #crisis since 1970 should help refresh the mind after an intoxicating decade of 'good times'...Here a taste of 'uber #Stagflation'...Yes stock markets can drop 50% in times of double digit inflation...

7/10 The journey continues...Welcome to 1986 when the real value of #Oil fell 80% in less than a year and #Texas and #Mexico hit the wall...#Crisis #Investing

8/10 The #Crisis exploration continues...2000 the wheels came off the #Tech driven orgy and the longest expansion the market had ever seen (then) came to an abrupt end..."The tech sector lost nearly $1.8trln in market value between March & Sept...

9/10 A #Crisis voyage - Next stop: Northern Rock and the pain of 2007...when the #US stock market fell 777 points in a day and 8.7mln US jobs were lost...

10/10 Last but not least, some European flavour...#Crisis #Investing....Lessons from a time not so long ago...

• • •

Missing some Tweet in this thread? You can try to

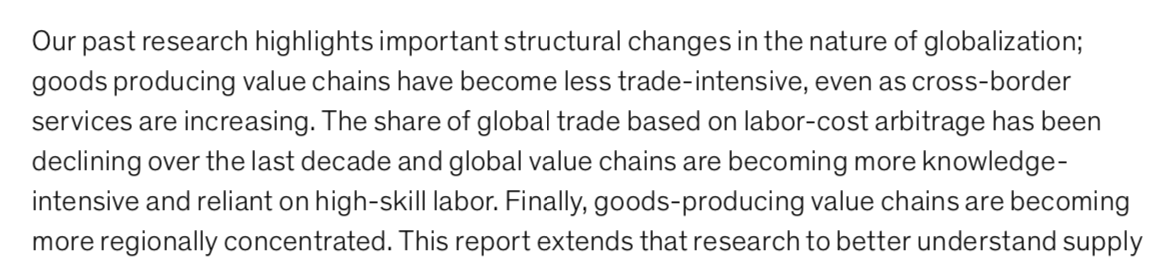

force a refresh