The @BIS_org has dropped their 'Quarterly Review' bis.org/publ/qtrpdf/r_… for 2/3rds of it they have gone #CryptoNerd w. deep dives on #payments, #tokenization & Central Bank #DigitalCurrencies but it does hold plenty of other interesting #insights as well...some takeaways (1/11)

2/11 A look @ #PE, the state of #US public markets & murky #PrivateCredit dynamics..Co's increasingly avoiding the relative 'daylight' of public markets & #PE driving #IPOs as they take the #Exit..PE crew has been minting it in increasingly covenant lite private credit markets..

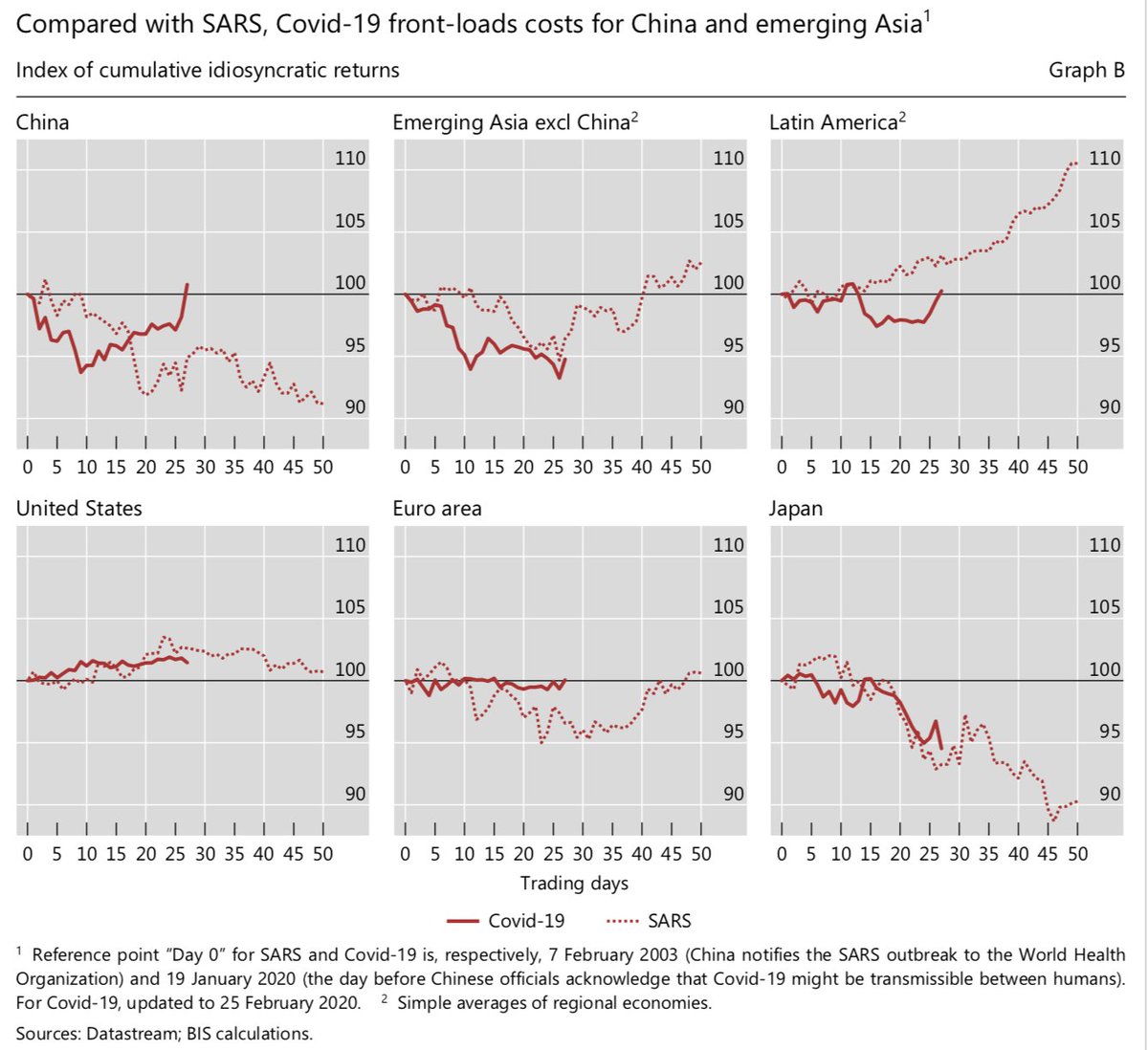

3/11 #VirusMarketWatch: Comparing front-load costs in key equity markets between Covid-19 & SARS....

4/11 A look at #Innovation in securities markets as #Tokenization crew takes aim at the "estimated $17-24bln spent annually on trade processing"...#Technology #Securities

5/11 A look at Central Bank controlled #DigitalCurrencies through BIS tinted glasses...The promise, the elements of "decentralisation" & overview of current retail #CBDC projects globally...#GlobalTrends

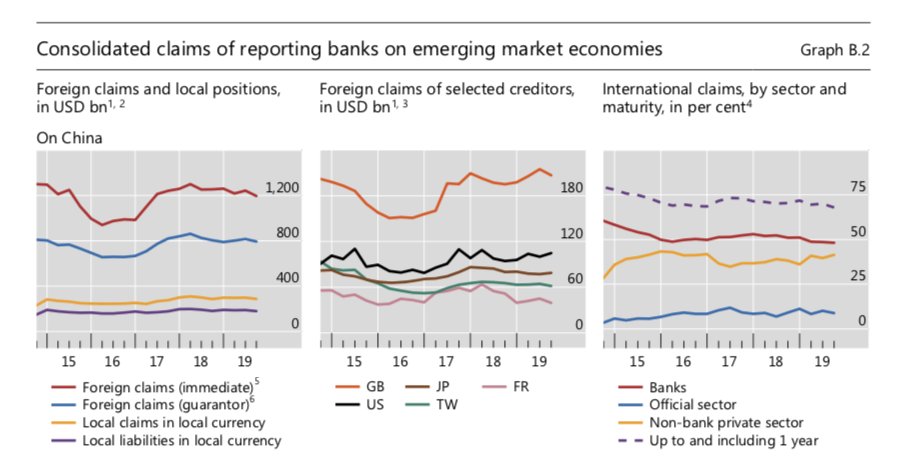

6/11 Overview of 'consolidated claims of reporting banks on #China'...at $1.2trln Foreign claims appear manageable & the #UK banks/investors appear to carry most of it...#EMs #Risks

8/11 Overview of global #liquidity indicators - #USD denominated credit outside the #US...#GlobalTrends

9/11 Overview of 'Global bank #credit to the non-financial sector by residence of borrower..' (Banks cross-border credit + local credit in all currencies) #EMs inc. #China is elevated but appears to be mainly a local situation with only a sliver of cross-border loans...

10/11 Overview of downward trend in #USD denominated credit to non-banks outside the #US & overview of 'foreign currency credit to non-banks in #EMs...

11/11 Overview of 'total #credit to the government sector at market value (core debt % to GDP)...#Italy & #UK the outliers in #Europe & #Japan the undisputed leader...#GlobalTrends

• • •

Missing some Tweet in this thread? You can try to

force a refresh