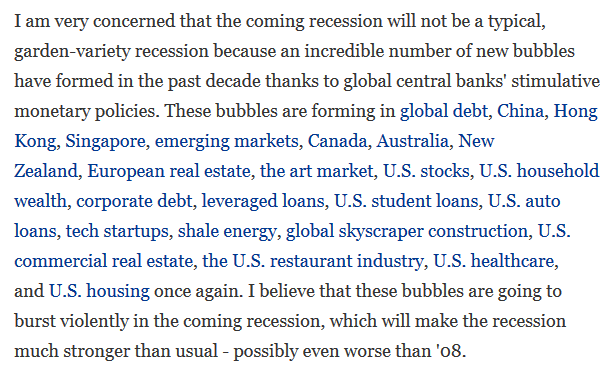

China, Hong Kong, tech startups, shale are absolutely imploding. The others are next.

I wrote this warning in June 2019, pre-coronavirus: forbes.com/sites/jessecol…

Now, a recession is basically guaranteed because this oil plunge is going to burst the shale energy bubble that was such an important driver of U.S. economic growth & job creation. Disaster.

I tried warning - I warned my heart out.

Everyone thought I was crazy and attacked me and ignored me...and now what I warned about is coming true and is just getting started!

Listen, people!!!

The bubbles were always slated to implode one way or another.

Coronavirus is just the trigger. If it wasn't coronavirus, it would be something else.

Don't get distracted by coronavirus - focus on the core, which is bubbles.

It provides the perfect excuse and cover for them so that people don't blame them for the economic crash that is due to the bursting of the bubbles that they've created.

Brilliant!

Everyone who dismissed and downplayed those recession warnings is an abject fool and did a tremendous disservice to society.

Well, it's happening!

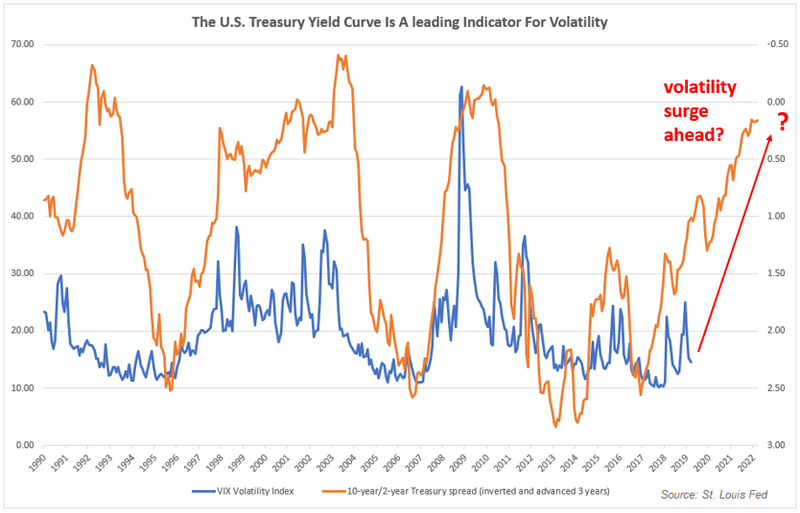

$VIX $VXX