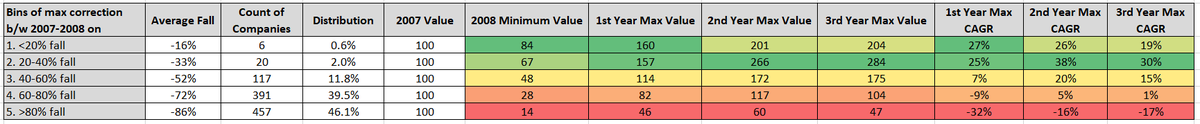

1. Data quality is not ensured though all the data cleaning has been done and >95% accuracy could be expected

2. Please understand that this is generalization n there could be outliers in each bucket

3. This is excluding dividends, not worth time

1. Yes, what goes down the max is what recovers the minimum on 1,2,3 year basis

2. What goes down the minimum, really stands out, however, this minimum draw down could also be up to 40%. There were only 6/1000 companies which fell <20%, that is 0.6%. How many

portfolios have that kind of visionary stand.

3. However, what is soothing is , the next bucket of 20-40% generates maximum amount of return in next 1,2,3 years. However, this bucket had also only 20 companies which is 2%. So, only 2.6% companies fell <40% 😀

4. More than 46% companies, almost half fell more than 80% and then could never recovered with -17% 4 year CAGR. Who said money making is easy? 😁

5. The 40-60% bucket had 15% return which is still decent but this too is 12% of universe. So, even if you stuck to 15% of

population, then, you could get >15% return

6. If you were not a part of this top 15% of stocks universe and held a stock at peak of 2007, then, your next 4 year CAGR was between -17% to 1% on a generalized basis. This means 85% of stocks, You did not make any money in 4 yrs

7. This highlights 2 things - Importance of stock selection and importance of sell or buying on dips if could not sell

Again, this is a generalized analysis at basket level. There could always be outliers, however, enough to chew, think and ponder.

Thanks,

Saurabh