That's what it did last night by giving ACCESS of cheap USD liquidity to RBA

*Swaps involve 2 transactions - a foreign central bank (CB) sells domestic FX (RBA selling AUD) to get USD

*The foreign CB has to buy back the AUD at a future date at the same FX😎

*Foreign CB decides who gets access & collateral accept.

*Foreign CB has to pay back USD & carry the credit risk of domestic lending of USD!

*Foreign CB pays the Fed back the USD w/ interests on the USD borrowed that is usually = to the amt the CB earned on USD lending operations

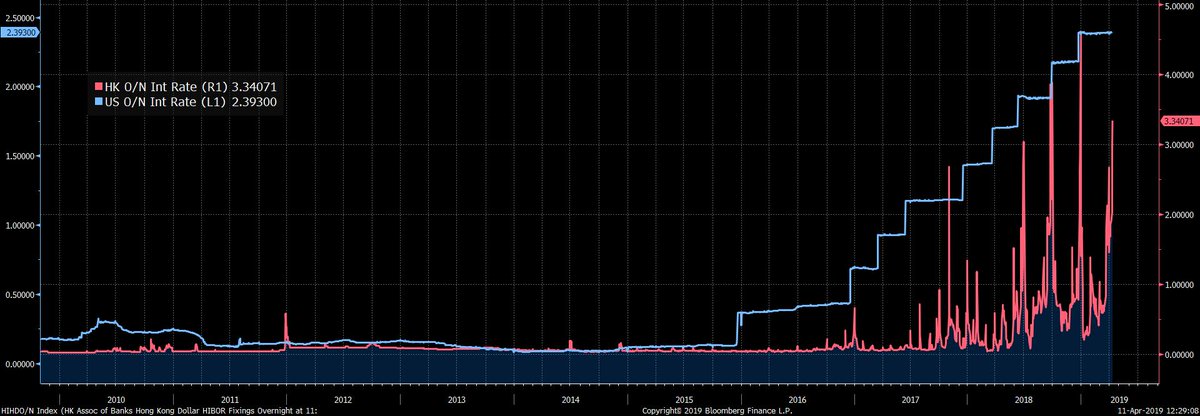

B/c of the role of the dollar in global finance, the Fed's lender of last resort.

Some people asked will the USD liquidity be completely solved by this? No

Fed is a de facto global CB & should lend!

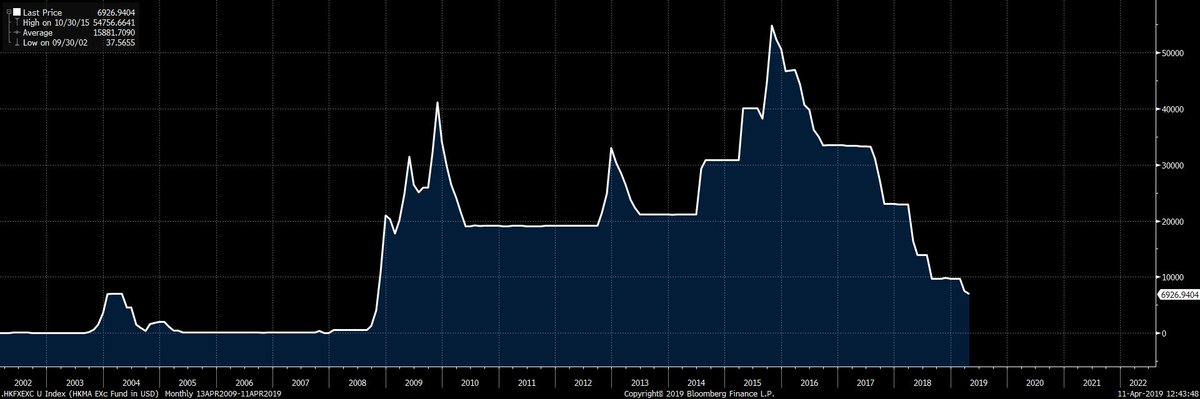

How swap lines work & what the Fed did during GFC:

newyorkfed.org/medialibrary/m…

My op ed to explain what happens to global balance sheets: ft.com/content/37f0e8…

My research on Asia USD. DM if u want access.

a) Too much leverage in the system, which means deleveraging coming

b) Role of the USD means the Fed has to act like lender of last resort

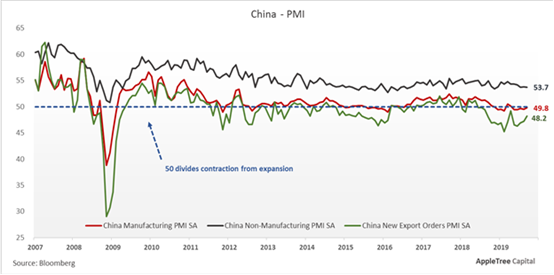

On the income side (merchandise trade, tourism, remittances) also down but!

Capital =Indonesia worst

Income =Malaysia worst

Finally, if u look at how wide is the exit door (depth of markets), well, ASEAN bad, esp Malaysia, Vietnam, the Philippines.

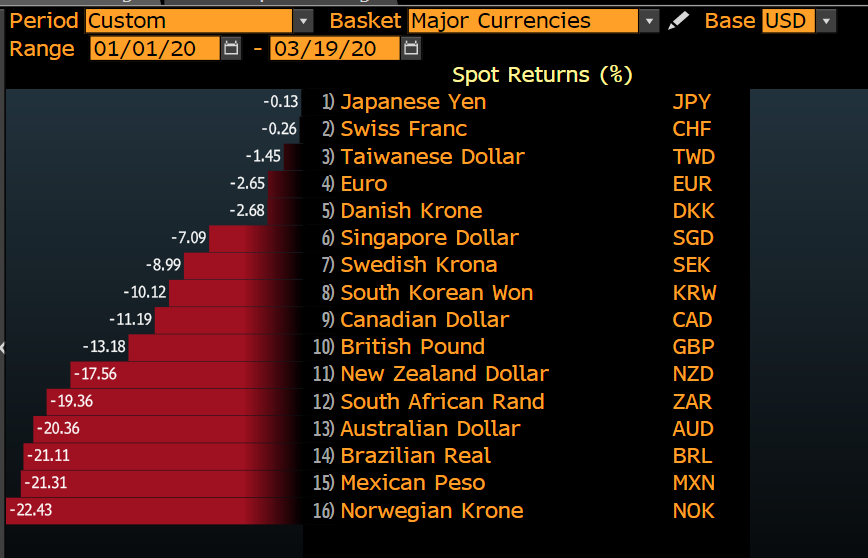

Now u see why people want dollar

Now u know why EM Asia needs swap lines🙇🏻♀️🙇🏻♀️🙇🏻♀️