Covid-19 has created a proverbial 'perfect storm'. While we are fighting an unprecedented medical crisis, the after-effects of this pandemic will have far-reaching implications.

A #thread on a commonly heard legal term - #ForceMajeure and its' business ramifications

👇

Have divided the thread in three parts:

a) Concept & genesis (4-6) – One may skip to b) if aware/ not keen

b) Facts & current developments across industries (7-17)

c) Inference & future implications (18-25)

Note: Not an expert on legal matters and sharing basis my reading

For events to constitute Force Majeure, they must be “unforeseeable”, “external to the parties” of the contract and “unavoidable”.

Indian Contract Act, 1872, the governing law, is SILENT on the term (but mentions 'impossible act'). Absence here does not mean it is implied.

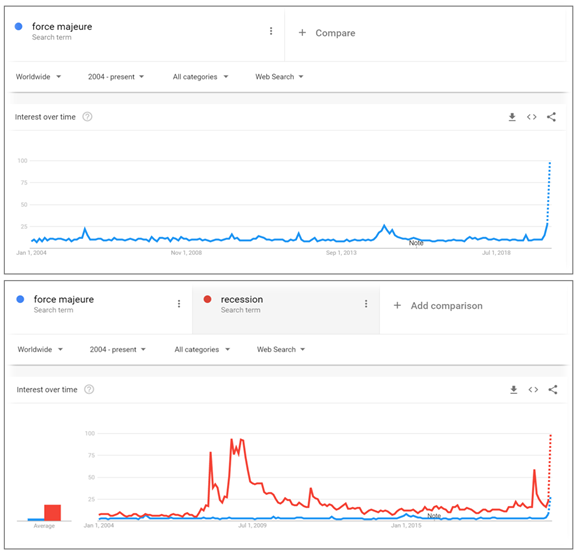

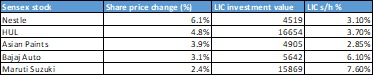

The lockdown & uncertainty of economic recovery has led to a cash crunch and resulted in widespread invocation of the Force Majeure clause (FMC) across industries, especially those with large share of fixed expenses.

economictimes.indiatimes.com/markets/stocks…

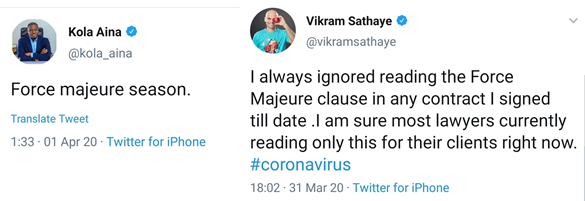

And the noise is getting louder:

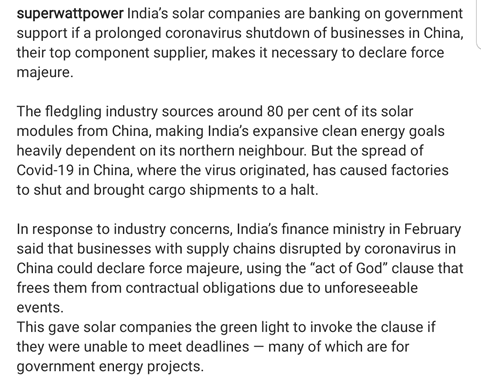

Industry wise developments in India:

A.MULTIPLEXES:

Both PVR and Inox (+others) have invoked ‘act of god’ & decided not to pay rent (during lockdown) to mall owners. Rental ranges b/w 15-20% of revenues & is the largest fixed cost (~45%).

Read: economictimes.indiatimes.com/industry/media…

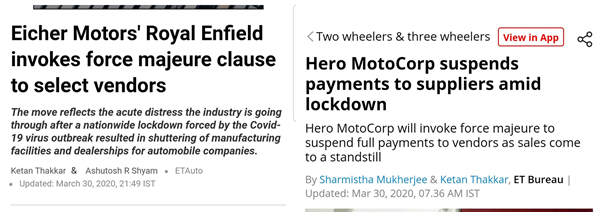

B.AUTOMOTIVE OEMs:

Eicher Motors has invoked FMC to select vendors, Hero Motocorp has suspended payments to suppliers, so has Volvo. We can expect to hear more in coming days.

Allied reading: livemint.com/news/india/cri…

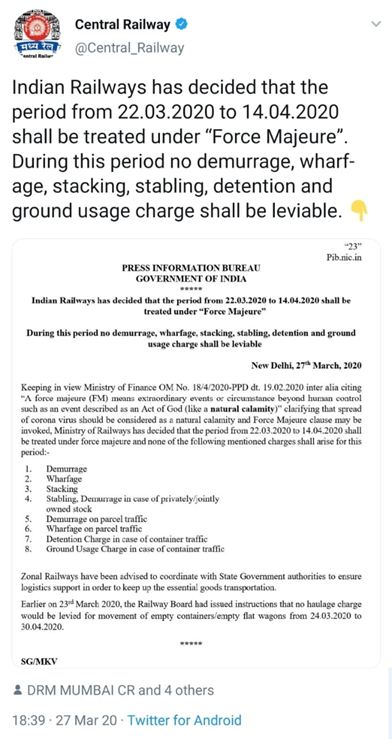

C.PORTS and LOGISTICS:

7-8 ports (Krishnapatnam, Dhamra + Mundra (Adani Ports), Tuna, Gopalpur, Karaikal & Gangavaram) have declared FMC. The Ministry of Shipping has directed all ports to not levy penalties on port users for delay.

Good read: maritime-executive.com/article/india-…

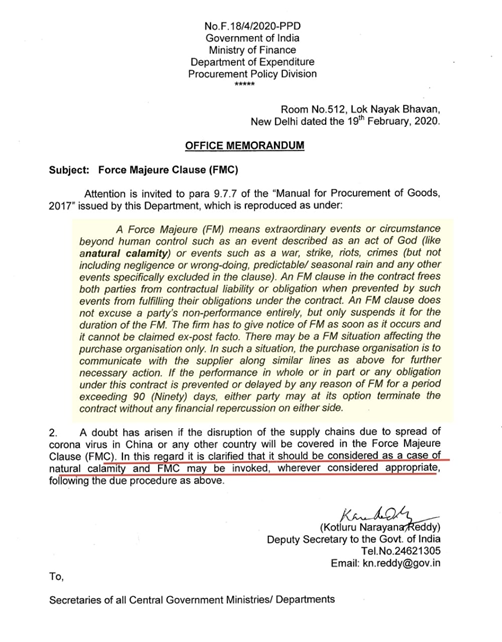

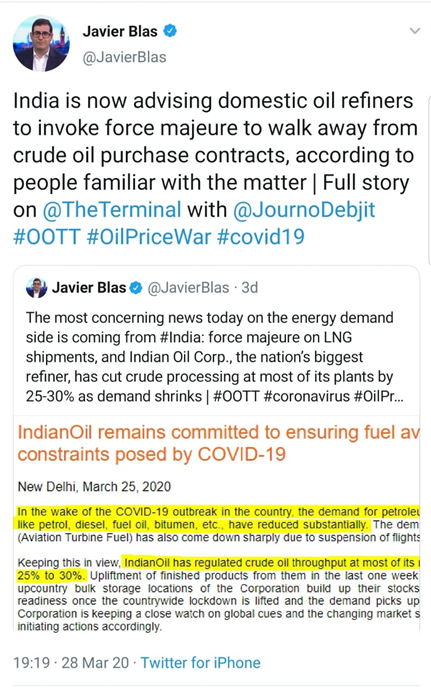

D.OIL AND GAS

HPCL has invoked FMC on Iraqi oil to cancel 2 oil cargoes, as local fuel demand is hit by lockdown. GAIL has sent FMC to ONGC, Petro LNG. So has IOC to Middle East based players. It’s a chain reaction & complicated.

See image.

Read: economictimes.indiatimes.com/industry/energ…

H.REAL ESTATE

Covid-19 has aggravated the liquidity crunch in Real Estate and calls for FMC are arising. The views of the President of the Real estate body #NAREDCO Mr. Niranjan Hiranandani in image.

Allied good read: corporate.cyrilamarchandblogs.com/2020/04/covid-…

I.RETAIL

This is where it gets a little murky. Even Reliance Retail has invoked FMC to not pay the rent due to the outbreak of coronavirus.

If he can’t, who can?🤔

iknockfashion.com/reliance-retai…

J.INSURANCE

As more and more industries invoke FMC, aka Act of God, the Insurance segment, which showed early stress post #Covid, is showing signs of easing.

One may remember this famous scene from the movie OMG: Oh My God 👇

INFERENCE AND FUTURE IMPLICATIONS

The big Q. - Is #COVID19 a #ForceMajeure event? Can this cascade into large scale termination of contracts?

The jury will be out to debate this once the lockdown is over and we start the path towards normalcy. Can be case to case basis.

Courts place the burden on the party invoking breach of contract via Force majeure defense to demonstrate its' existence.

Misuse of FMC: It is likely that many companies misuse the COVID-19 situation to escape out of payment or performance. Hence the complication.

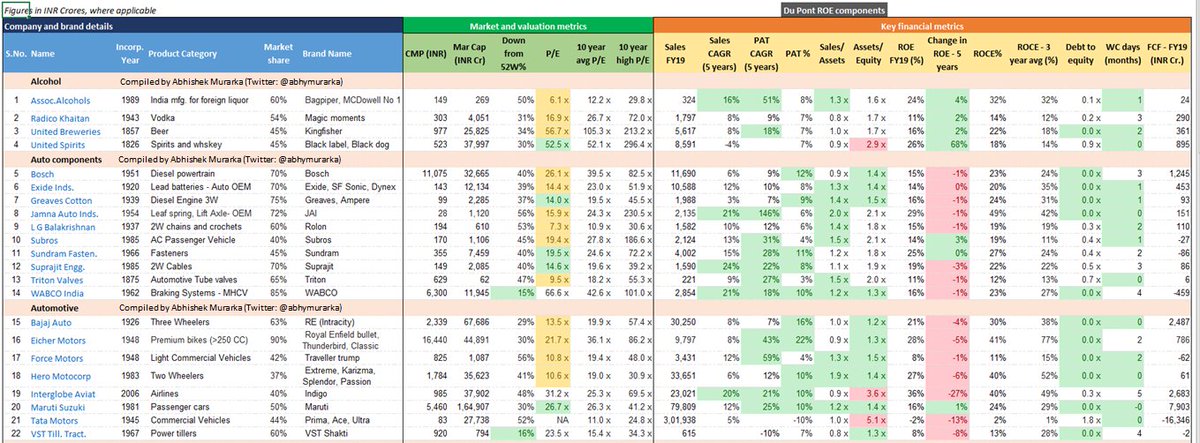

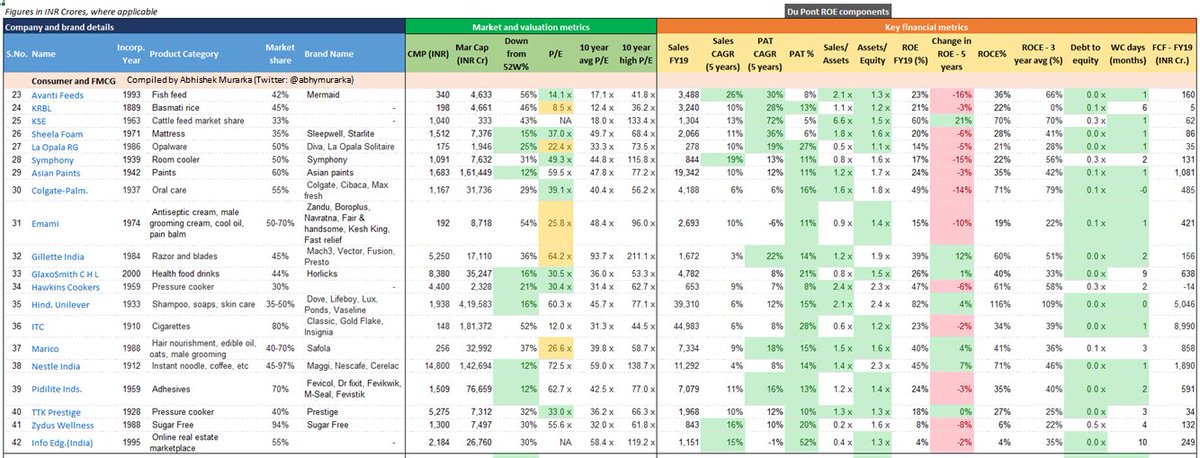

Sector wise views:

MULTIPLEX: As per call, Inox has sent letters to 132 mall owners invoking FMCs for rent. Received 15 replies: 7-8 agreed, 4-5 opposed, while 4-5 are proposing 50-50 sharing of burden.

Current cash of ~100 cr = 3-4 months of Fixed Cost @~30-35 cr/ month.

For AUTO, the virtuous cycle of deferring payments might lead to withering away of small auto comp players and massive job cuts.

OEMs can defer payment to auto comp manufacturers, but a large chunk of RM cost is via imports, which cannot be passed on.

Result – Job cuts.

For MULTIPLEXES, where the “bargaining power” is split between the mall owners and multiplex owners, a common path may be found.

But auto ancillary players hardly have any “bargaining power” over the OEMs, which shows which way the wind might blow.

The ramification on ENERGY sectors, given the global supply chains, is geo-political in nature and difficult to assess. One would also needs a view on the future direction of oil prices, which I don’t have.

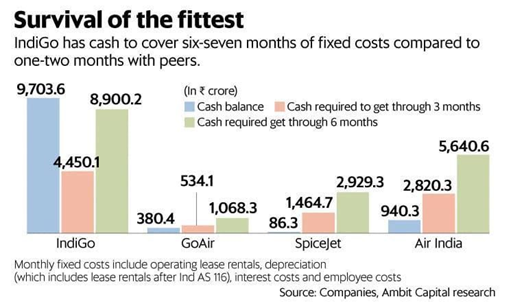

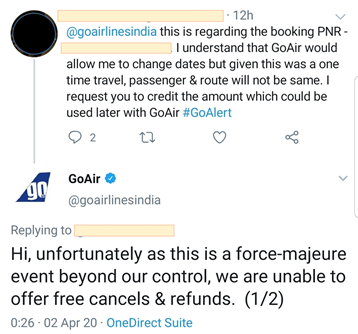

AIRLINES

IMO, most should sail through with extension of lease rentals (some structuring) and some salary cuts and even some job losses. Cuts have already been announced at #Spicejet.

Also, one may expect some consolidation.

CONCLUSION

Once the medical battle is over, the wide-spread invocation of FMC indicates an ensuing legal battle. The best hope is to expect clear guidelines from Ministry to ensure speedy resolution. But the path to recovery will be full of new challenges.

Views invited.

If you want, you may join via the link (you will need to save my contact to start receiving): bit.ly/2P1OHoC

Just realized there is movie by the name of "Force Majeure". And looks absolutely fantastic going by the trailer. Can be a great topical watch!